YieldMax ETFs: 5 Essential Takeaways For Investors Chasing 20–40% Payouts

The hidden costs behind those sky-high payouts

I retired five years ago, at the age of 40, and I can honestly say it’s been every bit as rewarding as I’d hoped.

Thanks to steady investments covering my bills, I can afford a few indulgences along the way. But I remember scraping for every edge, craving bigger, faster results on my path to financial independence—so when “YieldMax” ETFs emerged, I knew caution was key with their double- or triple-digit “yields.” Before jumping in, it’s crucial to examine how they work, what risks they carry, and whether they truly fit into a stable long-term plan.

Will these monster-yield ETFs genuinely elevate your lifestyle—or could they unravel everything you’ve worked for?

Unlock my complete high-growth portfolio strategies today

Join 30,000+ American investors. Start cutting years off your retirement timeline with my investment portfolios and in-depth guides. 30-day money-back guarantee.

Subscribe today and instantly receive a free copy of Set Yourself on FIRE—a practical roadmap to help you jumpstart your journey toward financial independence.

What on Earth Are YieldMax ETFs?

YieldMax funds emerged in 2022 as high-octane income ETFs. Instead of holding actual shares (like a normal index or dividend ETF), they rely on:

Synthetic Long Exposure: Buying call options + selling put options to mimic holding the stock.

Covered Call Overlays: Selling additional call options on that synthetic position to generate income.

This isn’t standard buy-and-hold. It’s a souped-up, options-based strategy that can pay handsomely—or burn through your capital if things go south.

Upside: Potential for really big payouts.

Downside: It’s heavily reliant on a single stock’s performance and can be volatile.

The Upside: Massive Yields

These ETFs regularly boast double-digit, even triple-digit annualized yields.

Short-Term Income: Ideal if you want more cash right now.

Synthetic Leverage: They can magnify returns because they don’t hold shares directly.

It’s undeniably attractive.

If I’d seen these in my earlier years, I might’ve been tempted to load up.

Very attractive for those needing quick income.

The Big Concerns

1. Lack of Diversification

YieldMax ETFs typically concentrate on single stocks like Tesla, NVIDIA, or AMD. This lack of diversification means that poor performance in one stock can significantly impact your investment, unlike diversified index funds that spread risk across multiple companies.

2. Capped Growth Potential

The covered call strategy limits your ability to benefit fully from the underlying stock’s appreciation. While you receive regular income, your long-term growth is stunted, making it harder to accumulate substantial wealth.

3. Capital Erosion High-yield strategies can erode your principal over time.

If the underlying stock declines, the income from option selling may not compensate for the loss in Net Asset Value (NAV), reducing your overall investment.

4. High Volatility

YieldMax ETFs can experience significant price and dividend fluctuations. This volatility introduces unpredictability, making it challenging to maintain a stable investment portfolio necessary for early retirement.

5. Unsustainable Strategies

Continuous option selling may not be sustainable in the long run. Market downturns or increased volatility can disrupt these strategies, potentially leading to substantial losses.

Ask yourself again: Can I handle that emotional roller coaster?

Am I okay if the stock I’m tied to dips 30% or more?

Do I have time to recover from a big loss?

Is short-term yield worth potentially eroding my long-term nest egg?

Why It’s Often Better to Buy the Underlying Stock

Long-Term Appreciation: If your primary goal is growth, direct stock ownership (or a broad-market index) captures all the upside. A covered-call overlay inherently forfeits some (or much) of that potential gain.

Company Dividends (If Any): Holding actual shares may grant you the company’s real dividends (if it pays one). With YieldMax, you do not receive the underlying stock’s dividends—only the option-related income.

Evidence of Underperformance: History shows that these ETFs often lag behind what you’d earn by owning the underlying stock. When the stock rallies multiple times, these funds get left behind further each time.

You might still make money with a YieldMax ETF, but over the long haul, you’d likely see better results—and less complexity—by buying the actual shares or using diversified index funds.

You may also find useful:

How to Grab 20–40% Yields—Only If You Can Tolerate the Risks

The key is to treat volatile, single-stock yield plays as a small, speculative slice—only if you fully understand the downsides and have the risk tolerance to weather the storms.

Strategy Blueprint

Core Growth (80–90%)

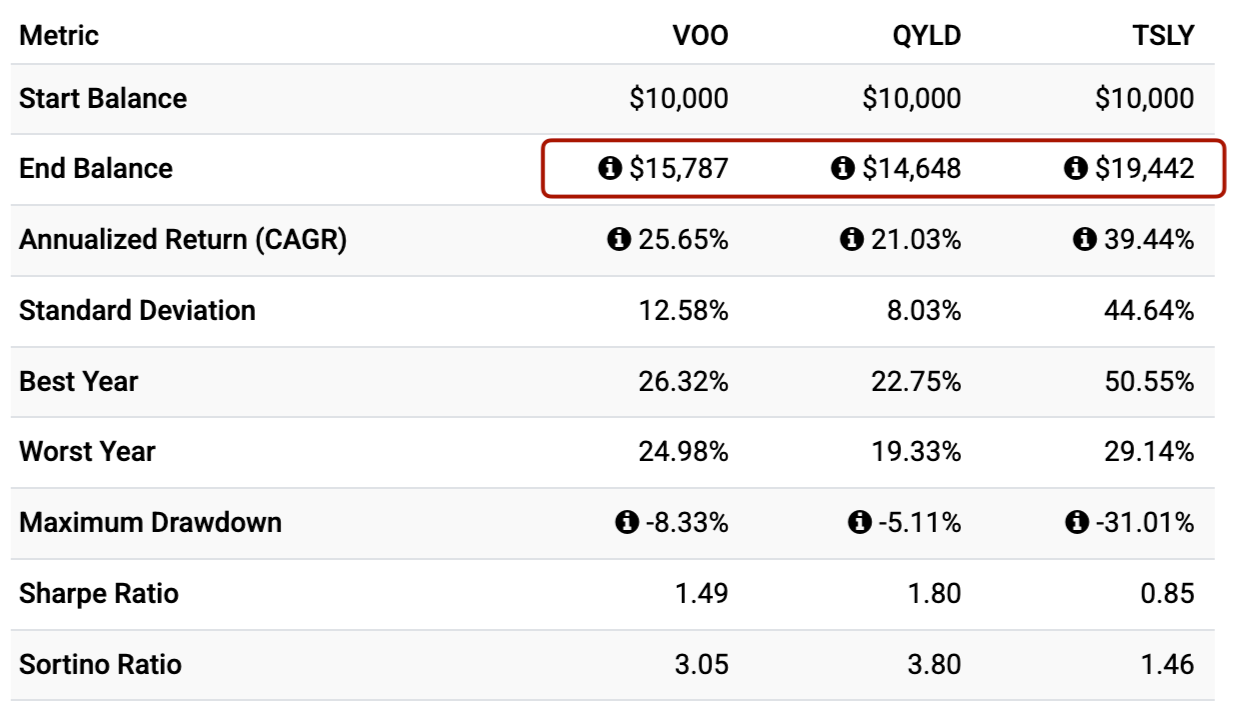

Anchor your portfolio with low-cost index funds (e.g., VOO, VTI) or a mix of stable dividend-growth stocks. This foundation provides broad-based growth and a track record of reliability.Moderate Yield (10–15%)

Consider covered-call index ETFs like QYLD or JEPI. These ETFs distribute decent yields but diversify their option exposure across many companies, lowering concentration risk.Speculative Slice (Up to 5%)

If—and only if—you have a high tolerance for volatility and truly understand the mechanics of option-based income, you may explore YieldMax. I wrote this in bold. Keep it minimal. This ensures that your broader portfolio remains intact if the fund tanks or fails to capture the upside.

Rule of Thumb by Timeline

Closer to Retirement (5–10 years out)

Limit or avoid single-stock, high-octane strategies that can drastically cut your principal. Capital preservation becomes crucial as your time to recover losses shrinks.Longer Horizon (20+ years)

You might afford a small allocation to higher-risk segments, but consistent growth almost always trumps chasing yield. Significant gains can still come from diversified equity exposure over time.

Why This Matters for Compounding:

A single big loss early in your wealth-building can drastically reduce your final nest egg. Protect your principal so you can compound over time—it’s the simplest but most critical rule.

Under the Hood: Why These Yields Are So High—And Risky

YieldMax ETFs use option strategies to mimic a stock’s movements while generating premium income. This can produce flashy payouts, but also:

Delta & Gamma Exposure: Sharp swings in the underlying stock can translate to even sharper swings in the ETF.

Theta Decay: Options lose time value, requiring precise management to avoid steady capital erosion.

Liquidity Gaps: In volatile markets, wide bid-ask spreads can erode returns.

In English: You might enjoy substantial monthly checks, but you’ll miss out on the full growth of the underlying stock and expose yourself to potentially large drawdowns.

Example: QYLD (Broad-Based) vs. YieldMax Single-Stock

QYLD (Covered-Call ETF on NASDAQ 100)

Typically yields around 11–13%. While it underperforms a pure NASDAQ index in bull markets, it spreads risk across 100 stocks.YieldMax Single-Stock (e.g., TSLY for Tesla)

Potential 20%+ yields—but you’re riding one company’s volatility. The upside is capped, and the downside can be brutal if that stock slumps.

Moral: Both rely on covered calls, but broad-market coverage significantly reduces the roller-coaster effect versus a single-stock approach.

Still Want to Do It?

Step 1: Evaluate Your Risk Tolerance

If you’re the type who panics during a 10% drop, single-stock YieldMax might be too volatile.

Consider a small allocation if you can handle swings and have a long horizon.

Step 2: Define Your Time Horizon

Nearing your financial goal? Go safer

Plenty of time left? A 5% slice may be manageable.

Step 3: Pick the Right Holding Structure

IRA/Roth IRA (where possible) to reduce taxes on high-yield distributions.

Taxable Accounts: Frequent payouts may lead to higher tax bills.

Step 4: Diversify the Rest (80–90%)

Indexes (VOO, VTI) and stable dividend funds. This is your safety net and primary growth engine.

Step 5: Rebalance & Track Total Return

Check your portfolio monthly or quarterly.

If YieldMax creeps above your target slice due to short-term outperformance, trim and reallocate to safer assets.

Always keep an eye on whether you’re actually making money after dividends and price changes.

Final Thoughts: High Yields Are Never “Free”

Remember that nothing is truly free if you’re drawn to YieldMax for its sky-high dividends.

The bigger the potential payout, the more significant the potential drop if the underlying stock flops. Always balance your hunger for monthly income with a long-term view that protects and grows your capital. High-yield strategies like YieldMax can be a small boost, but if you want the ultimate dream of stress-free financial freedom, focus first on stable, proven growth.

Thanks for reading—stay tuned for more premium updates and guides!

- Mike

You may also find useful:

Thanks for this post on these YieldMax ETFs. While it's evident that the risks are heightened, the potential returns appear to justify making a modest investment.