My 5-ETF ‘Sleep-Easy’ Portfolio: Protect Your Money and Watch It Grow, Even Against Inflation

The next few years could be wild. Think inflation, geopolitical chaos, and all sorts of curveballs.

Below are my five favorite ETF picks for 2025—showing

WHY each matters

HOW they might fit together and

WHAT to do so you’re not losing sleep when markets swing.

…and most importantly, how they can safeguard your capital, and grow it so you can retire early and stay retired.

Note: This portfolio isn’t strictly about chasing the highest potential returns.

It’s based on overall utility for a FIRE (Financial Independence, Retire Early) plan—factoring in diversification, inflation resiliency, expense ratios, and long-term growth potential.

Why This is a Game-Changer During Volatile Times:

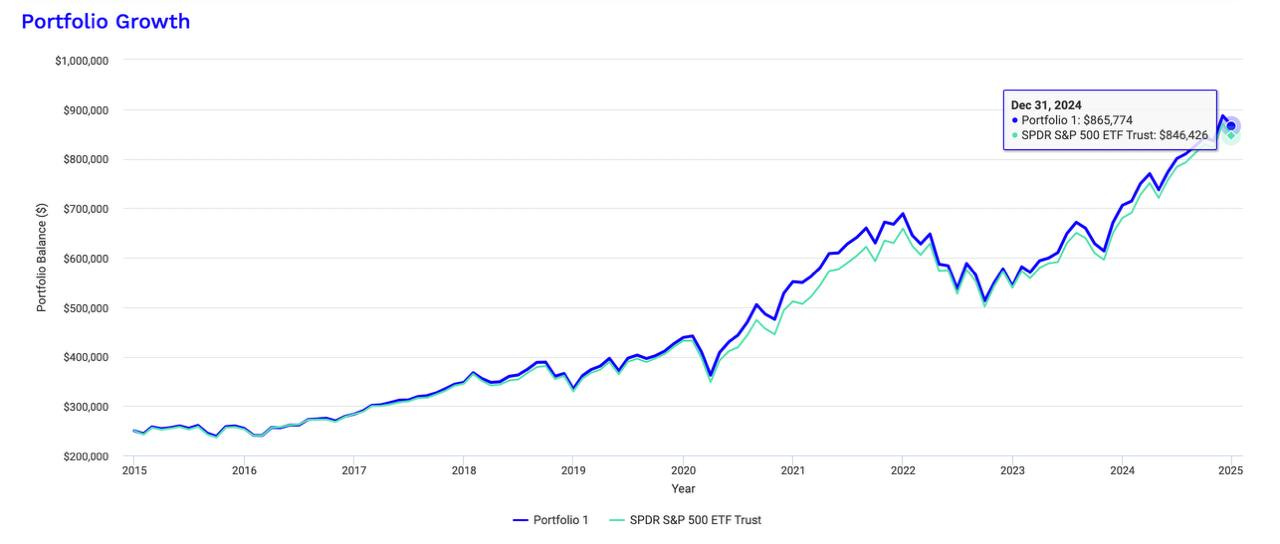

Outperforms Where It Counts - This portfolio didn’t just outperform SPY—it delivered $33,000 more over 14 years. During bear markets, it preserved more capital, keeping you in the game when others were forced to panic-sell.

Built to Handle Real Risks

Iflation? Covered. TIPS protect your savings from rising prices.

Volatility? Managed. Dividend income cushions the blow when markets tank.

Growth? Maximized. Tech-driven growth to capture the upside when markets rebound.

Offers what SPY can’t:

Broader diversification with exposure to large, mid, and small caps.

Inflation hedges and steady income to weather rough patches.

Tech-driven growth that thrives when markets roar back.

Tailored for Any Risk Level or Timeline - I've got you covered with aggressive, moderate, or conservative options inside.

Ask yourself:

“Am I throwing away money on high fees or gambling on risky individual stocks that might derail my dreams of an early retirement?”

In Today’s Premium Issue: Why This Portfolio Works for You

Exact ETF Allocations: Whether you’re aggressive, moderate, or conservative, I’ll show you the perfect mix tailored to your timeline and risk level.

Step-by-Step Strategy: Understand how each ETF works together to balance growth, income, and safety—even in volatile times.

Solve the real challenges FIRE investors face: inflation, market swings, and capital preservation.

A better portfolio - a better future. Let’s go!

My 5 ETF Picks

Here’s a brief overview of my top candidates in the ETF space. They catch my attention due to their cost, performance history, and overall value in an early retirement plan.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.