You must avoid the 96% of stocks that won’t move the needle

Discover the data-backed strategy for spotting real winners—while staying safe in 2025’s volatile market.

Top investors are hoarding cash.

They are buying fewer stocks.

Why?

Due to high valuations and uncertain earnings.

You can’t just buy any AI stock and hope for the best.

You must avoid the 96% of stocks that won’t move the needle.

If you want to retire early, you must pick carefully—or sit on cash until great opportunities emerge.

Let me explain why top investors are extra picky and how to replicate their success with data.

Looking ahead to Thursday:

I’ll share 5 Dividend Aristocrats I trust completely and show you how to slot them into your portfolio step by step.

It’s Premium-only content designed to give you a ready-to-implement plan for stable, compounding income.

Let’s dive in!

Why Being Choosy Is Key

Top investors are being choosy in Jan 2025 for a straightforward reason.

The Fed might cut rates, but if everyone already expects it, stock prices won’t necessarily leap higher.

At the same time, big tech looks expensive—some names trade at forward P/Es 30% above their five-year average. A slight earnings miss could disrupt your portfolio.

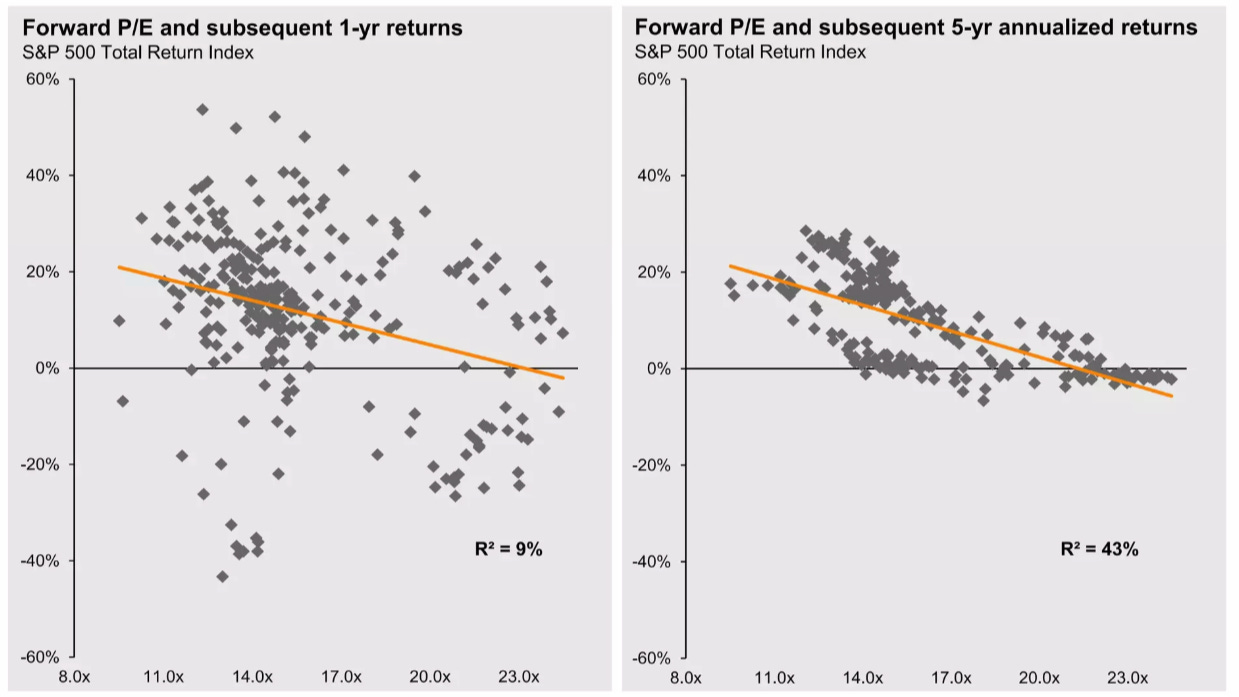

The S&P 500’s forward P/E is near 20, above the historical norm of 16–17 after strong years.

I expect single-digit returns, not another 20% rally.

Historically, only about 4% of stocks drive most of the market’s returns.

You can’t just buy anything and hope it compounds your way to millions.

I’m sticking with quality companies with proven growth or holding cash until genuine bargains appear.

Overpaying for mediocre stocks will stall your journey to early retirement, especially if you rely on steady compounding to meet your goals.

1. The Power of Compounding

After 10 years, a $1,000 investment with 15% annual growth becomes $4,046. At 8%, it’s only $2,159.

The gap is enormous.

Historically (1972–2023), companies that consistently raise dividends outperformed non-dividend payers by about 2.6% per year (Ned Davis Research).

Key Point: Focus on companies that effectively reinvest profits or steadily increase dividends for long-term gains.

2. How to Spot a Durable Moat

From 2005 to 2015, companies with a high return on invested capital (ROIC) outperformed the S&P 500 by approximately 3.6% annually.

They usually possess at least one of these moats:

If a company has no clear moat, I pass.

Historically, moatless businesses underperform or lose pricing power.

3. My 2-Step Test

Can I Predict Earnings 5+ Years Ahead?

Look for 5+ years of stable revenue/EPS growth above 10%.

Reason: Studies show businesses with consistent 10%+ growth often double faster than market averages.

Is It Reasonably Priced?

Historically, paying over 25× forward P/E often leads to below-average 3–5 year returns (FactSet).

Rule of Thumb: Forward P/E < 20, PEG < 2, ROE > 15%.

Use Tools: Finviz, Yahoo Finance, or Morningstar to screen these metrics.

4. Why Holding Cash Can Be Smart

As of late 2024, money-market funds yield about 4–5%, close to the top quartile for short-term instruments over the last 20 years.

Data Point: During corrections of 20% or more (which happened about once every 5–6 years historically), having cash lets you scoop up bargains at lower prices.

Bottom Line: Don’t fear missing out if valuations look insane. Earning a safe 4–5% while waiting is better than risking a big drawdown.

5. Sectors & Plays I’m Watching

Here’s a deep dive in case you missed it: I explain exactly where I’m putting my money and why—so you can see the reasoning behind my positions in more detail.

6. Stock-Picking Checklist You Can Use Immediately

Over decades, discipline + compounding = serious wealth.

If you can’t see clear growth and a fair price, hold cash.

The market usually punishes those who overpay—that’s backed by a century of data.

***💡Tip: If you want to master Buffett-inspired valuation techniques and avoid paying inflated prices, check out my new stock valuation course. The first two lessons are free to read.

Set up a screener to find moat-protected growth stocks or reliable dividend payers, validate metrics, and hold. This strategy leverages market truths, placing you ahead of investors who chase hype without a plan.

Stay disciplined, stay data-driven, and you’ll thank yourself 5–10 years down the line.

- Mike