You’ve poured your blood, sweat, and tears into building your wealth—no way should shifting tax laws siphon off your hard-earned money.

The 2017 tax breaks may vanish after 2025, meaning higher brackets, fewer deductions, and diminished credits could lurk around the corner. If you’d rather keep that cash compounding inside your investments, it’s time to stop playing defense and switch to offense.

The tax code is a strategic battleground, and we’re here to win. Whether you have a W-2 job, run a side hustle, or steadily build an investment portfolio, you need real, no-nonsense moves to shield your money from the IRS—legally and effectively.

Over the past couple of years, I’ve fine-tuned 10 razor-sharp tactics to keep more than $10,000 in my pocket each year.

I’ll hand you the exact strategies, step by step, with clear examples you can put to use immediately. From expertly timing deductions to mastering Roth conversions. These moves are designed to give you an edge in the face of changing tax laws.

If you’re serious about making the most of your hard-earned money and making the most of every tax credit while it still exists, this guide lays out exactly how to stay ahead.

Let’s secure what you’ve built and put it back where it belongs: fueling your investments and accelerating your path to financial independence.

Key Legislation & Important Dates

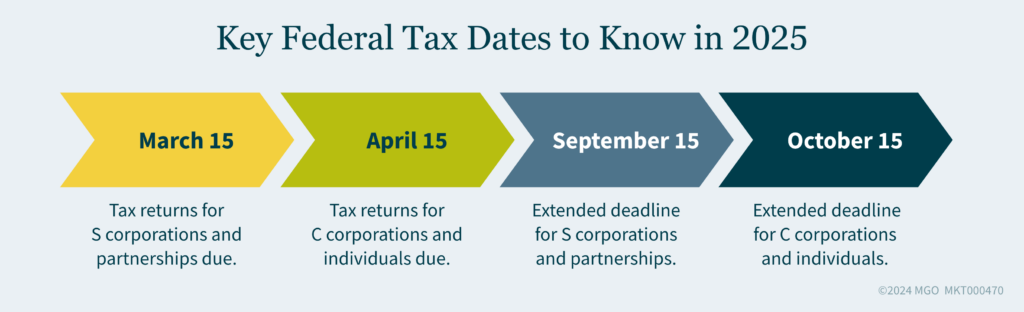

Primary 2025 Federal Deadlines:

April 15: If you’re anything like me, you used to wait until the last minute. Don’t—pay any owed taxes by then, or interest and penalties start to accrue.

Quarterly Filings (June 15, Sept. 15): This matters to me because I have side income. Missing estimated payments taught me a costly lesson once.

Oct. 15: If you filed an extension but still owe money, paying late can totally erase any potential savings.

Why Everything Could Flip in 2025

The 2017 changes (tax rates, bigger standard deduction, SALT cap) may revert unless renewed.

I keep an eye on the news because I’ve seen last-minute laws swing entire strategies.

Filing On Time

I know it’s tempting to push taxes to the back burner, but penalties can seriously undermine all your tax hacks. I learned that the year I procrastinated.

Don’t do it.

Source: MGO

Strategy #1: Take Advantage of Retirement Contributions

What & Why

401(k)/403(b): The 2025 employee cap is $23,500 plus another $7,500 if you’re 50+. Every dollar I put in typically reduces my taxable income—especially with a Traditional 401(k).

IRAs: We can stash up to $7,000 in 2025, plus $1,000 for catch-up if 50+.

Why It Helps

Traditional: Gives me an upfront deduction. Lowers my AGI—useful for unlocking other credits or deducting certain expenses.

Roth: I pay taxes now but enjoy tax-free growth and tax-free withdrawals later. That can be gold if I think my future tax rate will be higher.

Caveats

There are income phaseouts for deductible IRAs, especially if you or your spouse has a workplace plan. I always verify if I’m eligible for the full write-off.

I personally juggle Traditional 401(k) (for the bigger immediate deduction) and a Roth IRA (for that future tax-free pot).

That’s not a universal rule, just a personal blend I like.

Quick Example: Let’s say I throw $8,000 into a Traditional IRA and another $15,000 into my 401(k). That’s $23,000 shaved off my gross income. At, say, 22% tax, I’m looking at about $5,000 saved (not including state tax). That’s not peanuts.

Strategy #2: Dial In My Withholding & Estimated Taxes

What & Why

If I used to get giant refunds (read: interest-free loans to the government) or I owed big sums with penalties, I realized I’m not optimizing my cash flow.

There’s an IRS Withholding Estimator tool that helps me figure out the sweet spot so I’m neither overpaying nor underpaying.

Caveats

Some folks love big refunds because it forces them to save. But I prefer using that money to invest monthly. If I underpay, though, I’ll rack up penalties. So I keep it balanced.

Quick Example: One year I realized I was giving $3,600 too much in withholding. That’s $300/month I could’ve funneled into my HSA or IRA. I changed my W-4 at work and boosted my monthly investing instead of waiting for the next spring to get my “forced savings” back.

Strategy #3: Chase the Tax Credits

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.