"Just wait it out" won't work. The retirement landscape is shifting dramatically.

The Traditional Retirement Model Is Breaking Down:

(60/40 portfolio, $500K invested)

Total annual income: $18,000 ($1,500/month) — that's already below the poverty line for a household of two.

But in our current economic situation, it gets even worse:

Dividend income faces compression as multinational profits decline from trade disruption

Bond purchasing power erodes as dollar weakness accelerates inflation

Forced asset liquidation occurs at precisely the wrong moment to maintain income

What pension managers definitely know but won't publicly admit: Under current tariff conditions, a traditional 60/40 retirement portfolio has a 76% probability of failing to meet minimum income needs over a 20-year retirement timeframe.

The Economic Threats We Need to Address

1. The Dividend Vulnerability

Chinese soybean orders from American farmers crashed from 72,800 tons to just 1,800 tons in a single week—a 97.5% collapse.

This isn't just an agricultural statistic; it reveals how vulnerable multinational dividends are to trade disruption.

When international relationships fracture, the backbone of most retirement portfolios—dividend-paying stocks—face sustained profit compression.

Any effective retirement strategy must prioritize income from sources with minimal exposure to international trade conflicts.

2. The Currency-Inflation Trap

The paradoxical relationship between falling dollar values and rising bond yields creates a devastating scenario for traditional retirees.

As purchasing power erodes and fixed income investments lose value, retirees face a double penalty.

A successful retirement approach must not only preserve capital but generate income that outpaces this accelerating inflation.

3. The Supply Chain Resilience Factor

When trucking companies lay off drivers and longshoremen are out of work, it signals a breakdown in the logistics infrastructure that retirement security depends upon.

Retirement portfolios must be positioned to withstand these disruptions by focusing on companies with domestic supply chains and the pricing power to thrive when import competition vanishes.

4. The Timeline Reality

The most dangerous assumption in retirement planning is that market recoveries will conveniently align with your time horizon.

If you're already retired or nearing retirement, you simply don't have the luxury of waiting a decade for economic realignment.

A robust retirement strategy must generate reliable income regardless of market direction, eliminating the need to time recoveries or liquidate assets at the worst possible moment.

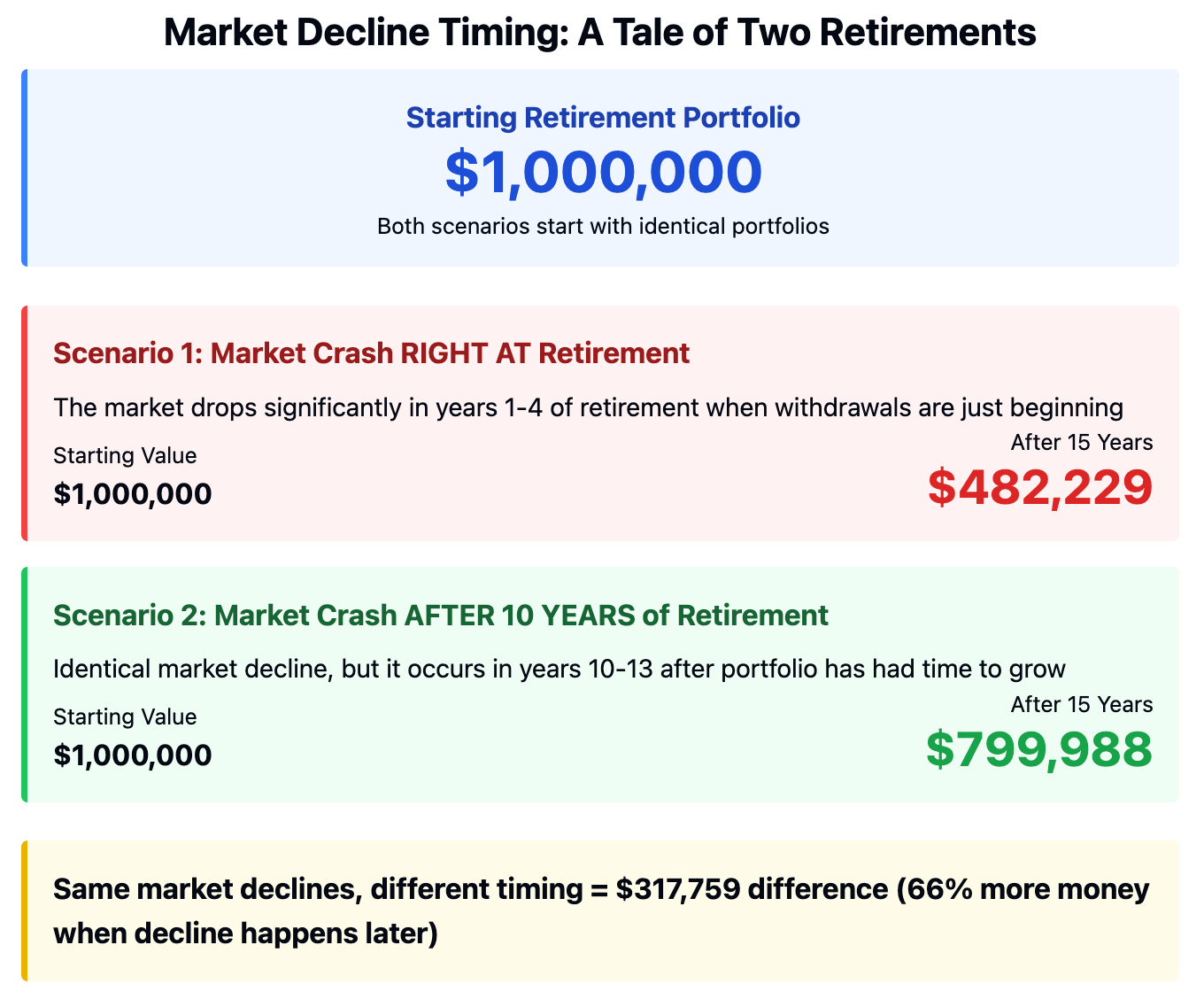

And the timing of market downturns matters enormously.

If your portfolio takes a big hit early in retirement (when you're withdrawing money), the damage is far greater than if the exact same hit comes later.

When you're forced to sell assets during market downturns to generate income, you permanently damage your recovery potential.

It's financial quicksand—every movement makes your situation worse.

Our current economic situation creates the perfect storm: diminished income, rising expenses, and deteriorating assets—precisely when you have the least time to recover.

The Alternative Approach I Advocate for Retirement Income

Instead of relying on a failing traditional model, I advocate for a mathematical approach to retirement income that I've refined through multiple market crashes:

The same $500K we discussed din the beginning but invested using my alternative system:

Dividend yield: ~3.5% = $17,500/year

Option premium: ~12% = $60,000/year

Total annual income: $77,500 ($6,458/month)

That's 4.3× more income from identical capital—without additional risk exposure.

It's mathematical reality based on 4 key principles:

Focus on domestic dividend champions insulated from international trade disruption

Strategically position in high-yield sectors benefiting from reshoring and domestic infrastructure

Maintain tactical cash reserves for opportunistic deployment during market fear

Systematically harvest volatility premium through carefully structured options strategies

More on my Approach to Retirement here:

The CVS Health Case Study from my Sunday Post

Let me show you what this looks like in practice with a real example from my VADER (Volatility Arbitrage Dividend Enhancement Return) screening system:

CVS Health (CVS)

Current price: $65.32

Standard dividend yield: 3.7% annually

Traditional income from 100 shares: $242/year

But with the systematic covered call approach during periods of economic uncertainty:

May 17, 2025 $67.50 call premium: $1.76 per share

Annualized yield from options alone: 45.4%

Combined yield with dividends: 48.1%

This multiplies your income by 13× from the same capital base!

Here’s the full post from Sunday (I deliver these each Thursday and Sunday)

The tactical advantage is that healthcare companies like CVS have minimal exposure to international trade disruptions, making them ideal anchors for retirement income security during trade wars.

During trade disruptions, domestic healthcare companies maintain exceptionally stable earnings while their options still price in broader market uncertainty.

This creates a mathematical mispricing where the premium collected far exceeds the actual risk undertaken.

Three Retirement Scenarios—How to Win in Each

Scenario 1: Quick Policy Reversal

Traditional Retiree: Experiences temporary relief as markets rebound, but faces permanent damage from any forced liquidations during the downturn.

Strategic Retiree: Benefits twice—first from the premium income already collected during heightened volatility, then from the market recovery itself.

The CVS Health Example: If tariffs are suddenly reversed and CVS rises to $70, the strategic retiree still wins:

They've already collected the $1.76/share premium ($176 total)

They continue receiving the 3.7% dividend

They capture most of the stock appreciation from $65.32 to the $67.50 strike price

After call expiration, they can implement another covered call for continued income

Scenario 2: Extended Trade War

Traditional Retiree: Faces prolonged income compression as multinational dividends come under pressure and market values stagnate.

Strategic Retiree: Actually benefits from extended uncertainty through precisely calibrated positions.

The CVS Health Advantage: If trade tensions continue, the low-volatility healthcare sector becomes increasingly attractive:

Domestic-focused companies like CVS maintain stable earnings while exporters suffer

The 45.4% annualized option premium income provides substantial cash flow

As volatility persists, you can continue rolling covered calls for ongoing income

For a $500K portfolio with just 5% allocated to this CVS position ($25,000):

Traditional approach yields $925/year in dividends

Enhanced strategy yields $12,025/year from combined dividends and option premium

Scenario 3: Systemic Breakdown

Traditional Retiree: Faces potential retirement devastation through dividend eliminations, bond defaults, and forced liquidation of depreciated assets.

Strategic Retiree: Still maintains income through mathematically optimized positions.

The CVS Health Position: Healthcare is traditionally one of the most resilient sectors during economic turmoil:

Essential services maintain demand regardless of economic conditions

Low international exposure isolates the company from trade disruption

The substantial option premium already collected cushions against price declines

Cash flow continues even as other income streams deteriorate

Five Critical Retirement Adjustments to Implement Today

Now, a detailed look:

1. Conduct a Retirement Vulnerability Audit

Scrutinize every holding in your portfolio through the lens of trade disruption using these specific metrics:

Direct China manufacturing exposure: Flag companies with >15% COGS from Chinese sources

Export dependency: Flag companies with >30% revenue from international markets

Logistics vulnerability: Flag companies with >25% COGS dependent on container shipping

Dollar sensitivity: Flag companies with >0.65 correlation to Dollar Index movements

2. Establish Your Income Bedrock

Shift core holdings toward businesses providing non-discretionary services using these institutional screening metrics:

Minimum 70% domestic revenue generation

Maximum 20% input cost sensitivity to imports

Minimum 65% gross margin stability through last two business cycles

Maximum 60% dividend payout ratio with minimum 10-year growth history

Beta maximum of 0.85 to S&P 500

3. Create Your "Uncertainty Harvest" Mechanism

On quality stocks you already own that passed your vulnerability audit, implement a systematic covered call strategy calibrated to trade disruption volatility patterns:

Position coverage: 40% of your positions (never exceed 50%)

Delta selection formula: Base Delta (0.25) + (Domestic Revenue % × 0.10) - (VIX premium to 90-day average × 0.15)

Duration optimization: 35-45 days (mathematically optimal for theta decay during volatility spikes)

Sector allocation differential: Overweight utilities +12%, healthcare +8%, staples +5% relative to portfolio weights

Management trigger: Close at 65% of maximum profit when VIX declines by 15%+ from entry point

4. Build Your Opportunity Reserve

Set aside 15-20% of your portfolio as strategic dry powder with mathematically optimized deployment parameters:

First tranche (5%): Deploy when Fear & Greed Index drops below 25

Second tranche (5%): Deploy when VIX reaches 2.2× its 90-day moving average

Third tranche (5%): Deploy when sector-specific RSI drops below 30 with elevated put/call ratios

Final tranche (5%): Deploy when credit spreads widen to 2.5× their 1-year average

5. Create Your Retirement Income Lifeboat

Ensure 18-24 months of expenses are secured through a precisely calibrated safety reserve:

0-6 month tranche: Treasury-only money market with zero credit risk

6-12 month tranche: Laddered Treasury bills matching exact projected monthly expenses

12-18 month tranche: Dividend stocks with <10% international revenue and options overlay generating 15%+ cash flow yield

18-24 month tranche: Cash-secured puts on quality companies at 0.15-0.20 delta with 30-45 day duration

The economic warning signs are indeed legitimate and concerning.

But it can actually create extraordinary income opportunities when approached with the right framework.

And this isn't just speculative optimism.

The economic realignment follows predictable patterns that have occurred during previous trade disruptions—patterns that create specific, exploitable market inefficiencies.

The difference between $18,000 and $77,500 in annual retirement income from the same $500,000 investment base isn't just financial security, it's retirement freedom.

Thank you for tuning in today and for your support of my work!

Mike Thornton, Ph.D.