Generate Income in Retirement 2025: The Multiplier System Explained

How do I replace my paycheck in retirement? — I get this question all the time.

Not with another recycled list of dividend stocks.

I developed a self-reinforcing income system—what I call "The Multiplier”—that turns four simple pillars into a retirement paycheck machine:

1. A foundation of quality businesses that grow their dividends faster than inflation

2. A high-yield component that delivers immediate cash flow

3. A T-Bill sleeve that keeps your capital liquid, earns steady interest, and lets you buy quality stocks at discounts when fear spikes

4. An income accelerator that converts market volatility into predictable paychecks

Premium income → buys more dividend stocks → generates more dividends → creates more covered call opportunities → produces more premium income

It's what I use myself.

It's what I've relied on for nearly two decades.

And it's what I'll explain to you in the next 20 minutes.

The Multiplier Philosophy: Income First, Growth Second

The investment world is split into two camps:

The Growth Cult: "Just buy VOO and wait 30 years." Great if you're 35. Useless if you're 65.

The Dividend Disciples: "Just buy high-yield stocks." Until those yields get cut and your principal evaporates.

My approach is different.

After watching three market crashes from inside Wall Street's machine, I've built an investment philosophy around one timeless truth: Cash flow is king, but only if it's sustainable and growing.

The secret isn't picking either growth or income—it's engineering a portfolio that generates both, with emphasis on immediate cash flow without sacrificing principal protection.

What Makes My Approach Different:

It treats volatility as an asset class to be harvested, not feared

It prioritizes current income without sacrificing future growth

It employs institutional tactics that most advisors reserve for their wealthiest clients

It builds in crash resilience without paying for traditional hedges

This exact system allowed me to weather 2008 and 2020 without a single missed mortgage payment or lifestyle cutback. And when I see people stressing about retirement, I know exactly what they're missing.

The Four Pillars That Hold Up Every Retirement

No wonder panic sets in around age 60.

Most investors spend decades chasing returns, then suddenly need to figure out how to turn a pile of assets into monthly income.

Let me simplify your life.

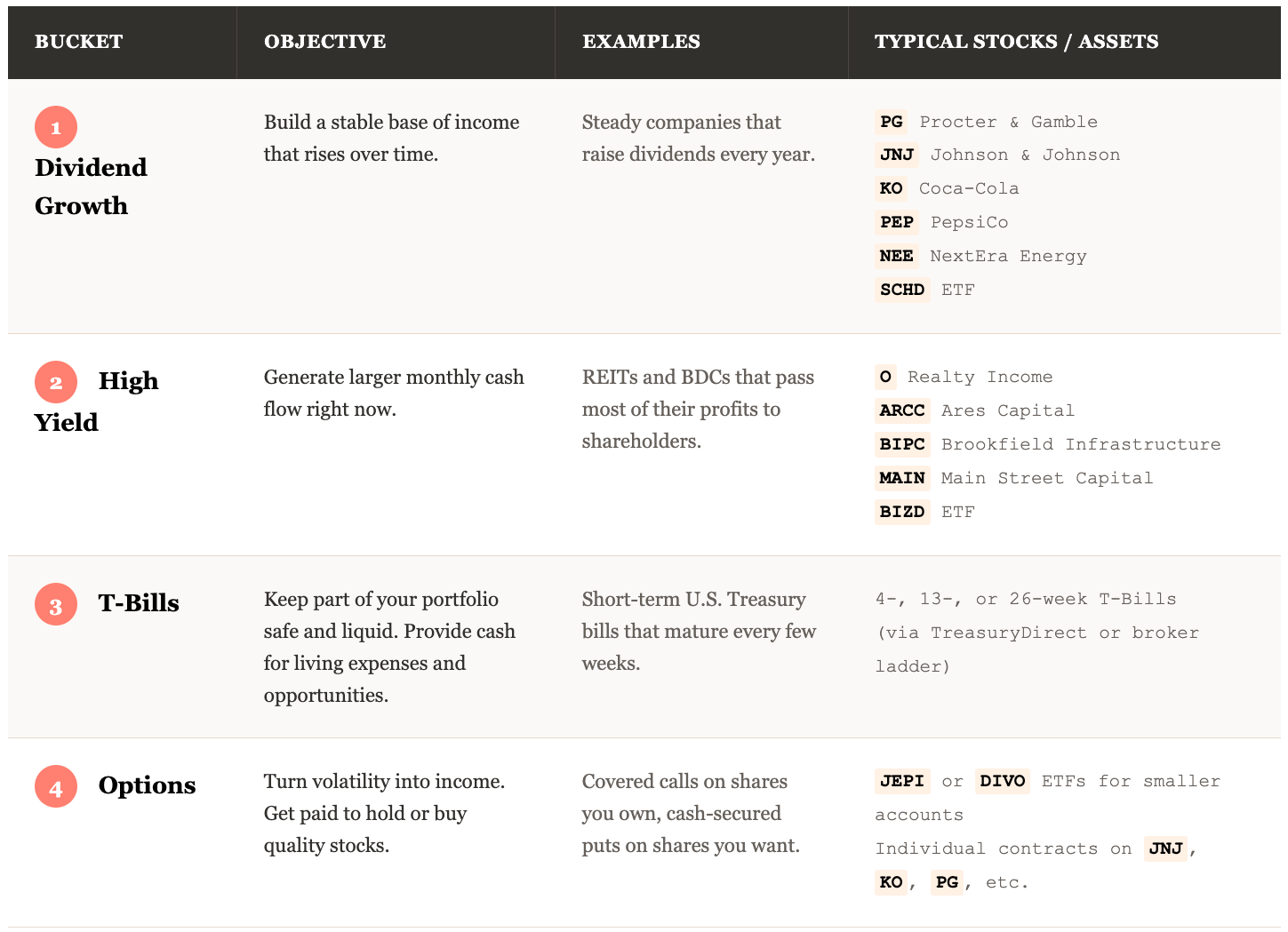

Every dollar in your portfolio should fit into exactly one of these buckets:

Dividend Growth – Aristocrats that raise payouts like clockwork.

High Yield – REITs, BDCs, and pipelines with fat coupons.

T-Bills – Short-term U.S. Treasury bills that keep your capital safe, liquid, and ready for opportunity.

Covered-Call & Options Income – Renting upside on stocks you already own and getting paid to wait on those you want to own.

Why Four Pillars, Not One Strategy?

Each pillar serves a distinct purpose.

You wouldn't build a retirement on lottery tickets alone, so why build one on a single investment approach?

When recession hits Pillar 2, Pillar 1 keeps paying.

When growth stalls Pillar 1, Pillar 3 picks up slack.

And Pillar 4 works in all environments, turning market anxiety into monthly checks.

And this is how we get here:

Pillar 1: Dividend Growth provides the foundation.

These are companies like Johnson & Johnson, Coca-Cola, and Procter & Gamble that have raised dividends for 25+ consecutive years. They're the bedrock of your portfolio because they:

Provide inflation-beating income growth

Survive recessions without dividend cuts

Compound wealth without requiring perfect timing

Pillar 2: High Yield delivers the immediate cash flow.

These include REITs, Business Development Companies, and pipeline operators yielding 6-9%. They're crucial because they:

Generate income to pay today's bills

Reduce the need to sell assets in down markets

Complement the lower yields of Pillar 1 stocks

Pillar 3: T-Bills preserve your liquidity and provide stability.

This pillar is the portfolio’s safety buffer. It holds short-term U.S. Treasury bills (4-, 13-, or 26-week maturities) that do three things:

Protect your principal during market stress — T-Bills are backed by the U.S. government and considered risk-free in nominal terms.

Provide steady, state-tax-exempt interest income that helps fund your monthly paycheck.

Serve as collateral and “dry powder” for future cash-secured puts and value buys.

When markets panic, this liquid reserve lets you deploy capital into discounted opportunities without ever selling your core holdings. It’s the quiet engine of capital preservation that keeps your income machine running through every cycle.

Pillar 4: Covered-Call Income acts as the accelerant.

This involves selling options against stocks you already own. It's powerful because it:

Multiplies your yield without requiring more capital

Converts market volatility directly into cash flow

Reduces your effective cost basis over time

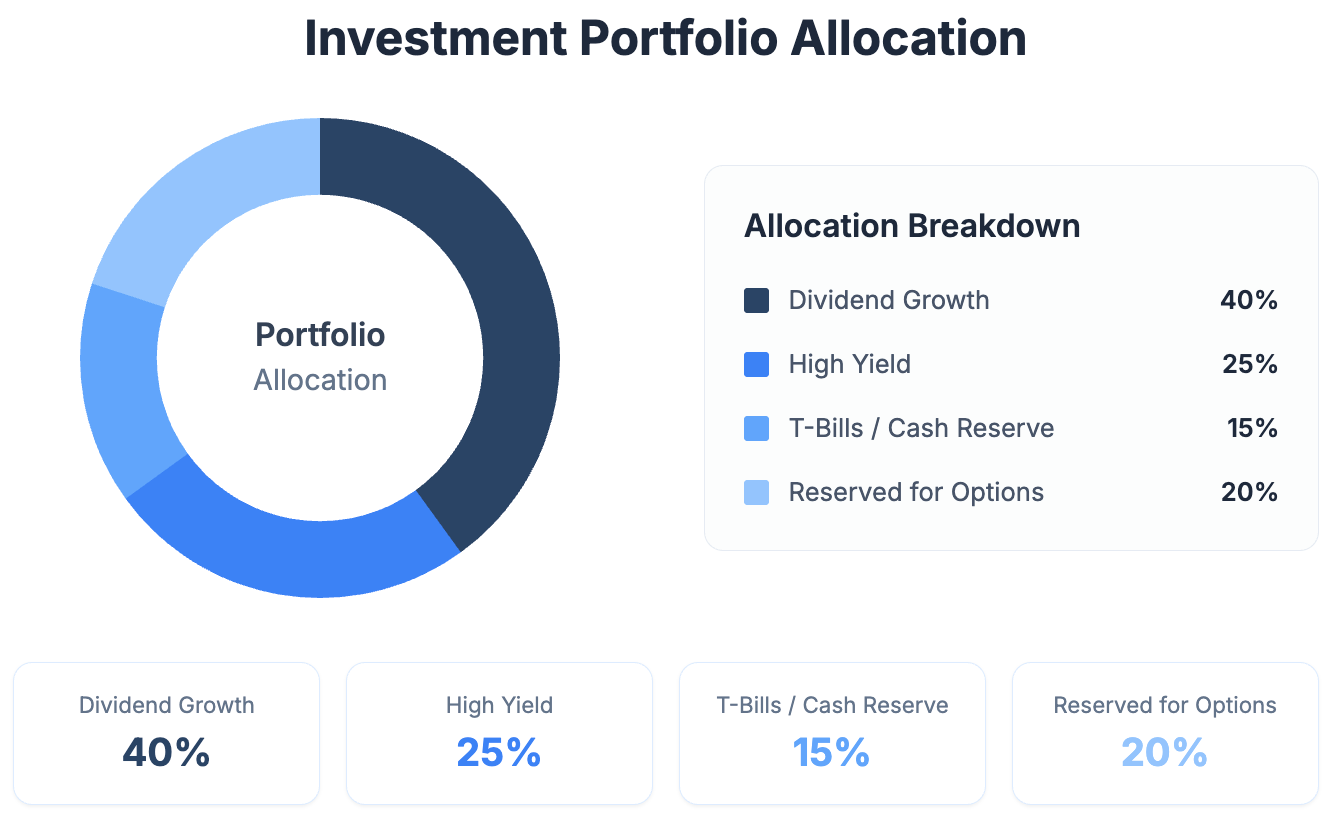

A Real-World Portfolio Allocation

For those who prefer specifics to theory, here's how I structure my own retirement portfolio:

Allocation Breakdown:

40% – Dividend Growth (JNJ, PG, KO, etc.)

25% – High Yield (ARCC, O, ENB, etc.)

15% – T-Bills / Cash Reserve (4- to 26-week U.S. Treasuries ladder held via TreasuryDirect or ETF such as SGOV)

20% – Reserved for Cash-Secured Puts

This isn't a recommendation to copy this exactly—your allocation should reflect your personal income needs, risk tolerance, and time horizon.

But it gives you a starting point for thinking about proportions.

The Income Math They Hide From Retail

Most kitchen-table investors treat options like firecrackers—fun to watch; dumb to hold.

Meanwhile, the pension funds and family offices are selling covered calls on boring stocks like Procter & Gamble, collecting an extra 6-12% a year, and calling it a day.

I spent 20 years watching the big money do this.

Here's what they don't print on brochures:

Johnson & Johnson:

Dividend yield: 3%

35-day, Δ 0.35 covered call: 1.3%

Annualized blend: ~18-20% total yield if the stock drifts sideways

That's why institutional managers don't sweat bear markets—they're clipping coupons all the way down.

What Does This Mean in Real Money?

Let's translate percentages into actual retirement cash flow on a modest portfolio:

Traditional Approach (60/40 portfolio, $500K invested):

Dividend yield: ~2% = $10,000/year

Bond income: ~4% = $8,000/year

Total annual income: $18,000 ($1,500/month)

The Multiplier Approach (same $500K invested):

Dividend yield: ~3.5% = $17,500/year

Option premium: ~12% = $60,000/year

Total annual income: $77,500 ($6,458/month)

The difference isn't just numerical—it's life-changing.

It's the difference between worrying about grocery bills and getting that trip to Italy.

There's no free lunch, but there are inefficiencies that retail investors can exploit, especially when they're focused on income rather than trading gains.

Understanding the Trade-offs

Let's be crystal clear about what you're giving up with this approach:

Some upside potential – When you sell a covered call and the stock rockets past your strike price, you miss gains beyond that point

Some simplicity – This approach requires more monitoring than "set it and forget it" index funds

Tax efficiency – Option premiums are generally taxed as short-term gains (though this can be managed)

What you gain in exchange is what matters most in retirement: reliable monthly income that significantly exceeds what traditional approaches deliver.

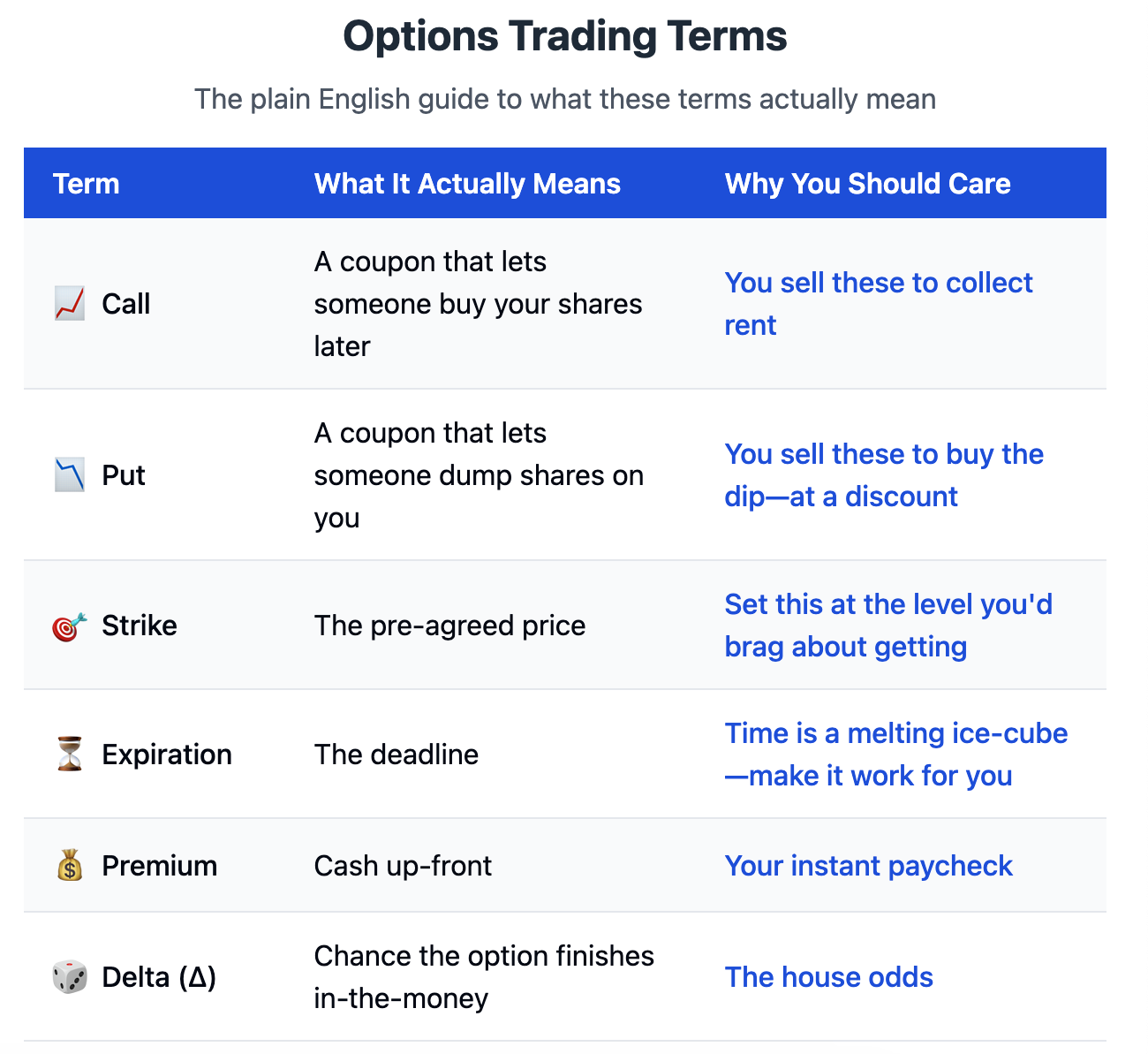

Option Lingo in Plain English

The Turbocharger Effect: How Options Boost Each Pillar

1. Dividend Growth 🔄

Goal: Compound safe payouts faster than GDP grows

Option Boost: Cash-Secured Puts on Aristocrats like KO and PG 5-10% below fair value—collect 10%+ annualized premium while waiting to buy quality at prices you'd want anyway.

Example: Sell KO 57.5 put (38 days) for $0.70. Your effective buy price is $56.80, which happens to be 9% below my fair value model.

2. High Yield 💸

Goal: Maximize cash flow today without bleeding capital tomorrow

Option Boost: Covered Calls on REITs / BDCs during volatility spikes. The premium bridges dividend cuts and smooths sector drawdowns.

Example: Own ARCC at $20. Sell ARCC 22.5 call, collect $0.35. Add that to its ~9% dividend yield, and suddenly you're pushing 18% cash yield.

3. T-Bills 🪙

Goal: Preserve capital and maintain liquidity for future opportunities.

Option Boost: Use the cash backed by your T-Bills to sell cash-secured puts on quality stocks you want to own. You earn premium income on fully collateralized positions while your reserve still accrues interest.

Example: Hold $50,000 in T-Bills laddered via SGOV. Sell two KO puts at $57.5 for $0.70 each (38 days). You collect $140 in premium while your T-Bills keep earning ~4 % interest — every dollar working, fully collateralized. If KO drops, you buy a blue-chip stock at a discount; if not, you keep both interest and premium.

This is the safest way to keep every dollar working without ever touching margin or sacrificing principal.

4. Covered-Call Income 📬

Goal: Monetize sideways markets on stocks you already own

Option Boost: Weekly or 30-day calls at Δ 0.20-0.30. Slide delta up when vol sleeps; rake extra rent when fear spikes.

Example: Own 100 XOM @ $112. Sell XOM 122 call (35 days) for $1.95. Layer in the 3.3% dividend and you're closing in on 11% forward yield.

Covered Calls: Turning Boring Stocks into Monthly ATMs

You own 100 shares of a blue-chip stock?

Congratulations—time to rent out the roof.

What Is a Covered Call (In Plain English)?

A covered call is conceptually similar to renting out property you own.

You're not selling the property—you're just collecting rent for giving someone else the option to buy it at a specific price within a specific timeframe.

With stocks, you're selling someone the right (but not the obligation) to buy your shares at a predetermined price (the "strike price") before a specific date (the "expiration date"). They pay you money up front (the "premium") for this right.

What makes this powerful?

You collect this premium whether or not they end up buying your shares. And you can set the strike price high enough that you'd be happy selling at that level anyway.

How It Works in Practice

Example: Johnson & Johnson

Own 100 JNJ @ $152

Sell JNJ 160 call (40 days) for $2.10

Up-front cash: $210 → 16.5% annualized

If JNJ spikes, you still bank the gain up to $160 plus the dividend

If it drifts, you keep the shares and the premium

Possible Outcomes:

Scenario 1: JNJ stays below $160

The option expires worthless

You keep your shares, the premium, and any dividends

You can sell another covered call and repeat

Scenario 2: JNJ rises above $160

Your shares get called away at $160

You keep the premium and any dividends

Your total gain is ($160 - $152) + $2.10 = $10.10 per share (6.6% in 40 days)

Covered calls convert volatility into cash without needing a crystal ball—what I call sequence-of-returns insurance.

That's financial planner speak for "protecting you when the market decides to crash right after you retire."

Step-by-Step Covered Call Setup:

Choose the right stock – Ideally, one you own that's relatively stable (not highly volatile)

Check option volume – Make sure the option has decent liquidity (open interest > 100, bid-ask spread < $0.20)

Pick your strike price – Usually 5-10% above current price (where you'd be happy selling)

Select expiration – 30-45 days is the sweet spot (premium vs. time commitment)

Place the order – Sell to open, limit order slightly above the current bid price

Monitor occasionally – Check weekly, not daily—this isn't day trading

Broker Selection: Fidelity, Schwab, and TD Ameritrade all offer covered call trading in retirement accounts.

Their basic "Level 1" or "Level 2" options approval is all you need (simply check "income generation" as your objective on the application).

Cash-Secured Puts: Paid Limit Orders That Beat Waiting in Cash

What Is a Cash-Secured Put (In Plain English)?

Remember when you were house-hunting and told your realtor, "I'd buy that place if it drops to $400,000"?

A cash-secured put works similarly, except you get paid while waiting for the price to drop.

With a CSP, you're selling someone the right to sell you shares at a specific price (the "strike price") before a specific date. They pay you money up front (the "premium") for this right. You set aside the cash needed to buy the shares just in case.

Why is this better than a limit order?

Because you collect premium regardless of whether the stock drops to your target price. It's like getting paid to shop.

How It Works in Practice

Example: Coca-Cola

Want to own KO near $57

Sell KO 57.5 put (38 days) for $0.70

Either KO falls and you buy at an effective $56.80, or KO stays high and you pocket $70 for doing absolutely nothing

Possible Outcomes:

Scenario 1: KO stays above $57.50

The option expires worthless

You keep the premium ($70)

You can sell another put and repeat

Scenario 2: KO falls below $57.50

You buy 100 shares at $57.50 (regardless of how low it goes)

You keep the premium, lowering your cost basis to $56.80

You now own a blue-chip stock at a discount to your target price

Step-by-Step Cash-Secured Put Setup:

Choose a quality stock – Focus on companies you genuinely want to own long-term

Determine your target buy price – Be honest about what price represents real value

Select a strike price at or near that target – The strike becomes your purchase price if assigned

Pick an expiration date – 30-45 days typically maximizes your time-decay benefits

Verify cash coverage – Each put requires setting aside $100 × strike price (e.g., $5,750 for a $57.50 strike)

Place the order – "Sell to open" a put contract as a limit order slightly above the current bid

Practical Example: If XYZ trades at $100 and you'd love to own it at $90:

Sell the $90 put expiring in 30-45 days

Collect perhaps $1.50 per share ($150 per contract)

Set aside $9,000 to potentially buy 100 shares at $90

Your effective buy price if assigned: $88.50

The traditional approach tells retirees to keep a "cash cushion" for market downturns. But cash earns pitiful yields even in high-rate environments once inflation is factored in.

Cash-secured puts transform that idle cash into a premium-generating machine while simultaneously setting up limit orders to buy quality stocks at prices you'd be thrilled to pay anyway.

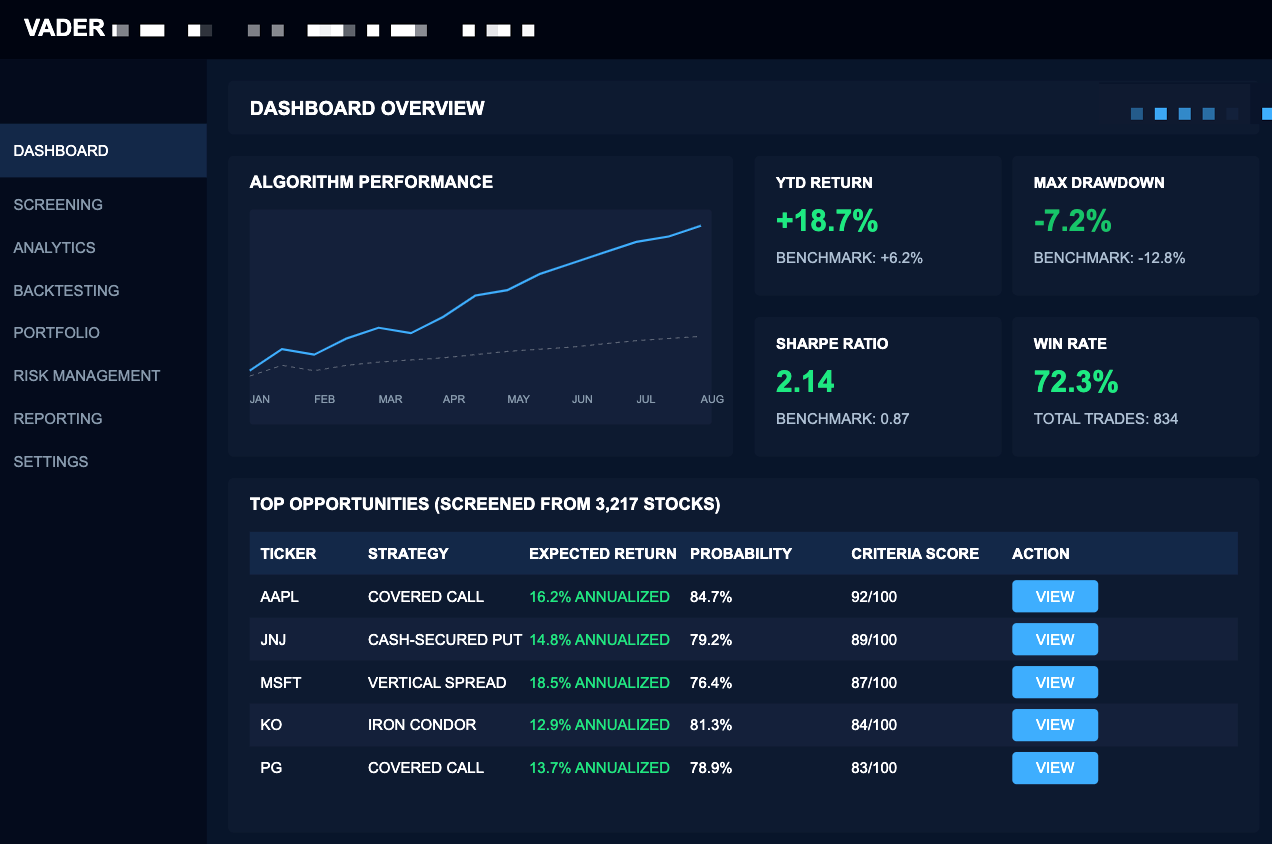

Inside the VADER System: How I Filter 450,000 Options to Find the 0.005% Worth Selling

Most screens are garbage — spitting out hundreds of tickers with sketchy liquidity and landmine earnings dates.

That’s exactly why I built VADER — to narrow 3,200 stocks down to the few truly worth your retirement dollars.

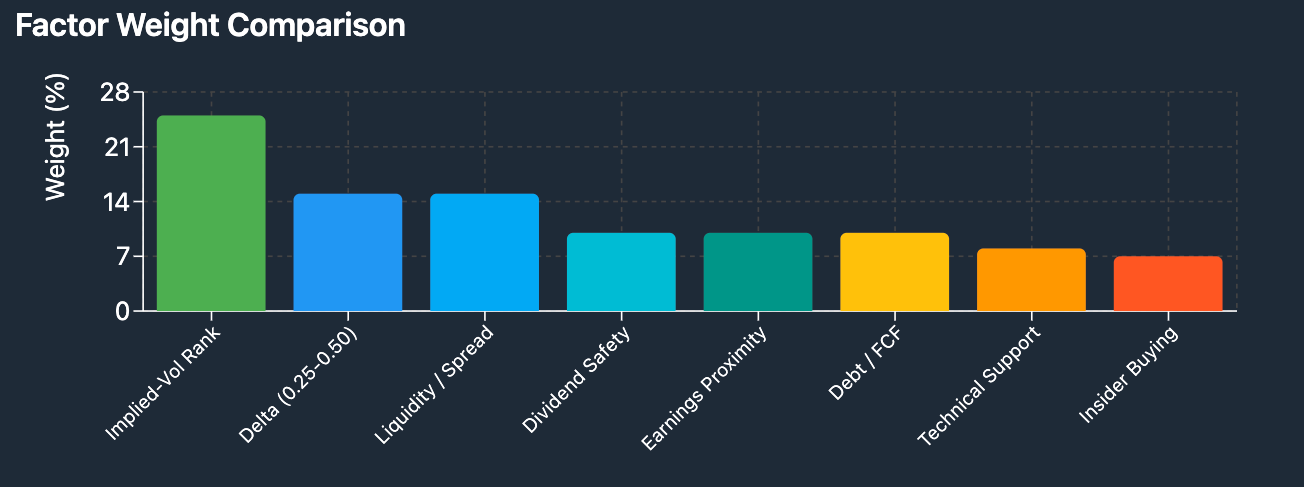

VADER stands for Volatility Arbitrage Dividend Enhancement Return — a proprietary screening engine I first built with a quantitative analytics group that managed options overlays for pension and endowment portfolios.

It was designed to identify the highest-probability trades under institutional risk limits — the same model that consistently produced a 78–82 % win rate across multiple volatility cycles (2011, 2015, 2018, 2020).

When I retired, I rebuilt VADER from scratch to run on my own capital — preserving its institutional core while streamlining execution for private portfolios. The result: disciplined precision — faster, clearer, smoother.

Today, VADER screens 450,000 + option contracts across 3,200 stocks every morning.

Each candidate passes through sixteen quantitative filters — liquidity, volatility structure, balance-sheet strength, dividend history, and upcoming catalysts — before a proprietary probability score is assigned.

Out of that entire universe, only ~40 setups make the daily shortlist.

From there, I hand-select the Top 3 Cash-Secured Puts and Top 3 Covered Calls, balancing yield, safety, and timing.

Once VADER finishes scoring, the human filter begins — that’s where I step in.

Every weekday morning, Premium Members receive the full private VADER scan inside our exclusive Telegram control room — about forty qualified setups, ranked and color-coded for selectivity (~0.005 % of all screened trades).

Then, every Sunday, we run the Live Trading Lab — reviewing performance, updating management plans, and fine-tuning open positions together in real time.

The mission is simple: stack the odds, don’t gamble.

VADER turns option selling into a repeatable, data-driven income engine that compounds your cash flow month after month — no guessing, no hype, no luck.

Inside the VADER Workflow

Step 1: Universe scan of 3,217 optionable stocks sorted by liquidity, IV Rank, and earnings dates.

Step 2: Sixteen quality filters, including payout ratio, FCF stability, and bid-ask spread ≤ 0.3 %.

Step 3: Tier sort into ⬇️

• 🔹 Conservative (8–12% target yield)

• 🔸 Balanced (12–24% target yield)

• 🔺 Aggressive (25% + target yield)

Only the shares that clear all three stages appear on the Daily VADER Scan (≈ 40 best setups).

Last Month's Trade Ledger

March option income: $1,145

March dividends: $397

Combined one-month yield on $100k model: 18.5% (non-annualized)

The trades above represent actual results from my model portfolio, but a few important notes:

Not all trades work this smoothly – I'm showing a typical month here, not cherry-picking only winners

Trade execution matters – I use limit orders and sometimes miss trades if the price moves too quickly

Scaling matters – These results came from a portfolio with sufficient diversification (25+ positions)

Not every month yields 18.5% – During very low volatility periods, yields can drop to the 10-12% range

The goal isn't to hit home runs but to generate consistent income through all market conditions.

Some months will be better, some worse, but the average tends to substantially outperform traditional income approaches.

How Can You Replicate It at Home?

Not ready to plug into VADER?

You can still spin up a lean, home‑brew mini‑screen — just remember it’s a stop‑gap.

VADER ingests 50+ real‑time data feeds, runs walk‑forward optimisations across two decades of market regimes, and recalibrates strike selection the moment volatility shifts.

The DIY recipe below will surface decent ideas, but it can’t replicate that institutional‑grade edge.

1. Start with a quality baseline:

Visit FinViz.com and screen for stocks with:

Market cap > $10 billion

Dividend yield > 2%

P/E ratio < 20

Debt/Equity < 0.5

2. Add the volatility layer:

Visit BarChart.com or your broker's platform

Check for stocks with IV Rank > 50

Ensure option volume > 500 contracts daily

Confirm bid-ask spreads < $0.20

3. Final manual filters:

Avoid stocks with earnings in the next 30 days

Skip biotechs and other binary-outcome businesses

Prefer companies with 5+ years of dividend increases

Obviously, this won't replicate VADER, but it will give you a solid starting point for identifying quality companies with options worth selling.

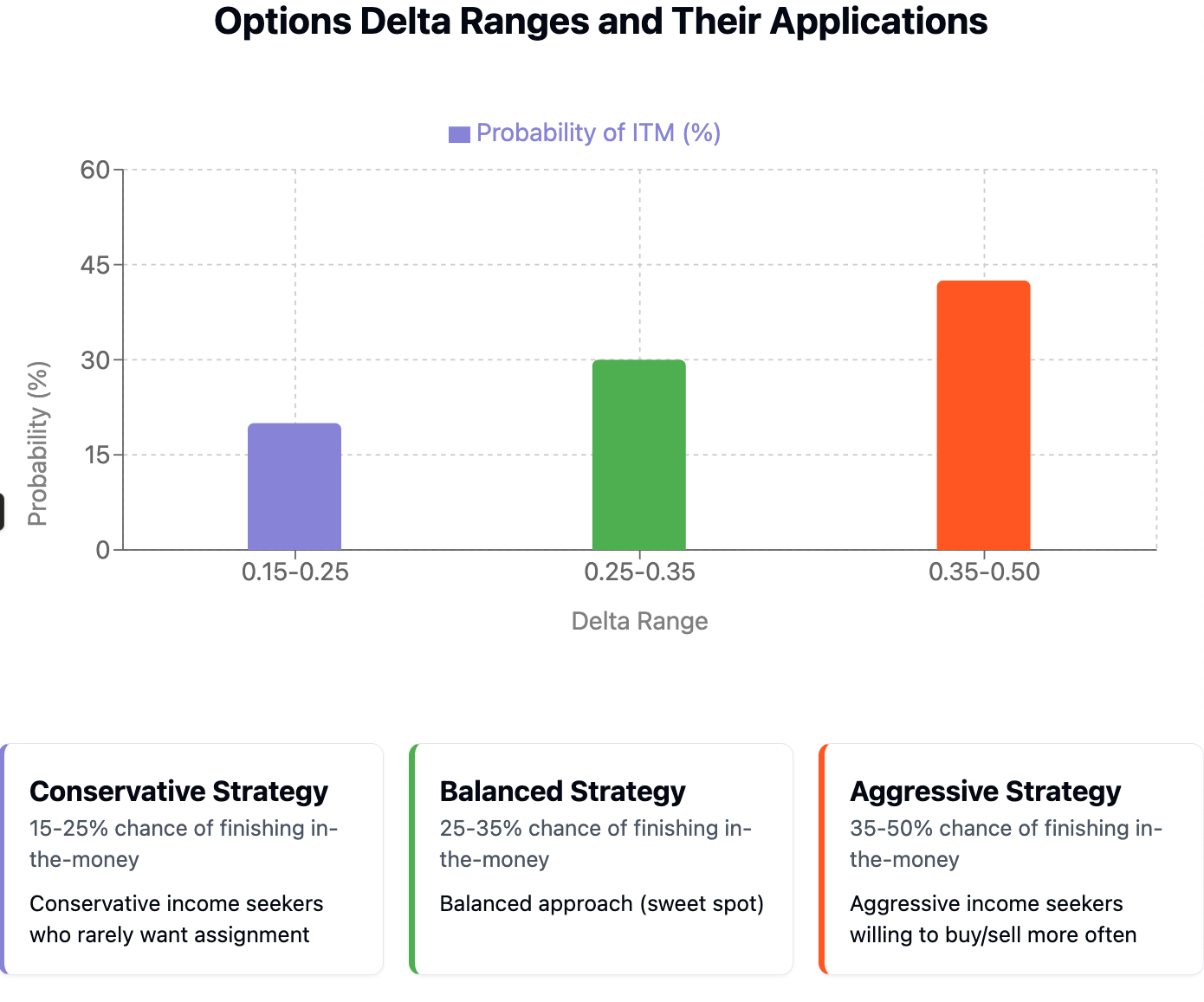

Strike-Picking 101: Delta Is the Only Greek That Pays Rent

Here's the simplest rule you'll ever need:

Δ 0.30 ≈ 1-in-3 assignment odds

High volatility? Drop to Δ 0.25

Volatility coma? Bump to Δ 0.45

In late February, the VIX lurked in the mid-teens to low-20s, then jumped above 30 after the early-April tariff shock.

We trimmed delta during the calm, raised it again once fear was fully priced.

Adaptable beats dogmatic. Every time.

The Strike Selection Framework Anyone Can Use

There's nothing magical about picking strike prices. It's a balance of risk versus reward that you can adjust based on your goals:

For Covered Calls:

Conservative – Pick strikes 10-15% above current price (lower premium, lower chance of shares being called away)

Balanced – Pick strikes 5-10% above current price (moderate premium, moderate chance of shares being called)

Aggressive – Pick strikes 2-5% above current price (higher premium, higher chance of shares being called)

For Cash-Secured Puts:

Conservative – Pick strikes 10-15% below current price (lower premium, lower chance of buying shares)

Balanced – Pick strikes 5-10% below current price (moderate premium, moderate chance of buying)

Aggressive – Pick strikes 1-5% below current price (higher premium, higher chance of buying)

Finding Your Strike Price Without Complicated Math

Every broker platform will show you Delta when you look at option chains. Here's how to interpret it:

Pro Tip: When the VIX (market fear gauge) jumps above 25, option premiums get juicy. That's when you can drop your Delta targets by 0.05-0.10 and still collect substantial premiums.

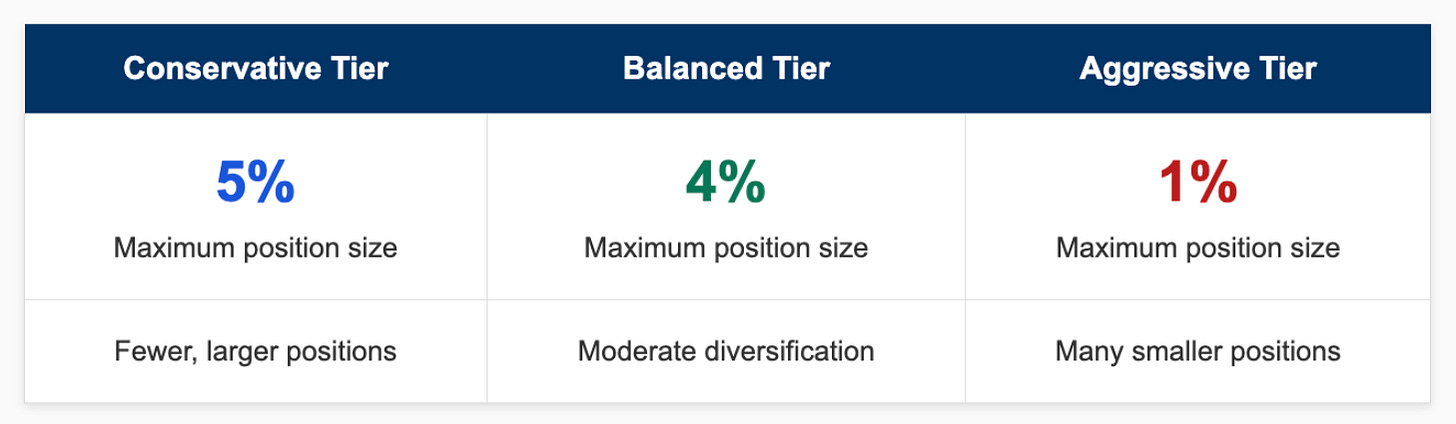

Position Sizing: The 5-4-1 Rule That Protects Your Sleep

Break this rule; the market breaks you.

I've seen more retirements implode from position sizing than from picking the wrong stocks.

What Position Sizing Actually Means in Practice

Position sizing is your first line of defense against catastrophe. Here's how to apply the 5-4-1 rule to a real portfolio:

For a $100,000 portfolio:

No more than $5,000 in any conservative position

No more than $4,000 in any balanced position

No more than $1,000 in any aggressive position

For a $500,000 portfolio:

No more than $25,000 in any conservative position

No more than $20,000 in any balanced position

No more than $5,000 in any aggressive position

This creates natural diversification and prevents any single position from torpedoing your retirement.

Position Sizing for Options Specifically

For covered calls, the position sizing applies to the underlying stock value.

For cash-secured puts, the position sizing applies to the total cash secured (strike price × 100 × contracts).

Example:

$100,000 portfolio

PG at $45 with $45 strike puts

Conservative position (5% max = $5,000 maximum)

Maximum position: 1 contract (1 × $45 × 100 = $4,500, which stays under the $5,000 limit)

When in doubt, go smaller.

You can always add more positions later.

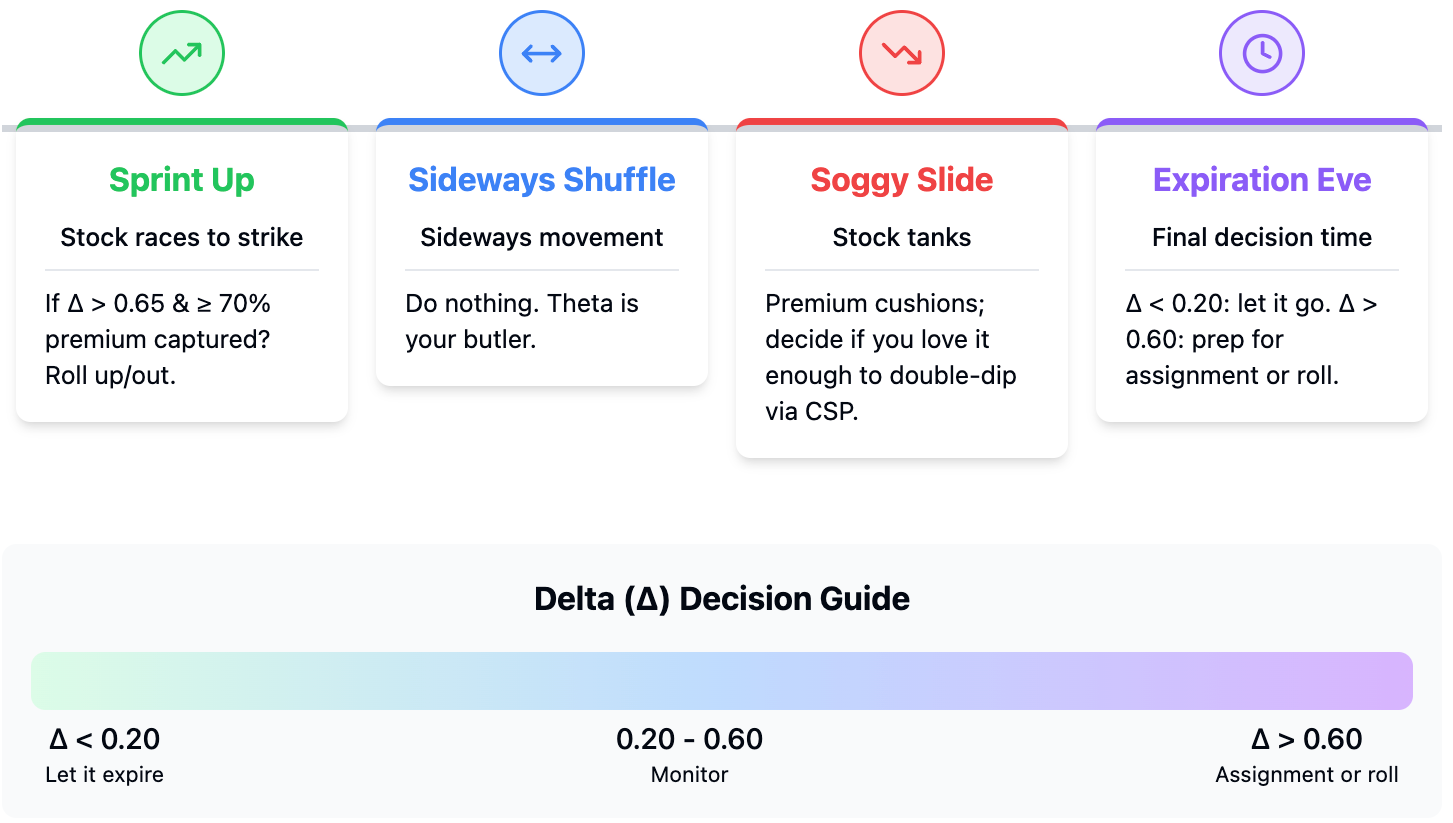

Exit Strategies for Each Market Mood

Sprint Up – Stock races to strike. If Δ > 0.65 & ≥ 70% premium captured? Roll up/out.

Sideways Shuffle – Do nothing. Theta is your butler.

Soggy Slide – Stock tanks. Premium cushions; decide if you love it enough to double-dip via CSP.

Expiration Eve – Δ < 0.20: let it go. Δ > 0.60: prep for assignment or roll.

Track decisions; patterns pay.

Converting Market Moves into Action Plans

Let's make the exit strategies crystal clear with specific scenarios and actions:

Scenario 1: Your Covered Call Stock Rockets Higher

You own XYZ at $50, sold the $55 covered call for $1.50

XYZ suddenly jumps to $54, with 2 weeks left until expiration

Delta is now 0.70 (70% chance of assignment)

You've captured 80% of the potential premium (option now worth $0.30)

Action:

Buy back your current call for $0.30

Sell a new call at $57.50 expiring in 30-45 days

Collect a fresh premium of perhaps $1.80

Result: You've locked in most of the original premium, raised your potential sell price by $2.50, and collected additional premium.

Scenario 2: Your Cash-Secured Put Stock Plunges

You sold the XYZ $45 put for $1.20 when stock was at $48

XYZ plummets to $42 on market-wide panic (not company-specific news)

Option now worth $3.50 with 3 weeks to expiration

Action options:

Do nothing – Accept assignment at $45 (effective cost $43.80 after premium)

Roll down and out – Buy back current put, sell new put at $40 strike with 45-60 day expiration

Cut losses – Close position if you no longer want the stock at any price

My typical choice: If it's a quality company I want to own anyway (think JNJ, KO, PG), I accept the assignment and start selling covered calls. If it's a shaky company or one I've cooled on, I close the position.

Hedging Strategies When Things Go Wrong

When a position moves against you, sometimes you need more than just an exit plan—you need a hedging strategy:

For Underwater Covered Calls:

Covered-Call Repair Strategy – If your stock drops far below your original purchase price, sell an additional call at a lower strike to generate extra premium income (works best in high-volatility environments).

For Threatened Cash-Secured Puts:

Roll-Down Repair Strategy – If a stock plunges far below your put strike, buy back the position and sell a new cash-secured put at a lower strike with more time (“roll down and out”). This lowers your effective cost basis, collects fresh premium, and keeps the trade fully collateralized—no spreads, no margin, no borrowed exposure.

For Overall Portfolio Protection:

Volatility Cushion Strategy – During extremely calm markets (VIX < 15), temporarily increase your T-Bill or cash allocation and widen strike cushions on new trades. This strengthens defense without ever buying volatility or paying for hedges.

Sector Rotation Hedge – Maintain small cash-secured put positions in sectors that typically move inversely to your core holdings.

The Essential Brokerage Setup for Retirement Income

Having the right tools and settings makes all the difference. Here's my actual brokerage setup that you can replicate:

Recommended Brokers (By Experience Level)

Beginner Friendly:

Fidelity – Clean interface, excellent customer service, free options trades.

Charles Schwab – Similar to Fidelity, slightly better research tools.

TD Ameritrade – ThinkOrSwim platform is excellent once you learn it.

For Experienced Traders:

Interactive Brokers – Excellent liquidity and execution quality for advanced users (margin features not required for this strategy).

Tastyworks – Built specifically for options traders, with an intuitive interface.

All of these brokers allow covered calls and cash-secured puts in retirement accounts (IRAs).

Free Tools Anyone Can Use

You don't need a Bloomberg Terminal to implement this strategy. These free tools cover 95% of what professionals use:

BarChart.com – Free IV Rank screener

OptionStrat.com – Visual option strategy builder

StockCharts.com – Technical analysis for support/resistance levels

Finviz.com – Stock screening and basic options data

Seeking Alpha – Earnings calendar and dividend dates (free tier)

FAQ From Last Week's DMs

"Can I do this in an IRA?" Yes; CSPs & covered calls are level-2 options at Fidelity, Schwab, and Vanguard. In fact, IRAs are ideal for this strategy because the frequent option income is tax-sheltered. No need to track all those short-term gains.

"Do I need $100k?" No. $25k runs clean. Under $10k is clunky but doable. The key constraint is that each cash-secured put or covered call controls 100 shares, so smaller accounts need to focus on lower-priced stocks. A $10k account can comfortably run this strategy on stocks priced under $50.

"What about LEAPs?" Long-term options (LEAPs) are fine for leverage junkies; dull for income. We want frequent paydays, not distant promises. LEAPs and “Poor Man’s Covered Calls” rely on borrowed exposure. Our approach avoids them entirely to keep every position fully collateralized.

"Part-time schedule?" Sunday & Thursday cadence takes 45 minutes each. I do mine with coffee before the kids wake up. The beauty of this system is that it doesn't require constant monitoring—just consistent execution twice a week. Most of my subscribers spend about 2 hours total per week managing their retirement income portfolio.

"Why not just buy dividend ETFs?" SCHD and JEPI are fine, but they can't adapt delta when fear spikes. We can. That's how we capture an extra 3-5% per year. ETFs also can't target specific sectors when opportunities arise or avoid specific companies with deteriorating fundamentals. The flexibility of our approach allows for tactical adjustments that passive ETFs simply cannot make.

"What about taxes? All that option premium is short-term gain, right?" For taxable accounts, yes—option premium is generally taxed as short-term capital gains. This is why many subscribers run this strategy primarily in their IRAs. However, when you're assigned shares through cash-secured puts, the subsequent stock can qualify for long-term capital gains if held over a year. For taxable accounts, we incorporate tax-optimization strategies in the Thursday dispatches.

"How do I handle a stock that tanks after I sell a put?" You have several options: 1) Accept assignment and start selling covered calls, 2) Roll the put down and out to a later expiration, or 3) Take the loss and close the position. Your choice depends on whether the drop is market-wide or company-specific, and whether your original investment thesis still holds. We cover specific examples in the case studies section of Sunday newsletters.

"What's the worst-case scenario?" The worst case is similar to owning stocks outright—a company collapses due to fraud or disruption. However, because you have the premium cushion and typically buy at below-market prices through cash-secured puts, your downside is reduced compared to traditional stock ownership. Proper position sizing (the 5-4-1 rule) prevents any single position from devastating your portfolio.

Putting It All Together: Your Retirement Income Machine

Let's be crystal clear about what we've built:

A foundation of quality businesses that grow their dividends faster than inflation (Pillar 1)

A high-yield component that delivers immediate cash flow (Pillar 2)

A T-Bill component that keeps cash safe, liquid, and ready to deploy when opportunities arise (Pillar 3)

An income accelerator that converts market volatility into predictable paychecks (Pillar 4)

Together, these create what I call the "Multiplier Effect" – a self-reinforcing income system where:

Premium income → buys more dividend stocks → generates more dividends → creates more covered call opportunities → produces more premium income

This is exactly how I've structured my own portfolio for nearly two decades.

Whether Powell raises, cuts, or freezes next month doesn't matter. Whether the Chinese real estate market recovers doesn't matter. Whether tech stocks have another tantrum doesn't matter.

What matters is building a machine that pays you to wait—and keeps paying you through every market cycle.

Thank you for tuning in today and supporting my work!

Mike Thornton, Ph.D.

Your bills don’t stop in retirement — and your income shouldn’t either.

Learn how to build your own reliable retirement paycheck with a simple, risk-aware income strategy.

The system requires approximately 30 minutes a week and is designed to preserve principal while generating a consistent cash flow.

Goal: Turn every $100k of capital into $500–$1,500 in monthly income — without leverage, guesswork, or sleepless nights.

How it works:

Every weekday morning (≈ 9:45 a.m. ET), Premium Members receive live updates through The Multiplier VADER Channel — a private Telegram feed built for clarity and speed.

Each message includes:

VADER Shortlist — ~40 trades that pass all 16 institutional-grade filters

Top 5 Picks — my hand-selected setups with the best balance of yield, safety, and timing

Trades are sorted by Risk Tier (Conservative 8–12 %, Balanced 15–25 %, Aggressive 25 %+) and Collateral Band (under $10k / over $10k).

Behind the scenes, VADER, my proprietary algorithm, scans over 450,000 option contracts across 3,200 stocks each morning — identifying only the ≈ 0.005% most efficient income setups.

I filter what survives and send you the clean, actionable results in real time.

It’s the same disciplined, fully collateralized process I’ve used for nearly two decades to generate income safely through every market cycle.

No experience required — I’ll show you exactly how to run it step by step, even if you’ve never traded options before.

What You’ll Get

Daily Live VADER Feed: Fresh opportunities every market morning

Weekly Portfolio Review: Sunday email summary with trade management and performance updates

Full Transparency: Every trade tracked in the model portfolio from open → close

Education Built In: Clear explanations so you understand the logic behind every move

Here’s what paid subscribers are saying:

Try It Risk-Free

I want you to be 100% certain this is the right fit for you. So here's my promise: Join today and put the entire system to the test for a full 60 days.

If you don't feel more confident and in control of your financial future, simply email me at mike@themultiplier.co, and I'll refund every penny. No questions asked.

If you are struggling with retirement planning & finance strategies, purchasing the The Multiplier Premium is the right decision.

Thanks, very well constructed and explained.

As an underwriter, how can I start wanting to build a portfolio of about 500k? Do you have an initial list of stocks of the different baskets (dividend growth, high yield, etc ...)?

Thanks.

Finally, perhaps there is a mistake here: you consider the sizing at 48%, not 4.8% ...:

-----------

Example:

$100,000 portfolio

KO at $60 with $60 strike puts

Conservative position (5% max)

Maximum position: 8 contracts (8 × $60 × 100 = $48,000, which is under $50,000)

------------

Thanks for the sharp, actionable options trading insights. The strategy is exceptionally well-structured, combining systematic trade execution with active management—particularly through monitoring Delta and price action. What makes it stand out is its ability to balance premium income with disciplined risk control, allowing traders to generate consistent and substantial returns. Definitely a must-attempt strategy for optimizing my options portfolio!