How Finance Pros Use the Dividend Snowball for Lifelong Passive Income

Building Wealth on Autopilot

I’ve tested all kinds of market plays—trendy IPOs, penny stocks, you name it.

Each time I chased the next “big thing,” I felt like a hamster spinning my wheels, never really moving closer to true financial independence.

Over time, I learned (through both formal training and hands-on exp) that a tried-and-true approach—steady dividends plus relentless compounding—often outperforms all that frantic speculation.

This well-known “Dividend Snowball” strategy has personally become a game-changer for me, pushing me closer to my FAT Early Retirement goals.

What the Dividend Snowball Really Means to Me?

Picture rolling a tiny snowball down a hill. With each turn, it picks up more snow and gains momentum.

Now translate that to dividend reinvestment: whenever a company sends me a dividend check, I immediately buy more shares—no second guessing, no drama about “market timing.”

Over time, those extra shares generate even bigger dividends, which then buy more shares, and so on. Before you know it, you have a financial fortress piling up in your brokerage account.

I’ll be honest: once I grasped this principle, I almost kicked myself for not doing it sooner. I used to stress over daily price swings; now, the more the market fluctuates, the more I love scooping up discounted shares.

The snowball loves a good sale. :-)

Why I Crave High-Yield Plus Growth

I’ve seen folks chase sky-high yields—10%, 12%, even 15%—only to watch the stock’s price crater or the company slash its payout. On the flip side, some investors focus exclusively on tiny yields that might grow quickly.

Both extremes felt like half-measures.

My sweet spot: above-average yields with a track record of consistent, rising payments. I want a payout I can actually live off of one day, plus the potential for real growth.

That way, my portfolio generates steady cash flow now and sets me up for exponential gains over the long run.

How I Turned My Approach into a Practical Blueprint

1. Find a Broker That Supports Automatic Reinvesting

I’m serious—if your broker charges for reinvestment or buries the feature under 12 clicks, it’s time to consider switching. I want zero barriers between me and hands-free compounding.

2. Search Out Companies With Payout Increases

Whenever I vet a stock, I ignore the hype and look directly at its dividend track record. Does the management consistently raise the payout? If so, they likely have their finances in order—something I can rely on for the next 5, 10, or 20 years.

3. Spread My Bets

I’ve learned not to stick to one sector—energy can be cyclical, real estate can be sensitive to rates, and healthcare can stumble with regulatory changes. My solution: take positions in multiple industries so one downturn doesn’t sabotage my entire plan.

4. Allocate & Automate

I generally give each stock a certain percentage—maybe 15–20% each if I’m working with 5 or 6 picks. Then I flip on that dividend reinvestment switch and let it ride. I revisit allocations once or twice a year, not every week. Nobody’s got time for day-trading nonsense.

5. Funnel Extra Cash In

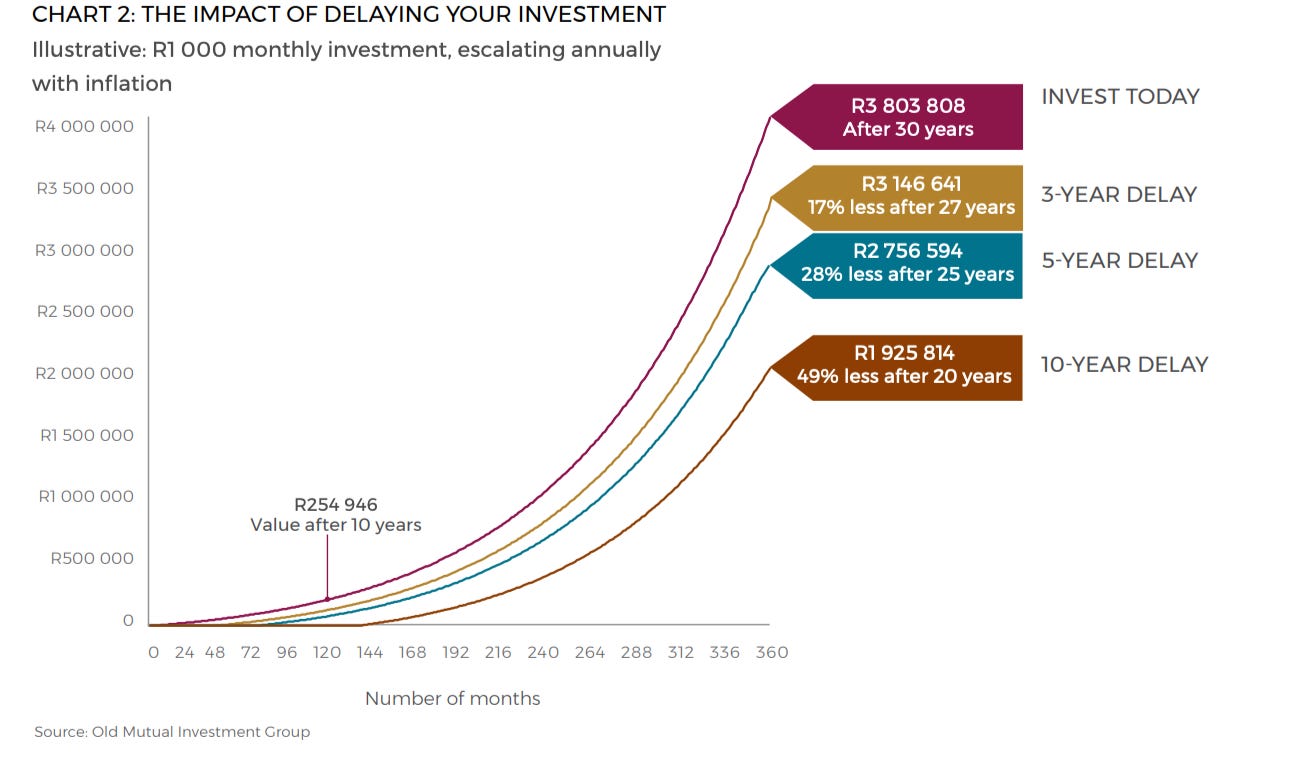

Every bonus, tax refund, or side hustle payoff goes straight into my portfolio. Why? Because the earlier I invest, the longer I can exploit that compound interest.

And the most important thing is: do not wait!

My Reflections on Market Swings

I used to let the market toy with my emotions. It’s only natural to freak out when you see red on your screen. But here’s what I’ve learned: the dividends don’t care.

When the broader market dives, I’m still getting paid, and I’m reinvesting at cheaper prices. Over time, that’s how you transform dips into discount opportunities.

Sure, we’ll face recessions or global events that shake confidence. But if you do your homework, if you pick companies with strong balance sheets and healthy cash flows, those dividends have a way of marching upward—even when everything else looks bleak.

Hazards to Dodge (From My Own Hard Lessons)

Chasing Mirages: If a yield seems off the charts, pause and research. Often, that’s a red flag—maybe the firm’s cutting corners just to maintain appearances.

Falling for Hot Tips: The moment you stop listening to “secret stock picks” from social media gurus, your returns will soar. Trust me. Stick to your plan.

Check out my article on the exact metrics and screening processes I use to separate true gems from high-risk “hype” plays.

Not Diversifying: I once put too much faith in a single high-yield sector. That was a brutal education in the value of spreading risk.

Ignoring the Fundamentals: Dividend investing is not about collecting a few checks and ignoring the underlying business. Monitor revenue trends, payout ratios, and the company’s overall health.

Incorporating Stable + High-Yield Stocks

Sometimes, I like to weave in names that combine steadiness with higher-than-average yields—even if they’re not all official “Aristocrats.”

For instance, Johnson & Johnson (JNJ) is well-known for its multi-decade dividend streak and massive healthcare portfolio. Meanwhile, Altria (MO) boasts a long track record of hefty payouts, and AT&T (T)—despite a recent cut—still delivers a solid yield.

How I Use Them

Check Sustainability: High-yielders can be fantastic as long as the dividend is sustainable. I look at free cash flow, debt levels, and management’s commitment to maintaining (or growing) the payout.

Limit My Exposure: These picks can be a nice boost to my overall income stream, but I’m mindful not to overdo it. If a dividend cut happens, I don’t want it wrecking my portfolio.

Blend With Core Dividend Growers: Combining higher-yield names with stalwarts like JNJ can strike a balance between current income and longer-term appreciation—a powerful mix in building that snowball.

This strategy comes straight from years of trial, error, and vetting reams of research. Most official lists and historical performance data point toward a blend of proven dividend growers plus a few stable, higher-yield equities for extra punch—just make sure each stock’s fundamentals hold up under scrutiny.

A Quick Look at Historical Performance

One of the biggest reasons I trust this process is because dividend-focused strategies have demonstrated strong resilience across different market cycles.

Consider, for example, the S&P 500 Dividend Aristocrats Index, which has historically matched or outperformed the broader S&P 500 over the long haul while often experiencing smaller drawdowns during downturns.

Meanwhile, studies like Hendrik Bessembinder’s reveal that only a small fraction of stocks drive most market gains—making established, consistently paying businesses even more valuable to a buy-and-hold approach.

From my perspective, that combination of stability and steady compounding is what makes dividend investing a go-to choice if you’re aiming to retire early without gambling on hyper-volatile sectors.

A Mini Example of the Snowball in Action

Let’s say you put $10,000 into a sturdy, dividend-paying stock portfolio yielding around 4%. If the companies you’ve chosen typically grow their dividends by about 5–7% each year, and you reinvest those payouts rather than spending them:

Year 1: You earn about $400 in dividends.

Year 2 & Onward: Those dividends buy additional shares, which generate more dividends—plus the payout itself may be rising. Over 10 or 15 years, that snowball effect truly takes off.

This is a simplified example, but it shows how exponential growth can evolve from what initially looks like modest numbers.

Over a decade or more, that initial $10,000 can double, triple, or go even higher—solely from reinvesting dividends into growing companies. And that’s without adding any new money.

Yearly Reality Check: My Simple Checklist

I’m a “set-and-forget” guy at heart, but even I do a quick review once a year. Here’s what that looks like:

Dividend Coverage: Are these companies still making enough free cash flow to sustain or increase dividends?

Payout Ratio: Is it creeping upward to unhealthy levels (e.g., above 70% for many stocks, though certain sectors allow higher)?

Sector Balance: Did I drift too heavily into one industry because it was doing well? Time to rebalance if that’s the case.

Company Guidance: A brief glance at annual reports or key news items. Any fundamental shake-ups on the horizon?

If it all checks out, I hit “reinvest dividends” once again and continue on my way.

This Is the Road to Financial Freedom (No Joke)

One of my biggest motivations has always been the vision of true financial freedom—where I can travel, spend time with family, or pursue passion projects without sweating about monthly bills. That, to me, is FAT FIRE. It’s not about lighting cigars with $100 bills; it’s about the freedom to live life on my own terms.

And guess what? Reliable dividends + autopilot reinvesting = unstoppable cash flow growth. Every dividend check is a step closer to the day your investment income alone covers every necessity plus the lifestyle perks you dream about.

It’s powerful. It’s real. And it works for anyone disciplined enough to avoid hype and focus on the long haul.

Here’s what I’d do if I were starting fresh:

Open an IRA or Brokerage Account with free dividend reinvestment.

Pick 5–8 dividend payers that have a track record of increasing payouts. Make sure you like their business models.

Invest—and I mean actually pull the trigger. Don’t get stuck in analysis paralysis.

Enable DRIP, then go about your daily life.

Add More whenever you’ve got extra funds, and review everything once or twice a year.

Within a few short years, you’ll see that snowball turning into a wrecking ball—knocking down every financial hurdle in its path.

No frantic day-trading. Just methodical, unstoppable compounding. It’s how I’ve carved out my route to FAT Early Retirement, and it can do the same for you if you’re ready to embrace steady growth over flashy chaos.

Trust me: once you feel that growing stream of cash landing in your account, you’ll never want to return to the old rollercoaster rides.

Grab your metaphorical shovel, start rolling that dividend snowball, and watch how quickly it takes shape.

That’s the stuff that turns modest beginnings into a lifetime of freedom.

Thanks for reading!

- Mike