$7,104 in 14 Days — My Covered Call Results. This Week's Picks Project $10,208 More

Correction (4 May 2025): An earlier draft used a 2024 price for AT&T and pre-split prices for Nvidia. All stock quotes, option strikes, premiums, and yield calculations now reflect the 2 May 2025 close. Every other figure has been triple-checked— the analysis is current, correct, and fully transparent.

Over the last 14 days, readers following this system collected $7,104 in covered-call income, while the market crawled up +1%.

Here's what happened: On roughly $190k of stock, folks executed the strategy and generated triple the S&P's return in two weeks flat.

This is why I live for covered calls: Wall Street's 7% projections assume we've got infinite time. We don't.

While the retirement industry peddles patience, I prefer collecting dividends.

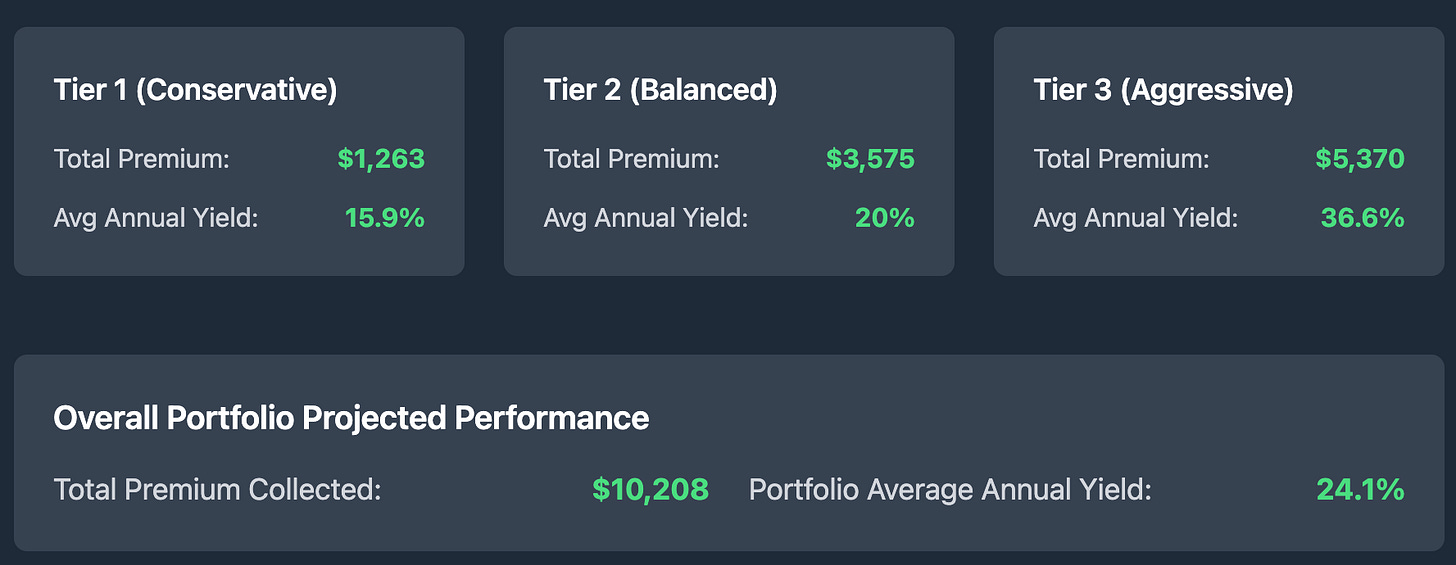

This week's covered-call strategy is projecting $10,208 in immediate premium income — with an average annualized yield of 24.1% across all twelve positions.

Below is the exact blueprint:

Three tiers match your risk tolerance; twelve picks across sectors that deliver portfolio balance without correlation headaches.

How Do I Pick My Targets for The Multiplier:

The VADER Screen

VADER stands for Volatility Arbitrage Dividend Enhancement Return system.

It's the proprietary screening algorithm that has followed me from the trading desk to my home office.

Every Sunday, I scan 3,217 optionable stocks, filtering for 16 specific criteria, including liquidity thresholds, volatility patterns, and technical support levels.

What remains gets sorted into three categories designed to fit different investor needs:

🔒 Tier 1: Conservative (8-12% target yield)

⚖️ Tier 2: Balanced (15-25% target yield)

🔥 Tier 3: Aggressive (25%+ target yield)

VADER's final selections are delivered directly to Premium subscribers every Thursday and Sunday.

Premium members receive verified picks at their absolute prime timing.

More on VADER and my Investment Philosophy:

This Week’s Picks

Disclaimer: Everything I've shared is simply for educational and informational purposes and should not be considered financial advice. Everyone's financial situation is unique, and what works for one person might be completely wrong for another. Before making any financial moves, it's always wise to consult a qualified financial advisor who is familiar with your specific circumstances.

🔒 TIER 1: Conservative Income

Capital Preservation Focus - Highest Premium Yield % on Low-Beta Names (Δ ≈ 0.30-0.45, IV ≤ 60%)

Tier 1 Execution Guide

Tier-1 Execution Guide (Updated)

UNH – UnitedHealth (Jun 21 $430 C)

When to trade: 09:45 – 10:15 ET, when spreads tighten and volume peaks.

Position size: 7 % → 70 shares per $1 M.Premium target: limit ≈ $8.68 / contract (about $868).

Roll trigger: if price touches $405, buy back at ~50 % profit and roll to Jul $435 for ≥ $6 credit.

Assignment plan: if called, keep the shares and sell ATM weeklies until IV < 20 %.

XOM – Exxon Mobil (Jun 21 $110 C)

• When to trade: after the 10:30 a.m. EIA report (spreads calm ~10:45).

Position size: 6 % → 60 shares per $100 k.

Premium target: limit ≈ $2.18 / contract (about $218).

Risk guardrails: trail stop $102; if called, reacquire only < $108.

Roll strategy: when shares reach $104.50, buy back near $1.00 and sell Jul $112 for ≥ $2.50.

T – AT&T (Jun 21 $29 C)

• When to trade: sell in the first 30 minutes of the session (best liquidity).

Position size: 8 % → 80 shares per $100 k.

Premium target: limit ≈ $0.62 / contract (about $62).

Defense: if price falls < $26.00, roll to Jul $29 or add an Aug $25 protective put.

Weekly income: on assignment, chain $28 – 29 weeklies every Friday for maximum theta.

PG – Procter & Gamble (Jun 21 $170 C)

•When to trade: after the XLP staples ETF finishes its morning push (≈ 10:15-10:45 ET).

Position size: 6 % → 60 shares per $100 k.

Premium target: limit ≈ $3.00 / contract (about $300).

Protection: if shares break $155, buy the Jun $155 put (≈ $2.70).

Assignment action: keep the shares; sell $172 – 175 weeklies until called away.

⚖️ TIER 2: Balanced Approach

Income with Moderate Risk - Maximizing Premium Yield % ÷ Delta ratio (Δ ≈ 0.35-0.55)

This is where I deploy most of my cash. It balances meaningful income with quality businesses.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.