What the 90-Day Tariff Pause Means for Your Portfolio

Wall Street insiders are quietly preparing for these three predictable phases

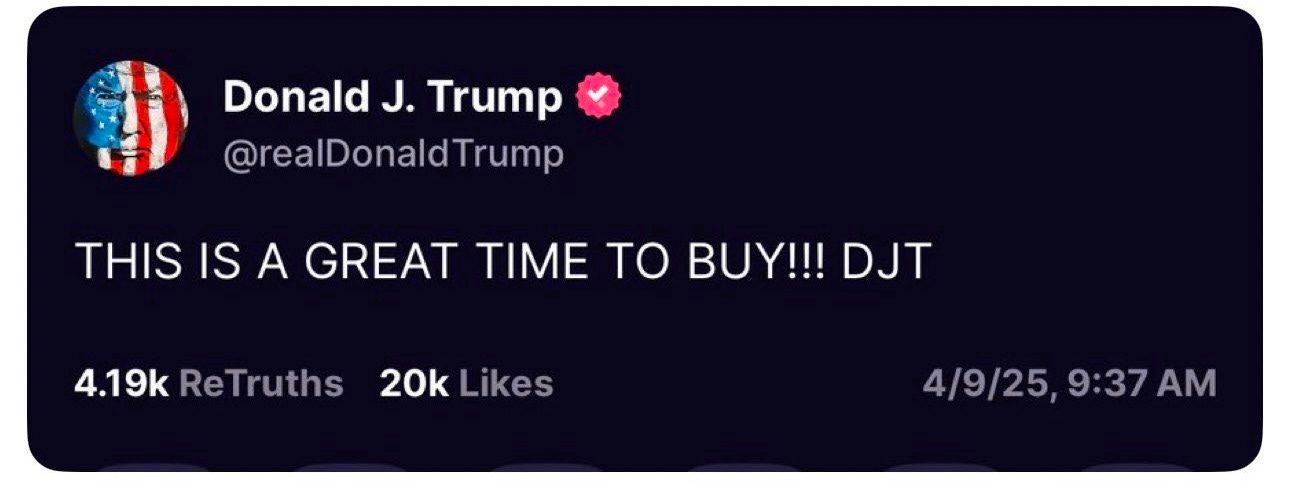

At 9:37 AM, a message appeared on Truth Social:

Within seventeen minutes, DJT stock surged 9.2%.

On a stake valued at $3.1 billion, that's approximately $285 million in paper gains created in less time than it takes to brew coffee.

But this was just the opening act.

At 11:42 AM came the announcement of a 90-day pause on most newly implemented tariffs (with China remaining at the elevated 125%).

The broader market response was explosive—the S&P 500 climbed 5.2% while the NASDAQ surged 7.3%. By market close, DJT stock had climbed 22.4%.

A $696 million single-day gain.

This was a textbook example of how markets can be manipulated through strategic announcements.

First, create a crisis, then "solve" it—while profiting on both the downswing and the recovery.

While stock investors were celebrating, something more telling was happening in the bond market

Treasury yields, which had spiked dramatically as tariffs went into effect, suddenly reversed course.

Why bond markets matter more than stocks:

The bond market is where the real money moves—it's roughly three times larger than the stock market.

When bond investors get nervous, they're essentially saying they're worried about America's ability to pay its debts or about fundamental economic stability.

During the tariff crisis, major foreign institutions (particularly from Japan) accelerated their selling of US Treasury bonds. They were dramatically reducing their exposure to America.

The bond market truly has a veto on stupidity.

What this tells us:

When foreign investors dump US bonds at this pace, they're sending a clear message about declining confidence in American policy stability.

And unlike stock market moves, which can be driven by emotion, these kinds of bond movements reflect cold, calculated institutional decisions.

Unpacking the 90-Day Pause: A Three-Act Play

This 90-day "pause" isn't a policy timeout—it's a market manipulation mechanism with a precisely engineered timeline.

Think of it as a three-act play, with each act creating different opportunities and risks:

Act 1: The Relief Rally (First 30 Days)

What happens: This is where we are now. Markets are surging on relief that the worst-case scenario has been postponed. Growth stocks (especially technology) typically lead the charge while safer investments lag behind.

Why it happens: Human psychology drives this phase. We experience intense relief when a feared outcome is delayed, even if the underlying problem remains unresolved. This relief triggers buying that becomes self-reinforcing as investors fear missing out.

How you can tell when it's ending: Watch for trading volume to decline while prices continue rising. This signals diminishing conviction. Also, watch for market "breadth" to narrow, meaning fewer and fewer stocks will participate in the rally. When most of the gains are concentrated in a handful of big names, the relief rally is running out of steam.

Act 2: The Complacency Trap (Days 31-60)

What happens: Media attention shifts elsewhere. Trading volumes decline. Market volatility falls to deceptively low levels. The tariff issue seems to fade into the background.

Why it happens: Our brains are wired to adjust to new normals quickly. The market collectively "forgets" about the looming deadline as immediate danger appears to have passed. This creates a dangerous complacency.

How you can tell when it's ending: Pay attention to renewed mentions of tariffs in financial media, particularly stories "reminding" investors of the upcoming deadline. Watch for subtle shifts in market-leading sectors—often defensive areas like utilities, consumer staples, and healthcare begin to outperform. This rotation signals smart money quietly repositioning before the masses catch on.

Act 3: The Anxiety Return (Days 60-90)

What happens: As the deadline approaches, market anxiety naturally increases. Volatility rises, often dramatically. Investors who were complacent during Act 2 suddenly rush to protect themselves, driving up the cost of hedging.

Why it happens: The deadline looms larger as it approaches, triggering our natural tendency to overweight imminent threats. The same traders who ignored the issue at day 45 become obsessed with it at day 85.

How you can tell when maximum opportunity/risk is present: Market commentary becomes increasingly focused on the tariff deadline. Headlines shift from "what if" to "how bad." Options become dramatically more expensive, especially put options that protect against the downside. The gap between stock market optimism and bond market caution typically reaches its maximum.

This Isn't New—Just Faster and Bigger

While this feels unprecedented, market manipulation has a long history. The most direct parallel comes from the 1920s "investment pools," where operators like Jesse Livermore and Joseph Kennedy (JFK's father) engineered market moves through coordinated action.

Their playbook was remarkably similar:

Quietly accumulate positions

Generate public enthusiasm through strategic information release

Watch prices surge as the public piles in

Quietly sell their positions at elevated prices

Move on before the inevitable collapse

The difference today — what once took weeks now unfolds in hours.

Information that once spread through newspapers now travels at the speed of social media.

But human psychology—the tendency to oscillate between greed and fear—remains unchanged.

How to Navigate Each Phase of the 90-Day Window

You don't need to be a Wall Street insider to use this knowledge.

Here's how different types of investors can navigate each phase:

During the Relief Rally (Days 1-30):

For conservative investors:

This is not the time to chase performance. The initial surge is driven by relief, not fundamental improvement. If you were considering reducing risk before the dip, the relief rally provides a more favorable exit point.

For opportunistic investors:

Pay careful attention to which sectors are leading the recovery. Technology and consumer discretionary stocks typically surge in relief rallies, but this enthusiasm often precedes actual improvement in business conditions.

Why this matters: Relief rallies create a false sense of "problem solved" when in reality nothing fundamental has changed. The tariffs are still partially in effect, and global business uncertainty remains high.

During the Complacency Trap (Days 31-60):

For conservative investors:

This middle period is ideal for methodically building positions in high-quality companies that may have been overlooked during the initial euphoria. Focus on businesses with minimal exposure to international trade disruption.

For opportunistic investors:

This phase creates ideal conditions for identifying asymmetric opportunities—investments with limited downside but substantial upside if the tariff situation resolves favorably.

Why this matters: The market's complacency creates mispricing. When everyone stops paying attention, pricing inefficiencies emerge that patient investors can exploit.

During the Anxiety Return (Days 60-90):

For conservative investors:

As the deadline approaches, market anxiety will naturally increase. Having dry powder (available cash) allows you to act when others are forced to react.

For opportunistic investors:

Market anxiety typically leads to indiscriminate selling. The best companies get punished alongside the vulnerable ones, creating potential bargains for those who can distinguish between temporary panic and actual business risk.

Why this matters: Financial history shows that some of the best investment opportunities emerge during periods of maximum uncertainty. The key is distinguishing between stocks being sold because of genuine vulnerability and those being sold simply because investors need liquidity.

I want to emphasize again — the 90-day tariff pause isn't a policy timeout—it's a deliberately engineered market manipulation cycle with predictable phases.

Understanding these phases doesn't require an economics degree; it requires recognizing patterns in human behavior.

The markets may have changed, but human psychology remains constant.

Fear and greed still drive short-term movements.

Artificial deadlines still create predictable behavior patterns.

And in a world where policy can change with a social media post, the ability to distinguish between price movements and fundamental value becomes more valuable than ever.

Those who think independently dine well regardless of market conditions.

Until next time,

Mike Thornton, Ph.D.

Thank you for this article. When the free fall started last week I remarked to my family that DJT needs to be a hero so he’ll create a crisis and then solve it and thus be the hero. I also saw it as a stock manipulation. But you have illustrated that we are living in a Shakespeare Tragedy and this is only Act 1. I have never considered this. So at the end of Act 3 when the free fall happens again do you see this pattern continuing?