📈🇺🇸 Week 6, '25—Inflation Spikes, Dollar Surges & Trade Tensions: Stock Market Analysis & Portfolio Action Steps

5 portfolio moves you can make today

Last week’s economic tremors—soaring inflation, an unexpected jobs slowdown, and a surging U.S. dollar—aren’t mere anomalies.

They’re warning signs echoing patterns that foreshadowed historic crises, from the 2001 tech collapse to the 2008 financial meltdown.

This time, the stakes are personal: your retirement savings, portfolio resilience, and financial future hang in the balance.

In This Week’s Premium Deep Dive, You’ll Gain:

A dividend fortress plan and an aggressive growth blueprint—complete with sector ETFs, hedging tools, and rebalancing triggers—to protect (and grow) your wealth.

Lessons from history’s playbook: Which sectors face the greatest risk—and how to spot them before the storm hits.

The inflation trap: Why today’s 4.3% price surge could stealthily drain your purchasing power (and the exact assets that outpace it).

Decoding the jobs slowdown: What weakening hiring means for your retirement timeline and how to bulletproof your income streams.

Dollar dominance decoded: How to navigate international investments when the greenback’s strength becomes a double-edged sword.

Trade war tactics: Sector-specific shields to deflect tariff shocks and supply chain chaos.

Let’s dive in.

1. Rising Inflation Expectations: The Silent Erosion of Wealth

The University of Michigan consumer sentiment data revealed that one-year inflation expectations leaped from 3.3% to 4.3%—the highest since November 2023.

Why This Matters:

Real Value Erosion: With inflation creeping up, the purchasing power of every dividend check and capital gain is at risk. For those living off dividends, this is akin to receiving a pay cut without any cost-of-living adjustment.

Fed Policy Implications: Elevated inflation expectations can compel the Federal Reserve to remain hawkish. That means a slower pace of rate cuts—or even more rate hikes—which could dampen economic growth and weigh on earnings.

Historical Perspective:

When inflation expectations spiked by around 1% in a single month during past periods (such as pre-2008), we often saw subsequent market corrections of 5-8%.

Whether you’re an aggressive growth investor or a dividend seeker, inflation is the invisible hand that could erode your real returns. It’s a wake-up call to either seek assets that outpace inflation or hedge against its damaging impact.

2. Weaker Job Growth

The January job report showed 143,000 new jobs, short of the anticipated 170,000. The unemployment rate remained at 4%. The slower-than-expected hiring raises critical questions.

Why This Matters:

Economic Cool-Down: A slowing job market might suggest that wage inflation and by extension, cost pressures—could ease, which might please growth investors if the Fed adopts a more dovish stance.

Warning of Underlying Weakness: On the other hand, sluggish job growth can be a precursor to an economic slowdown. This could impair corporate profits and, by extension, the sustainability of dividends.

Historical Perspective:

Recall the early signals during the 2001 slowdown and the 2008 crisis: Missed job growth data often preceded broader economic contractions.

Stay nimble. A cooling job market could be the calm before a storm or the trigger for a policy pivot. Your strategy should be ready for either scenario.

3. The U.S. Dollar Rally: Strength Amid Uncertainty

The U.S. Dollar Index (DXY) soared, propelled by the inflation narrative and global risk aversion. The greenback is flexing its muscles, reaching near multi-year highs.

Why This Matters:

International Exposure at Risk: A strong dollar compresses the value of foreign earnings when translated back to U.S. dollars. This could mean a significant headwind for those invested in international stocks or emerging markets.

Safe Haven Dynamics: A robust dollar also signifies a flight to safety. In turbulent times, currency movements can often be the canary in the coal mine for global liquidity shifts.

Historical Perspective:

Periods of dollar strength, such as the early 2010s, have typically been followed by undervaluation in international equities. This often sets up opportunities for a rebound of 15-20% when the currency normalizes.

If the dollar's strength persists, consider hedging or gradually rebalancing your international allocations. For many, a strong dollar signals domestic resilience and indicates that global markets may be bracing for tougher times ahead.

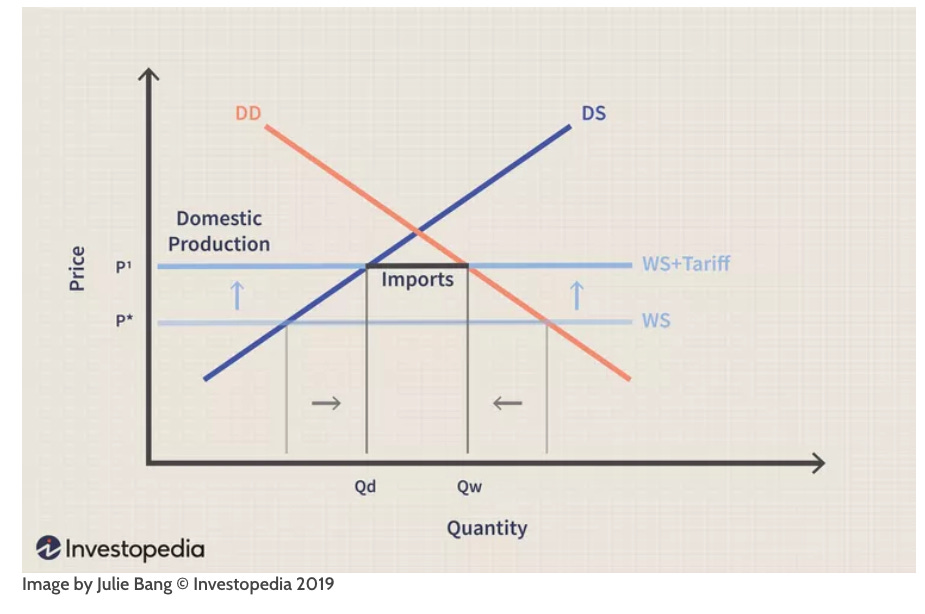

4. Trade War Tensions: Tariffs and Retaliation Rattling Markets

Despite temporary pauses on some tariffs, the underlying tensions with China remain unresolved.

New tariff threats on Chinese goods, coupled with potential retaliatory measures, are injecting fresh uncertainty.

Why This Matters:

Corporate Earnings at Stake: Tariffs function as hidden taxes. They raise costs for manufacturers and disrupt supply chains—factors that directly hit corporate profit margins.

Sector-Specific Vulnerabilities: Industries such as tech, automotive, and industrials, which rely on global supply chains, are especially exposed. A renewed trade war could trigger a significant revaluation of these sectors.

Historical Perspective:

Recall the trade tensions in the late 2010s and even the Smoot-Hawley era. At that time, tariff escalations were correlated with sector-specific corrections of 5-10%. Understanding these cycles can guide us in recalibrating our risk exposure today.

Recognize that geopolitical risk is an ongoing variable. This isn’t just an abstract policy debate; it’s a tangible threat to earnings and growth. Adjust your portfolio to mitigate exposure in sectors most vulnerable to tariff-induced cost pressures.

5. Gold’s Breakout: The Classic Flight to Safety

Gold surged to record highs this week, affirming its status as the ultimate hedge in times of uncertainty.

Despite a slight pullback after the initial spike, its breakout remains a critical signal.

Why This Matters:

Inflation and Geopolitical Hedge: Gold’s price action underscores investors’ concerns about both inflation and global instability. It’s a timeless asset that doesn’t suffer from currency devaluation.

Portfolio Diversification: Even a modest allocation to gold can serve as an insurance policy against a broader market collapse.

Historical Perspective:

During previous crises such as the 2008 financial meltdown, gold rallied by 20-30%, offering a stark counterbalance to the volatility seen in equities. Such data reinforces its role as a dependable safe haven.

For investors committed to long-term wealth preservation, integrating gold or a broader commodities basket can mitigate risks from macroeconomic shocks. It’s not about abandoning equities but about creating a balanced, resilient portfolio.

5 Portfolio Moves You Can Make Today

Now, we will review a dividend fortress plan and an aggressive growth blueprint—complete with sector ETFs, hedging tools, and rebalancing triggers—to protect (and grow) your wealth.

Let’s Start With Dividends

AllianceBernstein research shows Dividend Growth stocks tend to outperform in volatile markets and can maintain stable cash flows.

1. High-Quality Dividend Payers with Pricing Power:

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.