📈🇺🇸 Week 5, '25—Stock Market Analysis & Portfolio Action Steps: Tariffs Return, DeepSeek Shakes AI, Dividend Stocks Shine

Three strategic moves you can make today.

I’ve never seen such a wild double-whammy in the markets: Tariffs are back in force—25% on Canada and Mexico, 10% on China.

Almost simultaneously, a new AI disruptor, DeepSeek, has upended the “massive data + supercomputers” model we assumed was unshakeable.

Two major shifts, one after the other. Sounds dramatic, right?

But if there’s one thing I’ve learned through multiple crises—chaos can breed opportunity if you know where to look.

Below is my personal breakdown of how to keep your income safe (and even growing) in this environment.

1. Why Tariffs Actually Matter This Time

Tariffs are a form of political theater and leverage.

What’s New:

President Trump signed an executive order imposing 25% tariffs on imports from Canada and Mexico and 10% on Chinese goods.

Goldman Sachs notes that every 1% tariff increase generally adds 0.1% to inflation. This means consumer prices could spike, possibly bringing us to 3–4% inflation by Q3.

Historically, as seen in 2018’s trade war when the S&P dropped 20%, companies with strong domestic supply chains (energy, manufacturing, etc.) often outperformed during the turbulence.

Why You Should Care:

A 10% tariff alone can cost the average middle-class household an extra $1,700 annually. Up that to 25%, and the pinch gets bigger.

With inflation creeping, the Fed may keep hiking rates or at least hold them high for longer.

Translation: your longer-term bonds get hit, and some stocks might stumble if borrowing costs rise.

2. The “DeepSeek” Bombshell on AI

DeepSeek proved you can build formidable AI without multi-billion-dollar data centers or top-tier GPU clusters.

They used smaller chips, less data, and a rule-based engine to achieve results that rivaled those of big players like OpenAI.

Implications:

Companies that hinged their entire “AI advantage” on spending billions for supercomputing & data might see margins squeezed

However, top-tier, high-grade AI (think advanced analytics, intuitive decision-making, complex tasks) may remain strong, meaning certain AI companies still have moats.

Investors might see a shift: part of AI could become “low-grade,” easily commoditized, driving some pure AI “hype stocks” down, especially if they can’t pivot.

3. Three Moves You Can Make Today

(1) Evaluate Your “Tariff Exposure”

Rule of Thumb: If over 20% of a company’s revenue or input costs come from tariff-hit regions (Canada, Mexico, China), reconsider your holding. Their margins are under fire.

Think auto parts retailers (O’Reilly, Advance Auto) with heavy Mexican imports, or chip names reliant on Taiwanese/Chinese supply chains. If you’re holding them, be ready for turbulence.

(2) Keep Some Cash (or Short-Term Bonds)

I aim for ~10% in cash equivalents (like the SGOV T-bill ETF, which yields 5%). I hate watching that chunk sit idle, but the payoff comes when fear spikes. Then, you can buy quality stocks at a discount.

(3) Focus on “Domestic, Essential Dividend” Stocks

If inflation rises and rates stay high, you want robust cash flow. Look at utilities, telecoms, waste management—stuff Americans can’t simply skip. Also, US-only supply chains are gold in a trade war.

Those three steps alone keep you ahead of most folks who’ll panic-sell at the first big headline.

This is your first layer of defense.

The premium section contains my deeper strategy (the exact holdings, the breakdown of which AI stocks survive DeepSeek, and the best inflation hedges).

Here’s my personal plan to protect (and grow) my passive income despite tariffs, inflation, and a potential AI narrative shakeup.

Okay, let’s roll up our sleeves.

4. My “Tariff-Proof” & DeepSeek-Proof Portfolio Shifts

1). Domestic Dividend Core

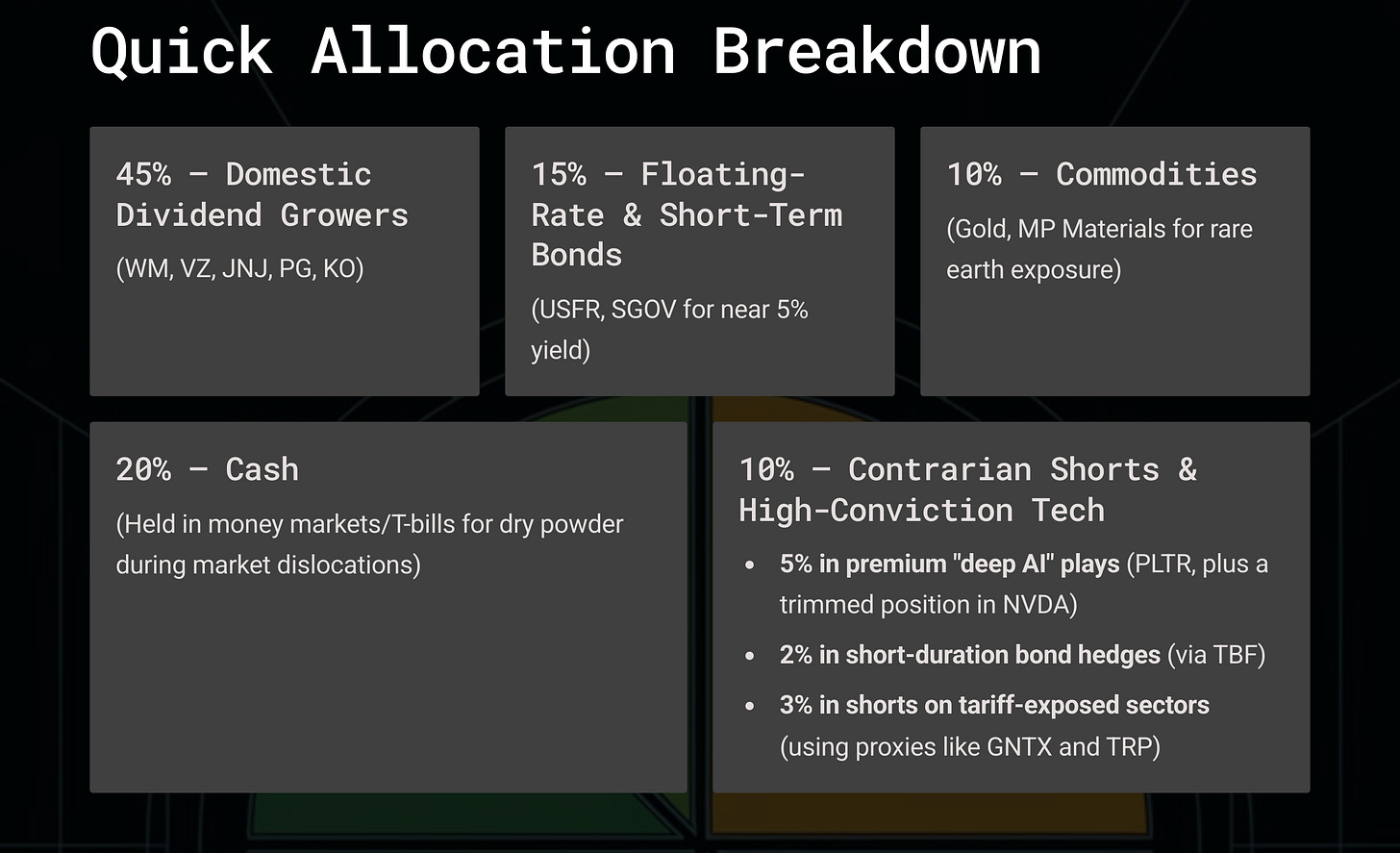

I’m putting 45% of my portfolio into U.S.-based dividend champions.

In stagflation-type scenarios, dividends historically provide a lifeline. In the 1970s, dividend aristocrats handily outperformed the broader market.

For example:

Waste Management (WM): With over 90% domestic revenue, WM is like a dependable friend who never disappoints—even when the economy is downturned.

Verizon (VZ): Despite hardware issues, Verizon’s service business remains rock-solid, ensuring consistent income.

Johnson & Johnson (JNJ) and Procter & Gamble (PG): These blue-chip giants are the gold standard in dividend reliability, renowned for their ability to pass on rising customer costs.

Coca-Cola (KO): KO’s global brand and vast distribution network make it a perennial safe haven, even when inflation rears its ugly head.

2). DeepSeek-Resilient Tech & AI

Sure, the chatter around “lite AI” like DeepSeek is loud, but don’t get caught up in every shiny headline.

The real winners in the AI race are companies with proper “deep AI” muscle, where tech meets strategic government ties.

My tactical plays include:

Palantir Technologies (PLTR): A strong government moat can protect against market turbulence.

Nvidia (NVDA): While I’ve trimmed my stake to about 2.5% of the portfolio, Nvidia remains essential. Its premium GPUs are the engine behind high-end AI.

(For those who crave a public proxy for innovative defense tech—look at defense plays like Lockheed Martin (LMT) for exposure to that same transformative power.)

3). Floaters and Tactical Shorting: Hedge Like a Pro

With inflation pushing the Fed to potentially maintain high rates, there's a need to safeguard your fixed income with agile instruments.

Floating-Rate Instruments (15%): I’m holding positions in assets like USFR and SGOV that adjust with interest rates, ensuring I lock in yields near 5% no matter what the Fed does.

Shorting Long-Duration Bonds (≈2%): By taking tactical short positions (think TBF), I hedge against unexpected rate hikes that could send long-dated Treasuries tumbling.

4). Commodities & Rare Earths: The Classic Inflation Shield

Gold: It’s the timeless safe haven—whether you prefer a physical gold bar or a low-cost ETF like GLD, gold’s got your back when inflation is on the rise.

Rare Earth Metals (e.g., MP Materials—MP): With retaliatory tariffs potentially curtailing foreign supplies, MP Materials is a critical player in domestic rare earth production.

5). Capitalizing on Vulnerable Sectors

The pain is most acute for firms with significant international exposure.

Auto Parts Retailers rely heavily on imported components (think 40% from Mexico), so I maintain a modest short position (~1–2% of my portfolio) in names like Gentex Corporation (GNTX) to capture potential margin squeezes.

Canadian Energy Plays: Tariffs on oil and gas exports can be brutal. For this reason, I use selective shorts in companies like TransCanada Corporation (TRP), which are vulnerable in a protectionist world.

Additionally, consider this: Canada supplies about 60% of U.S. crude oil. With tariffs on Canadian energy, companies like Vistra (VST) and Constellation Energy (CEG) might be uniquely positioned to capitalize on market volatility. And domestic industrials such as Caterpillar (CAT) often thrive when global trade stumbles.

Here’s how it all adds up:

6. The Strategy Behind the Structure

A) When tariffs and trade wars threaten to disrupt global revenues, you want companies that earn most of their money at home. That’s why my dividend core is stacked with U.S.-centric titans that can pass on rising costs to their customers.

B) Not all AI is created equal. Instead of chasing every shiny “AI” stock, I focus on those with true competitive moats. Palantir’s government contracts and Nvidia’s indispensable hardware are prime examples. This is about investing in the lasting value of innovation.

C) With inflation and interest rate uncertainty on the horizon, floating-rate bonds and tactical shorts protect your portfolio’s fixed income while keeping it agile enough to seize opportunities.

D). Commodities hedge against inflation and geopolitical shocks, and a hefty cash reserve lets me pounce on quality opportunities when market sentiment sours.

7. Lessons from the Past

Tariffs Are Real: I learned in 2018 that tariffs aren’t just political talk—they’re a force that can rearrange competitive dynamics.

Like those in my dividend core, companies with strong domestic pricing power weather the storm best.

AI Narratives Can Change Overnight: Remember how ChatGPT stole the spotlight before DeepSeek appeared?

That’s a reminder that while trends are volatile, disciplined exposure to quality, “deep AI” players can deliver long-term value.

Liquidity Equals Opportunity: Holding 20% in cash isn’t a sign of weakness—it’s a strategic reserve that lets you buy quality stocks at bargain prices when others panic.

Domestic Moats Matter: Companies that can increase prices to offset inflation ultimately win. My dividend core is built around this principle, providing both income and resilience.

This is it for today—don’t panic.

My strategy locks in the stability of reliable U.S. dividend giants while flexing tactical muscle in the deep AI space, floating-rate bonds, and even targeted shorts.

This isn’t about chasing the latest fad; it’s about smart, disciplined investing that not only survives the chaos but thrives on it.

Remember, a well-balanced, resilient portfolio is your best bet in uncertain times.

- Mike

Seen this movie before: '85 Plaza Accord, '95 semiconductor war, '18 China tariffs. Pure domestic plays don't exist anymore - even WM and VZ are global now. Smart money always bets on adaptation, not protection.