$17,135 in cash income. 28 days. $333,500 on standby.

That's a 66% annualized return from telling the market: "We'll buy your best companies, but only when your fear creates a price we can't refuse."

While others get caught in the market's emotional storms, VADER gets paid to sell the umbrellas.

This is what happens when you stop chasing stocks and start harvesting the mathematical certainty hidden beneath market chaos.

The math on that is a 5.1% cash return in 28 days. It's the simple difference between uncertainty having a price tag, and patience converting directly into income.

The Four-Step Loop: The Blueprint for Being the House

For those new to the fold, our strategy here is built on a simple, repeatable process for selling cash-secured puts (CSPs). I like to use the casino as an analogy.

We sell insurance to anxious market participants, with the odds mathematically stacked in our favor.

We identify situations where we can be paid to take on a calculated risk that we are already comfortable with.

Here’s our four-step loop.

Mastering this process is the key to consistent results:

Step 1: Screen with VADER

Everything starts with a selective, data-driven hunt.

Our proprietary VADER algorithm is the brains of the operation.

It sifts through thousands of options chains to find a specific confluence of factors that inflate the premiums we collect. The goal is to find the right put, where we're being overpaid to agree to buy a great company at an already attractive price.

Step 2: Sell & Collect

Once VADER has identified a target, we can execute by selling a cash-secured put. Let’s break that down.

When we "sell a put," we enter a contract and collect an immediate cash premium.

In exchange for that premium, we accept a conditional obligation: we agree to buy 100 shares of the underlying stock at a specific price (the "strike price"), but only if the stock is trading below that strike on the expiration date.

The "cash-secured" part is critical. It means we have the full amount of cash required for the purchase ($strike price × 100) already set aside in our account. We use no leverage. We take on no undue risk. We are simply formalizing our intent to buy a stock we like at a price we choose, and we demand to be paid for making that commitment.

Step 3: Manage the Position

Once the trade is on, there are two primary paths, and both lead to a good place.

Path A (Expiry): If the stock price stays above our strike price through expiration, the put contract expires worthless. The obligation disappears. We keep 100% of the premium we collected, and our secured cash is freed up. This is the most common outcome and the simplest form of income generation.

Path B (Management): If the stock price drops and challenges our strike price, we have options. We are never passive victims of the market. We can choose to "roll" the position. This is an elegant and powerful technique for managing risk. The process involves a single transaction to simultaneously buy back our current put and sell a new one on the same stock. The new put will have two key features: a lower strike price and a later expiration date. In most cases, we can execute this for a net credit. This means we are paid even more money to lower our potential purchase price and give ourselves more time to be right.

Step 4: Buy at a Discount or Repeat

If we choose not to roll an in-the-money put, we will be "assigned" the shares. This isn't a failure; it's the strategy's second form of victory. We now own 100 shares of a company we already vetted and wanted, and we bought them at the discounted strike price we chose from the start. Better yet, our effective cost basis is even lower, because we subtract the premium we collected from the strike price.

For example: if we sold a $100 strike put and collected a $3.00 premium ($300), our true breakeven price on assignment is $97.00 per share. We effectively bought the stock for less than anyone else on that day. And if we aren't assigned? We simply go back to Step 1, cash in hand, ready to sell another put and repeat the entire profitable cycle.

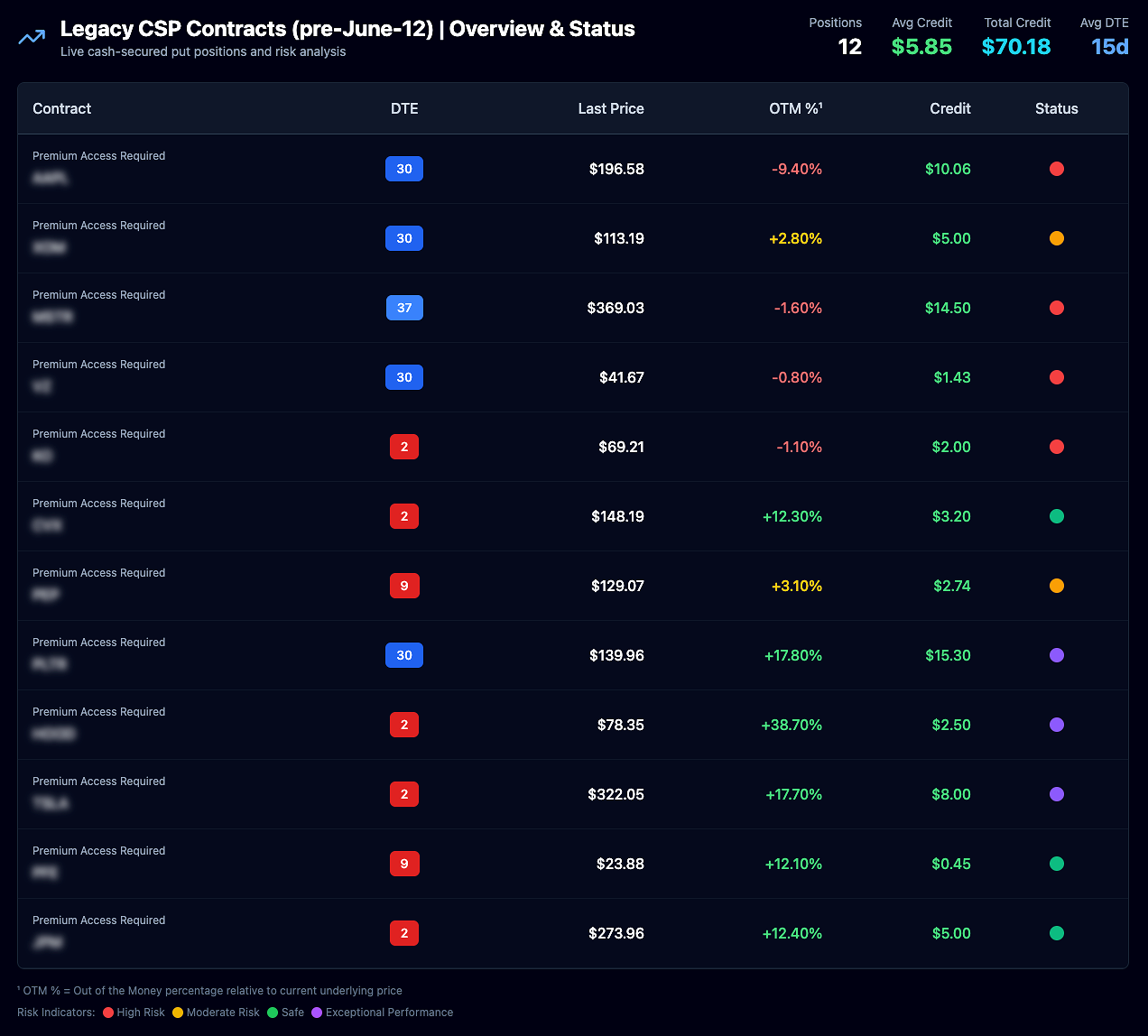

Performance Snapshot

Executive Snapshot (as of June 18, 2025, close)

→ 24 live cash-secured puts on the books,

→ diversified across eight distinct market sectors.

→ a total up-front premium of $17,135, against $333,500 of secured cash

→ that translates to a 5.1% return on collateral over an average holding period of just 28 days.

The portfolio's risk posture is deliberately mixed to balance income with capital preservation.

10 positions in the "Safe" Green Zone.

4 in the "Moderate" Yellow Zone.

7 in the "High Risk" Red Zone (in-the-money).

3 in the "Exceptional" Purple Zone, with premiums that are nearly pure profit.

Immediate focus is on managing the five contracts that expire this Friday, June 20th.

Structural Strengths:

Rich Implied Volatility: 18 of 24 positions were sold in the 70th+ IV percentile—selling umbrellas when storms are forecast. This drives our ≈7% monthly cash yield.

Staggered Expiry Ladder: Expirations span 2, 9, 30-37, and 58 DTE, preventing gamma shocks while creating continuous capital redeployment opportunities.

Deep Cushions on Growth Names: Our purple cohort enjoys 17-39% downside buffers yet still delivered 161-951% annualized yields thanks to sizzling IV.

Sector Diversification: Tech dominates with 13 trades, but energy, staples, healthcare, financials, and telecom positions blunt beta risk and broaden roll opportunities across market cycles.

But we study our winners and losers with equal intensity. Transparency is paramount.

🔓For Premium Members: The Implementation Playbook & Key Actions For The Week section contains my complete notes and intended actions for this week, covering:

→ Management of the June 20th Expirations.

→ Analysis of In-the-Money Positions: My notes on the challenged puts.

→ Portfolio-Level Adjustments: Managing current Tesla concentration.

→ Capital Redeployment: The plan for the capital freed up by the profitable positions.

This granular, position-by-position analysis is a core component of the premium membership.

While premium members get the detailed roadmap for managing our current positions, everyone benefits from identifying fresh opportunities.

With $61,000+ in collateral potentially freed up from Thursday's expirations, we need quality targets for redeployment.

That's where this week's VADER screening becomes crucial, because sitting on idle cash defeats the entire purpose of a systematic income approach.

Introduction to New VADER CSP Picks

We classify our puts into three tiers, allowing you to tailor your approach based on your risk tolerance and income goals.

Tier 1 (Conservative Income): These are puts on blue-chip, fortress-like companies. They are sold further out-of-the-money (typically >8% OTM) with low deltas (sub -0.20). The goal here is high-probability income generation; assignment is less likely but would result in owning a world-class business at a fantastic price.

Tier 2 (Balanced Risk/Reward): This is the sweet spot for many. We target quality growth or solid value stocks, selling puts a bit closer to the current price (typically 5-10% OTM) with deltas around -0.30 to -0.35. The annualized yields are significantly higher, and the probability of assignment is a reasonable ~30-35%.

Tier 3 (Aggressive Yield / Stock Acquisition): Here, we walk closer to the fire. These puts are sold at or very near the stock's current price, with deltas often exceeding -0.40. The premiums are exceptionally high, but so is the probability of assignment (~40-50%). Only sell these puts on stocks you genuinely want to own, as there's a good chance you'll be buying them soon.

CRITICAL DISCLAIMER: The tables below show how I screen for income-generating put selling opportunities. They are not trade recommendations, signals, or financial advice. Use them as an educational foundation only—back‑test, sanity‑check, and consult a licensed professional before risking a nickel. Selling cash-secured puts involves the obligation to buy the underlying stock at the strike price if the option is assigned, which can happen if the stock price falls below the strike at expiration. Ensure you have the cash secured and are willing to own the stock at that price.

This Week's Fresh VADER CSP Picks

🔒 Tier 1: Conservative Income

This tier is for the investor who prioritizes the safety of principal and consistent, high-probability income.

The common thread here is valuation.

Every strike price is at or below the long-term valuation floors we saw during the 2022 tightening scare. Furthermore, each delta signals roughly a 15-20% probability of assignment. This means that eight times out of ten, you simply sweep the cash. The other two times, you inherit a blue-chip stock at a discount, plus the upfront premium you already collected. This is the ideal recipe for a conservative income investor.

⚖️ Tier 2: Balanced Approach, Calculated Aggression

This tier is designed for the balanced investor seeking to significantly boost their monthly income while still maintaining a reasonable safety buffer.

This is where I deploy most of my personal capital.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.