Last week's Bank of America Global Fund Manager Survey revealed something that should make every investor sit up straight: 49% of hedge fund managers now expect a hard landing for the US economy, up from just 6% in February.

That's not gradual pessimism; it's a stampede for the exits.

Meanwhile, retail investors keep right on buying the same index funds and tech darlings, faithfully executing the strategy that's worked for a decade.

One group is catastrophically wrong—and your retirement might depend on figuring out which one.

The Divergence Between Wall Street and Main Street Has Rarely Been This Pronounced:

82% of institutional respondents believe the global economy will weaken—the highest percentage in 30 years

The BoA fund manager sentiment index has fallen below pandemic-crash levels

For the first time since 2021, the most crowded trade is no longer "Magnificent 7" tech stocks—it's gold

Meanwhile, retail inflows to equity funds remain resilient.

The disconnect is so dramatic that it demands an explanation beyond simple disagreement.

What's Really Driving Professional Investors Toward the Exits:

1. The Tariff Time Bomb

When professional traders see tariffs, they don't just see the headline number. They see a cascade of consequences:

First-order effects: Higher import costs, supply chain disruption

Second-order effects: Margin compression, inventory gluts, consumer price increases

Third-order effects: Demand destruction, layoffs, debt servicing issues

Fourth-order effects: Banking stress, credit contraction, economic deceleration

Bank executives are quietly increasing loan loss provisions. Shipping companies report container volume declines at major ports. Retailers are delaying orders. These signals rarely make headlines, but they're flashing red on institutional trading desks.

I wrote a piece on this a few days ago:

2. The Current Setup Bears an Uncomfortable Resemblance to Previous Market Regimes that Ended Poorly:

The Nifty Fifty era (1960s-70s): Concentration in a handful of "can't-lose" stocks before the 1973-74 bear market

The 2000 Tech Bubble: Extreme valuations justified by "new paradigm" thinking

2007 Housing Bubble: Leverage masking fundamental economic weakness

Each period featured prolonged euphoria followed by brutal corrections. Professional investors with 30+ year careers have lived through these cycles and recognize the patterns.

3. The Central Bank Tightrope

The Federal Reserve engineered what appeared to be a textbook soft landing. But the introduction of broad tariffs fundamentally changes the equation:

Tariffs are inherently inflationary

But their economic drag is recessionary

This creates a policy nightmare: Hike rates to fight inflation? Or cut to fight recession?

The "Fed put" that markets have relied on may not function in this environment. Institutions understand this policy constraint in ways retail investors often don't.

Why Retail Investors Keep Buying

Understanding retail psychology is critical for anticipating future market moves:

1. The Conditioned Response

Imagine training a dog to expect treats when a bell rings. After enough repetitions, the mere sound of the bell triggers salivation.

Similarly, a generation of investors has been conditioned to "buy the dip" through multiple crises:

Each recovery reinforces the behavior. When markets decline, the conditioned response activates: "This too shall pass."

2. The False Sense of Liquidity

Retail investors often assess risk through the lens of their personal experience:

"I can always sell if things get bad."

This assumption breaks down when everyone heads for the exit simultaneously. The market appears liquid until it isn't. Institutional investors size positions with this reality in mind; retail investors rarely do.

3. The Information Asymmetry

Consider how institutional and retail investors process economic signals:

This information gap creates different risk perceptions. By the time risks become obvious to retail, institutional positioning is often complete.

Historical Precedent: When Smart and Dumb Money Diverge

The current divergence isn't unprecedented. Similar gaps have occurred at pivotal market moments:

1987 Crash:

In the months before "Black Monday," institutional investors gradually reduced equity exposure while retail remained optimistic. The Dow dropped 22.6% in a single day.

2000 Tech Bubble:

As the Nasdaq approached its peak, institutional selling intensified while retail buying continued. The subsequent crash saw the index fall 78%.

2007 Housing Bubble:

By mid-2007, smart money was aggressively shorting subprime mortgage securities while retail investors continued buying financial stocks "on sale." We know how that ended.

In each case, institutional investors moved first, and their positioning proved prescient.

While no historical analog is perfect, the pattern is worth noting.

Portfolio Protection Strategies

First: Execute The Emergency Protocol

My comprehensive "Anti-Tariff 3-Phase Portfolio Defense Protocol" provides the exact day-by-day playbook with:

Precise sector allocation targets

Portfolio-size specific hedging strategies

Liquidity establishment instructions

Timing-based execution guidelines

This is for the financial emergency response—the moves that prevent the worst damage and position you for what comes next.

Then: Implement One of These Three Strategic Frameworks

Once you've executed the immediate protocol, you'll need to align your portfolio with one of these longer-term defensive frameworks:

Strategy 1: The Barbell Approach

Core (60%): Quality dividend aristocrats with fortress balance sheets

Examples: PG, JNJ, KO (consumer staples have outperformed in 8 of 9 past recessions)

Left Tail Protection (20%): Assets that thrive in crisis

Examples: TLT, GDX, strategic put options on indices

Right Tail Exposure (20%): Selective growth with limited downside

Examples: Subscription-based businesses, essential B2B services, healthcare innovation

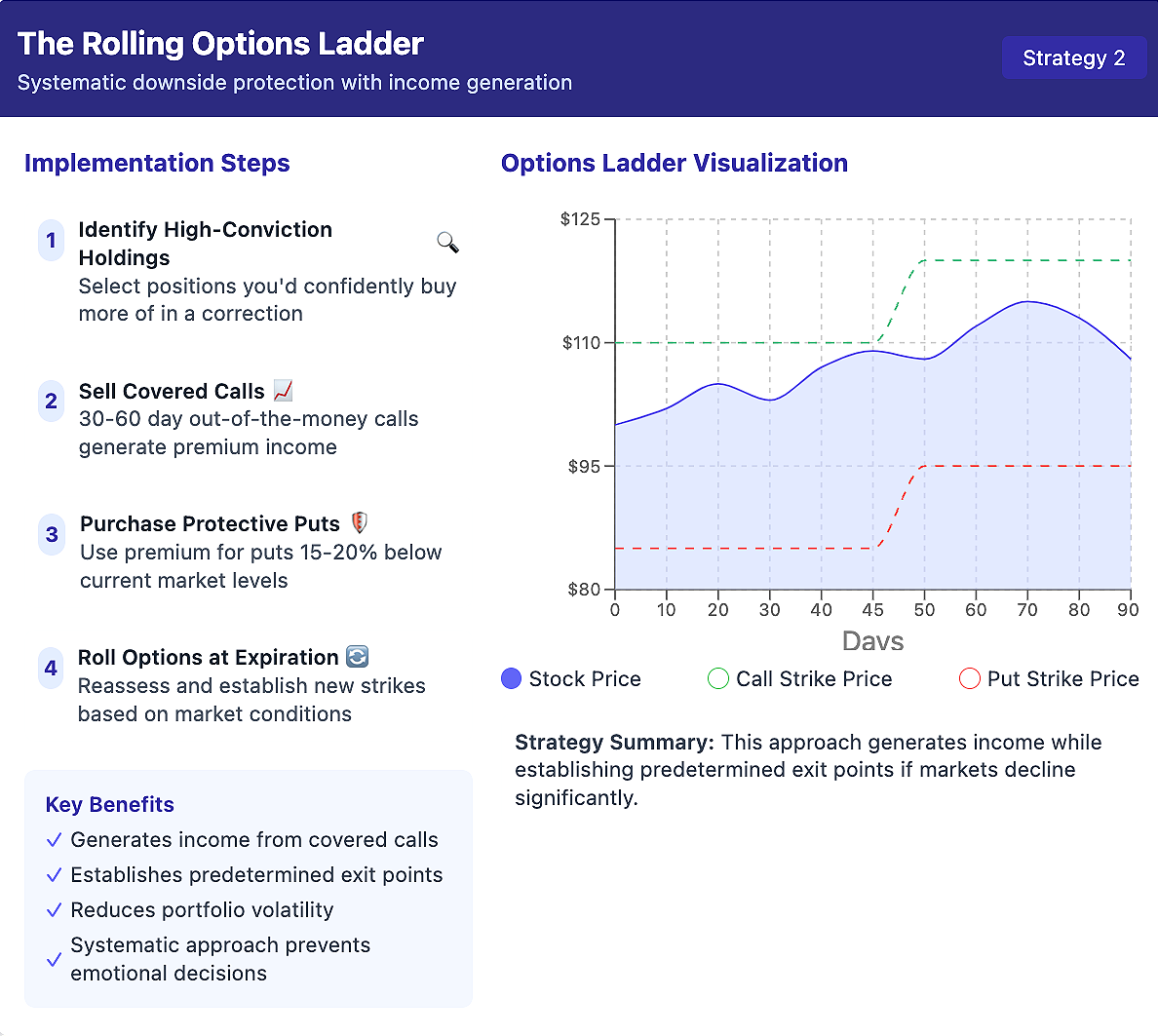

Strategy 2: The Rolling Options Ladder

Rather than selling everything, implement this systematic hedge:

Identify your highest-conviction holdings

Sell out-of-the-money covered calls (30-60 day expirations)

Use the premium to purchase protective puts 15-20% below current levels

Roll positions as options expire based on market conditions

Strategy 3: The Sector Rotation Blueprint

Position your portfolio based on where we are in the economic cycle:

Early Recession: Consumer staples, utilities, healthcare

Deep Recession: Gold, government bonds, cash

Early Recovery: Consumer discretionary, technology, industrials

Allocate 25% to current-phase sectors and 25% to next-phase sectors to navigate the cycle without perfect timing.

I'll definitely be looking into these strategies in more detail. The stark contrast between institutional and retail sentiment highlights the importance of having a well-thought-out defensive plan. This kind of sequential planning makes a lot of sense, especially given the historical recovery advantage for those who act quickly.

The Bottom Line

When nearly half of the surveyed fund managers suddenly expect a hard landing, up from just 6% two months ago, it's not just noise. It's a signal worth heeding.

The greatest investment mistakes often stem not from what we don't know, but from what we think we know that isn't so. Retail investors' confidence in continued market strength could prove to be exactly such a misconception.

Yet successful investing isn't about binary outcomes or perfect timing. It's about thorough preparation, strategic positioning, and maintaining the flexibility to adjust as new evidence emerges.

In the meantime, I want to wish all of you a Happy Easter weekend!

While markets may present challenges, I hope you're able to enjoy some time with family and loved ones during this holiday.

Sometimes stepping back from the screens gives us the mental clarity needed to make better investment decisions.

Thank you for tuning in today!

Mike Thornton, Ph.D.

Thanks for your expertise.