VADER Blueprint for Option Sellers: 3 Steps That Shrink 3,217 Stocks to 9 High‑Premium Trades—Every Week

What if you could ignore 99% of financial news and still outperform?

This week, $3,185 in premium was collected.

And the entire strategy is built on one simple rule: get paid to patiently wait for the price you want on a stock you're happy to own.

I’ll show you in detail how I do it, week after week.

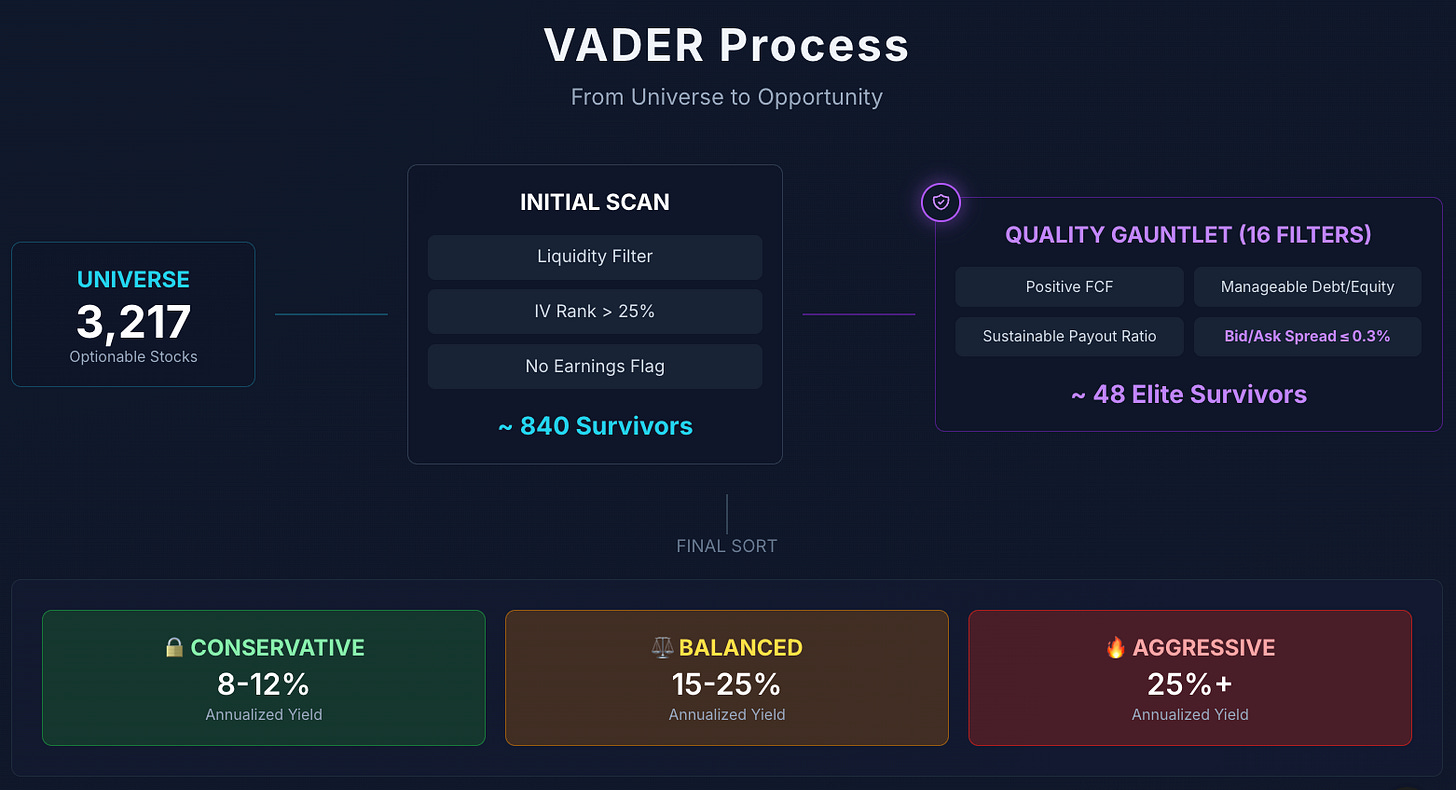

First, VADER: From 3,217 Stocks to 9 Premium Opportunities

The heart of my process is the VADER, an institutional-grade algo I developed with a team of quants during my years on a trading desk to find the small handful of optionable stocks truly worth our time and capital.

Think of VADER as a three‑layer coffee filter:

1: Universe Filtration - The first layer strains out the grinds that nobody wants to drink (illiquid, untradeable stocks).

2: Quality Assessment - The second layer allows only the highest-quality beans through (fundamentally solid, option-rich companies).

3: Risk Tier Classification - The third layer pours the brew into three labeled mugs—Conservative, Balanced, and Aggressive—so you never confuse a mild breakfast roast with a triple espresso.

That’s how the list shrinks from thousands of tickers to a single‑digit watch‑list you can actually deploy every week.

This process is why you won’t see hundreds of random tickers here.

You’ll see a curated handful of the best setups the market has to offer, delivered every Thursday (for Cash-Secured Puts) and Sunday (for Covered Calls).

The complete list of best picks is available to our premium members.

Current Portfolio Overview: As of July 3, 2025

A list of tickers isn't enough.

The single biggest failure of financial education is that it gives you a starting point but deserts you the moment things get messy.

What happens when a trade goes against you? When do you roll? When do you take assignment? When do you cut a loser?

Answering those questions is the difference between an amateur and a professional.

That’s why this service is built as a Live Trading Lab.

Think of it as a flight simulator for building your option-selling skills.

I don’t just give you entry ideas. I track every single position from our lists publicly, as if I owned 100 shares for each CSP sold.

You see the entire lifecycle:

The easy wins: When a trade expires worthless and we keep 100% of the premium.

The messy rolls: You'll see me manage a trade that's gone against us, rolling it down and out for a credit to give ourselves more time and a better breakeven.

The outright losers: You'll see when a roll doesn't work and we have to make a tough decision.

The assignments: You'll see when we get assigned shares and how we immediately transition from selling a put to selling a covered call (the "wheel" strategy).

The goal is not for you to blindly copy my trades.

It's for you to watch the decision-making process in real-time, under real market conditions, so you can build the muscle memory required for managing your own portfolio + you do get a powerful opportunity radar for when you have fresh capital to deploy.

This is the hands-on mentorship and transparent tracking that is missing from 99% of financial content.

Current Performance:

Theory is great, but portfolio performance pays the bills.

Below is a complete, unfiltered snapshot of the current Multiplier cash-secured put positions.

Summary Metrics:

Notice the color-coding:

Green (🟢) means the trade is working perfectly and requires no action.

Yellow (🟡) means it's getting close to our strike and needs to be watched.

Red (🔴) means the stock is below our strike price, and it requires active management—the very scenarios we'll tackle in the Implementation Playbook in the Premium Section.

33 of our 46 positions (over 71%) are in the Green Zone (🟢), performing exactly as planned and requiring no action. This is the direct result of the VADER system selecting the right companies at the right prices.

But the real test is how we manage the remaining trades.

The 13 positions in the Yellow (🟡) or Red (🔴) zones aren't problems; they are demonstrations of our process.

Each one has a clear, pre-defined management plan.

For example, take our two RBRK puts, currently 7.6% in-the-money (🔴). My plan, detailed in the Premium Implementation Playbook, is to roll these positions to a lower strike for a new cash credit of approximately $500-$600, while also extending the timeline by another 90 days. I get paid to improve my position.

Every single challenged trade in this portfolio has a similarly precise and logical plan.

Introduction to This Week's Fresh VADER Picks

CRITICAL DISCLAIMER: The tables below show how I screen for income-generating put selling opportunities. They are not trade recommendations, signals, or financial advice. Use them as an educational foundation only—back-test, sanity-check, and consult a licensed professional before risking a nickel. Selling cash-secured puts involves the obligation to buy the underlying stock at the strike price if the option is assigned, which can happen if the stock price falls below the strike at expiration. Ensure you have the cash secured and are willing to own the stock at that price.

The VADER system has scanned the market and produced a shortlist of compelling cash-secured put sales. Below, I’m giving every free reader a full, deep-dive analysis of our top Tier 1, conservative ideas for the week.

🔒 Tier 1: Conservative Income Picks

These strikes give us quality companies at prices that make sense, with enough premium to make the wait worthwhile.

Analysis and Strategic Rationale Example:

Disney is a company with a global moat, irreplaceable intellectual property, and a business model that, despite recent turbulence, has immense long-term staying power.

The stock is currently trading at $123.4.

We are not interested in buying it at this price.

We are, however, very interested in potentially owning it at $120.

By selling the $120 strike put, we are being paid $8.20 per share (or $820 per contract) for simply making that agreement.

Let’s break down the math and the scenarios:

Our Effective Purchase Price: If DIS were to fall below $120 by expiration and we were assigned the shares, our actual cost basis would not be $120. It would be $111.80 ($120 strike - $8.20 premium). We get to buy a world-class company at a 9% discount from today's price.

The Income Generated: The upfront premium of $8.20 on a cash-secured requirement of $12,000 (100 shares x $120) represents a 6.83% return on our cash in 260 days. On an annualized basis, that's a 9.59% yield. You are generating nearly double-digit returns on your cash while waiting to buy a stock you like at a price you've pre-determined.

The Probabilities: The delta of -0.35 gives us a rough, market-implied probability. It suggests there's about a 35% chance of this option finishing in-the-money. That means there's a 65% chance we simply keep the $820 premium and the stock never drops to our price, freeing up our capital to run the strategy again.

This is the quintessential Tier 1 trade: low stress, high-quality underlying company, and a solid yield that crushes what you’d get from a savings account or Treasury bond.

VADER also flagged higher-octane opportunities this week, including a 13.47% annualized yield target on Verizon (VZ) and a short-dated trade on Apple (AAPL) with a potential 56.78% annualized yield.

When you upgrade, you immediately get:

Full analysis of the Tier 2 and Tier 3 VADER picks.

The complete "Implementation Playbook" with my concrete next steps for every open trade including 🔴 RED and 🟡 YELLOW positions

My Sunday Covered Call report with fresh income ideas.

Access to the full archive of the Live Trading Lab to see how we've managed trades for months.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.