If you’d told me a few years back that American exceptionalism would lead to capital fleeing the S&P 500, I’d have laughed.

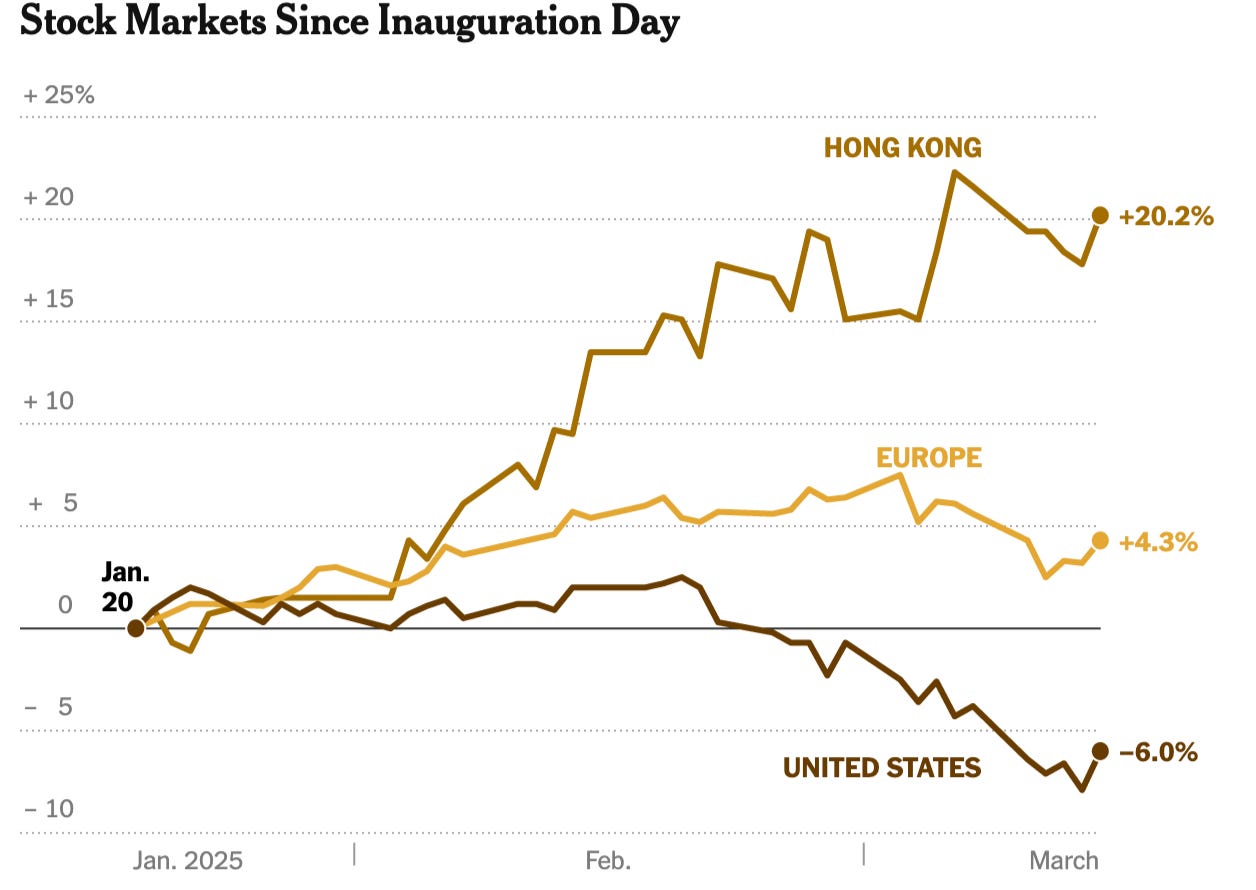

But here we are, months into President Trump’s new term and investors are pulling money from U.S. markets and channeling it into Hong Kong, Germany, and even Mexico.

The S&P is flirting with correction territory while big institutions—pensions, endowments, global asset managers—quietly shift their allocations abroad.

Now is the moment to figure out how we can capitalize on this remarkable pivot.

In this article, we’ll break down:

What’s driving capital out of the U.S. and across the pond

Two categories of European stocks that could fit your portfolio:

Steady dividend “anchors” designed to hold strong in volatile markets

High-growth “rockets” that can supercharge your gains

You’ll learn how to:

Balance these two types of investments

Navigate currency swings

Hedge against the political and economic twists that define the European landscape

By the end, you’ll have a clear roadmap for tapping into Europe’s evolving opportunities—without losing sleep over your next brokerage statement.

Why Look Across the Pond?

We are used to thinking American markets have a monopoly on “opportunity,” given how our financial media worships Tesla, Apple, Amazon, and friends.

Don’t get me wrong—I’m not throwing shade on U.S. equities. They financed my new porch, among other indulgences.

Meanwhile, Europe is staging its own quiet resurgence, often with cheaper valuations and policy sparks we just don’t see stateside.

Case in point:

Bigger European defense budgets—ironically spurred by Trump’s NATO demands—alongside massive digital transformations and slow-but-substantial green initiatives that funnel real cash into local companies.

Add in currency diversification, and Europe starts looking like a genuinely attractive home for your capital.

If you’ve ever wanted non-dollar returns or calmer valuations, you might find Europe’s door wide open right now.

EU Steady Dividends vs. High-Octane Growth

In this article, we’ll look at both flavors in Europe:

Low-Risk Dividend Payers for predictable income and peace of mind.

Higher-Risk, Higher-Return Picks if you’re up for more excitement (and can stomach the roller-coaster ride).

Whichever camp speaks to you—or if you’re game to blend them—you’ll walk away with a clearer picture of European opportunities that suit your unique style.

Let’s dive in.

Dividend Anchors — Low-Risk, Steady Payouts

LVMH (Luxury, France)

Parent to brands so iconic, you’d think royalty invented them—Louis Vuitton, Hennessy, Fendi, Moët & Chandon, and many more.

Why It’s a Steady Anchor:

Historical Performance & Trend

2024 Pullback: Fell 14% in its worst year since 2008, yet still up over 100% in five years—beating broader European indices.

Recent Rebound: Signs of recovery late in 2024 trimmed year-to-date losses to around 1%.

Macro Drivers

Global Luxury Demand: China’s reopening and potential pro-growth U.S. policies are reinvigorating wealthy consumer spending.

Long-Term Tailwinds: Rising numbers of high-net-worth individuals and a growing middle class in emerging markets bode well for sustained luxury sales.

Dividend Stability

Solid Payouts: Raised the dividend to €13 per share for 2024 (10% increase), yielding about 2.1%.

Robust Financials: Free cash flow of €10.5 billion (2024), a 23% operating margin, and pricing power help safeguard dividends during downturns.

Why It’s a Strong Pick

Iconic Brands + Resilience: LVMH’s luxury stable and track record in tough times form a strong moat.

Valuation: Trades at ~22× forward earnings, below its 5-year average (~25×), potentially offering a solid entry point.

Growth & Stability: Less volatile than smaller luxury names, yet still provides long-term capital appreciation and dividend growth.

Risks

Heavy Reliance on China & U.S.: Slower-than-expected recoveries or renewed economic headwinds in these key markets could strain sales.

Luxury Fatigue: Ultra-premium pricing may deter some consumers if sentiment shifts.

Other Challenges: Currency swings, trade tensions, and geopolitical events can impact results.

Still, given LVMH’s proven adaptability and brand power, it remains well-equipped to handle these hurdles over the long run.

BAE Systems (Defense, UK)

A bedrock defense contractor—their jets, submarines, and advanced systems underpin much of Europe’s and the UK’s military capabilities.

Why It’s a Steady Anchor:

Historical Performance & Trend

Consistent Growth: In 2024, BAE Systems’ sales jumped 14% to £28.3 billion, with adjusted EBIT also up 14%.

Record Backlog: £77.8 billion of orders provides strong revenue visibility.

Stock Upswing: By early 2025, shares soared ~16%, beating the broader FTSE 100. Investor enthusiasm spiked after Russia’s invasion of Ukraine, given forecasts of higher defense spending.

Macro Drivers

Defense Spending Surge: European budgets keep climbing, fueled by the Ukraine conflict and NATO’s 2% GDP commitment. Eurozone defense could reach 2.4% of GDP by 2027, opening up potentially hundreds of billions in contracts.

Project Opportunities: BAE is poised to benefit from AUKUS nuclear subs, armored vehicles, and aircraft orders, aiming for 7–9% sales growth and ~10% profit growth in 2025.

Dividend & Financial Strength

Rising Payouts: Dividend rose 10% in 2024 to 33 pence, yielding ~2.5–3%.

Solid Cash Flow & Balance Sheet: Over £1 billion in annual operating cash flow underpins consistent increases, with multi-year contracts cushioning volatility.

Why It’s a Strong Pick

“Defensive” Defense Stock: Steady earnings and dividends plus upside from expanding military budgets.

Attractive Valuation: Trades around 15× forward earnings, cheaper than similarly growing U.S. peers.

Long-Term Appeal: Ideal for investors seeking stability with moderate growth potential, especially given intensifying European rearmament.

Risks

Geopolitical Twists: A peace deal in Ukraine or shifts in U.S. leadership might dampen new orders.

Budget Cuts or Project Delays: Changes in government priorities can derail big contracts.

Integration & Currency: Large acquisitions could pose integration challenges; BAE reports in GBP but also earns in USD/EUR.

Despite these uncertainties, BAE’s solid global presence (over 40 countries) and entrenched reputation help it navigate potential storms, making it a compelling long-term holding.

If you duck out now, you’re missing a massive money shift that’s already got big institutions moving funds across Europe.

Up next: more dividend powerhouses and some real high-growth players that could seriously change your bottom line.

Hang tight—in a few years you’ll be glad you did.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.