In today’s issue:

select REITs and BDCs that keep pumping up to 10% yields—even when inflation soars and growth slumps.

It’s the simplest way to grow capital—without receiving calls about burst pipes.

The Stagflation Playbook: Lessons From the 1970s

Stagflation isn’t new. The 1970s taught us two brutal truths:

Inflation eats portfolios alive. Bonds get crushed. Growth stocks implode. Cash becomes confetti.

Real assets win. But not all real assets. Gold? Overhyped. Direct real estate? A part-time job.

The real winners were the landlords who owned essential properties—warehouses, hospitals, grocery stores—and could hike rents with inflation.

Today’s equivalent?

REITs with CPI-linked leases and BDCs lending to recession-proof businesses.

From 1973 to 1982, REITs delivered +385% total returns, while the S&P 500 limped to +47%, and 10-year Treasuries lost -12% after inflation (Nareit).

History’s screaming at us.

But here’s what no one tells you:

Stagflation rewards scarcity. When new construction stalls (thanks to tariffs or rate hikes), existing landlords raise rents.

Debt is a double-edged sword. In the 70s, landlords with fixed-rate mortgages won. Today’s REITs with 92% fixed-rate debt (like WPC) are the modern equivalent.

The Anti-Stagflation Cash Machines

1. Cohen & Steers Quality Income Realty Fund (RQI) – 7.7% Yield

Why It Works:

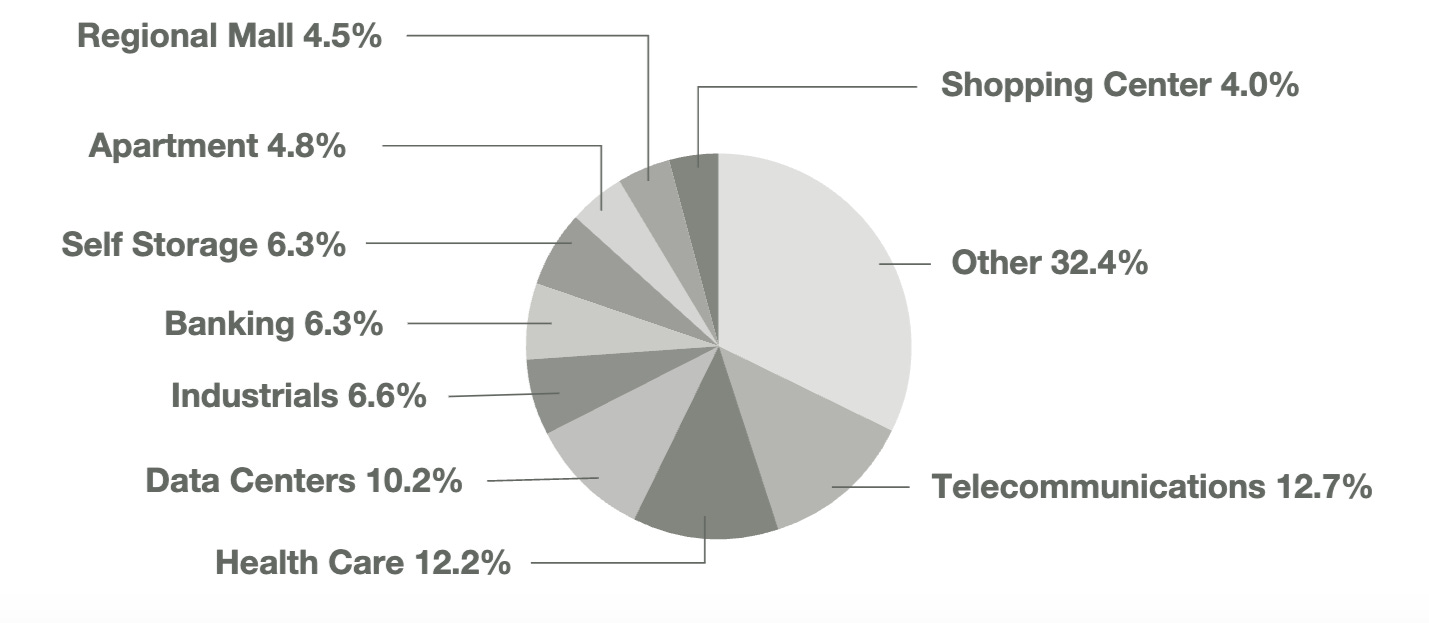

Diversified Armor: 208 REITs globally. Data centers, healthcare, industrial parks—sectors with 95%+ occupancy.

Leverage Done Right: 29% debt, fixed at 1.7%. When rates fall (and they will), NAV pops.

Tax Efficiency: $52.6M in undistributed gains. Monthly dividends compound quietly.

Hidden Risks:

“But leverage!” Yes, 29% debt amplifies pain if property values crash. Mitigation? 81% of debt is fixed-rate. The Fed’s done hiking. Relax.

“What about rate cuts?” RQI’s NAV rises as rates drop. A win-win for income and capital gains.

Most REIT ETFs charge fees for mediocrity. RQI’s actively managed, exploiting sector rotations. It’s the Vanguard approach—if Vanguard had a PhD in real estate arbitrage.

RQI’s top holdings—Digital Realty (DLR), Equinix (EQIX), Prologis (PLD)—aren’t random.

These are monopolies of the digital age.

Data centers are the new oil rigs. Prologis owns 1.2 billion square feet of warehouses. Amazon can’t ship without them.

Coming Next:

3 more stocks quietly delivering 7–10% dividends, even if inflation soars.

Protect your retirement.

Sleep well at night.

Lifetime Access is still yours for less than a fancy dinner out. Pay once, read forever.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.