The 3-Step Formula for Spotting Undervalued Stocks + My Checklist Inside

Math So Easy, You’ll Wonder Why Anyone Buys Lottery Tickets

Let’s start with the biggest myth: “It’s enough to buy great companies and wait.”

Not quite.

If you hand over your hard-earned cash at a stratospheric valuation, you’re tying an anchor around your own ankles.

Don’t do that.

The key is buying at a price that practically guarantees an upside, then letting your winners ride.

Let’s make that happen.

At the heart of a stock’s potential, three elements dance together:

Earnings Growth

Dividend Yield

Shifts in Valuation (a.k.a. P/E multiple changes)

If you want a quick mental snapshot of your potential annualized return over a given horizon, add those three components.

It’s that straightforward.

Let’s break them down so you can see exactly how I factor each one in before I hit the “buy” button.

1. Earnings Growth: The Stock’s Lifeblood

Earnings Per Share (EPS) growth is everything.

If a company’s profits don’t move up over time, the stock price is going nowhere.

Simple as that.

How to ballpark future growth:

Peek at the company’s historical earnings expansion—but keep a skeptical eye. Historical growth can be inflated by one-time events.

Listen to management forecasts, but assume they’re wearing rose-tinted glasses.

Check mainstream analyst expectations for the next few years. They’re often optimistic too, so shave a bit off for safety.

If a well-known tech giant has grown its EPS by 15% a year historically, analysts might call for 14–15% over the next decade.

Personally, I’d cut that by a few percentage points for a margin of error.

2. Dividend Yield: The Instant Sweetener

Dividends are the direct cash flow you pocket while waiting for the stock to (hopefully) climb.

If a stock pays, say, a 2% yield, that’s essentially a 2% annual head start on your total return—even if the price treads water for a while.

Watch out for yield traps:

A yield above 6% can look mouthwatering, but sometimes that’s the market’s way of screaming, “Danger ahead!”

The company could be in free fall or planning to slash its payout.

So if you see a suspiciously high yield, dig into the balance sheet and track record of dividend increases (or cuts).

3. Valuation Changes: Multiple Expansion or Contraction

The biggest swing factor is often whether the company’s P/E ratio rises or falls during your holding period.

Even if earnings are robust, an overpriced multiple can slam your returns.

On the flipside, if you buy a stock that’s beaten down but still has solid fundamentals, you get a sweet tailwind when the P/E rebounds to more normal levels.

Finding a “fair” P/E:

Glance at the average P/E over the last 5–10 years.

Consider macro conditions—are interest rates high or low? Are investors in a panic or euphoric?

If you think the current P/E is too high, assume it drifts lower and slice a bit off your annual return calculations.

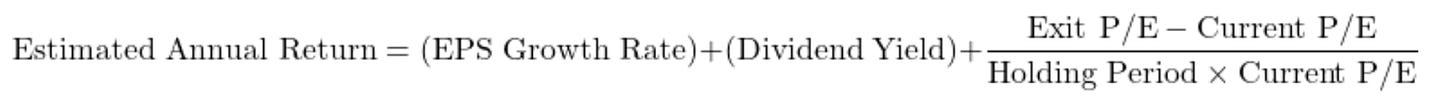

The “Earnings Growth Model” in One Simple Formula

I know, I know.

“Get to the math.”

Here’s the direct formula I use to quickly gauge a stock’s rough annual return potential:

Yes, that last part is a mouthful. Let’s demystify:

EPS Growth Rate: If you think earnings will expand 10% a year, that’s your big chunk of upside.

Dividend Yield: If the stock currently yields 1%, add that to your total.

Valuation Shift: If you’re holding for 5 years and you believe the P/E will drop from 30 to 25 by that time, you’re looking at a negative factor. If it goes from 20 up to 25, that’s a tailwind.

Finish those calculations and you’ll have a ballpark annual return figure.

Yes, it’s approximate, but it’s been a lifesaver for me in deciding where to deploy my capital.

Too low a figure? — I move on.

High enough to beat the market with a reasonable safety margin? — I’m interested.

Doubling Your Money and the Rule of 72

In case you need a quick reality check on how long it might take to double your initial stake, rely on the Rule of 72:

Time to Double = 72 / Annual Return (%)

If you think you can snag a 10% annual return, it’ll take a little over 7 years to double your money.

Aim for a 15% annual return? You’re looking at around 5 years.

Why do I love this rule?

It keeps me grounded.

If a stock’s “story” suggests I’ll triple my investment overnight, I slap myself back to reality.

That rarely happens unless you’re playing lottery tickets, and that’s not my business.

Overcoming “Analysis Paralysis”

I see it all the time: new investors say, “But what if the P/E is wrong?” or “What if the next recession flattens everything?” Trust me, I get it.

The market can be irrationally euphoric or dreadfully pessimistic.

That’s exactly why we bake in a margin of safety.

If you model 10% EPS growth but the market’s collectively singing about 15%, you’re already being cautious.

Truth is, no model is perfect.

That’s okay.

Real wealth-building isn’t about being perfect.

It’s about being consistently reasonable and letting time magnify your efforts.

Master this approach, and you’re already ahead of most folks who fling money at hype or passively hope for 20% returns every year.

Deeper Dive & Quick Examples

Example 1: Apple – A Growth Play

Current Metrics:

Forward P/E: ~26

Dividend Yield: ~1.0%

Forecasted EPS Growth: ~8% per year

Assumption for Valuation Shift: Drawing on historical trends, I expect Apple’s P/E to contract slightly over a 5‑year horizon—from about 26 down to 24.

Now, let’s plug these into our formula:

EPS Growth Rate: 10%

Dividend Yield: 0.7%

Valuation Shift:

Thus, the Estimated Annual Return becomes:

This rough calculation tells me that—even accounting for a slight contraction in multiples—Apple might yield around 7.5% per year.

It’s a compelling case if you’re after a growth opportunity that balances innovation with a touch of stability.

Example 2: Verizon – A High-Dividend, Slower-Growth Play

Current Metrics:

Forward P/E: ~10%

Dividend Yield: ~7%

Forecasted EPS Growth: ~2% per year

Assumption for Valuation Shift: For a mature, high-yield company like Verizon, I expect the P/E to remain fairly flat over the next 5 years.

Plugging these into our formula:

EPS Growth Rate: 2%

Dividend Yield: 7%

Valuation Shift:

While this return is lower than the growth play, it offers predictability and steady cash flow—qualities that can be especially appealing in volatile markets.

Practical Final Checklist

If you want something to pin on your wall, here’s a condensed game plan:

That’s it.

Seven steps—no complicated spreadsheets or advanced calculus required.

It’s really not rocket science.

It’s a systematic way to identify if a company’s price tag makes sense or if you’re about to overpay for hype.

Stay clear-headed, follow the steps, and you’ll be one of the rare few who actually understands why you’re investing in a particular stock, not just rolling the dice.

Stay bold,

Mike

with all due respect, where do you get Apple’s forward PE at 26? every reliable site i researched has it as 32-34. thank you