Tariffs, Deficits, and the Fragile Future of Social Security: Why 61% of Americans Can’t Miss a Single Check

If you want to understand the real risk in the economy today, there are two numbers you need to see from this week.

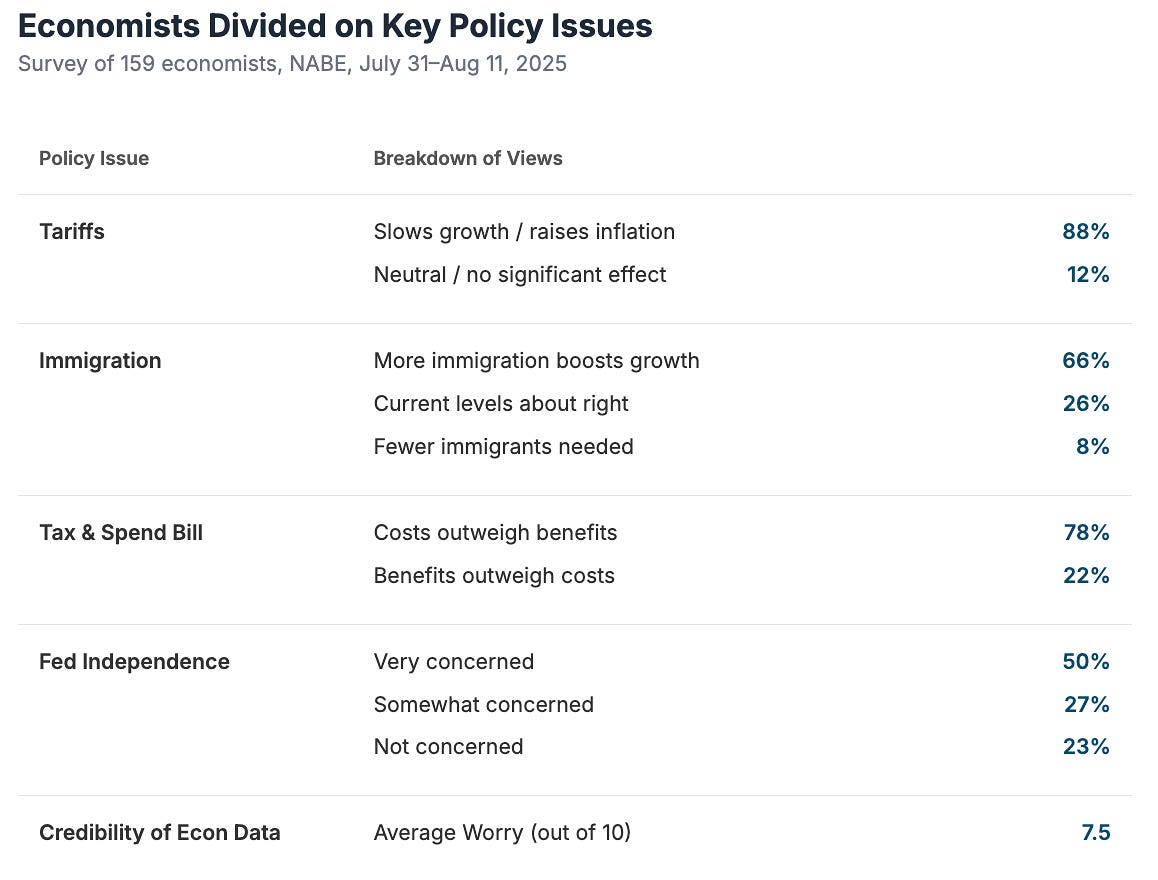

First, a survey of 159 economists concludes that the United States faces serious, ‘self-inflicted’ risks of recession and inflation from tariffs, deficits, and political games.

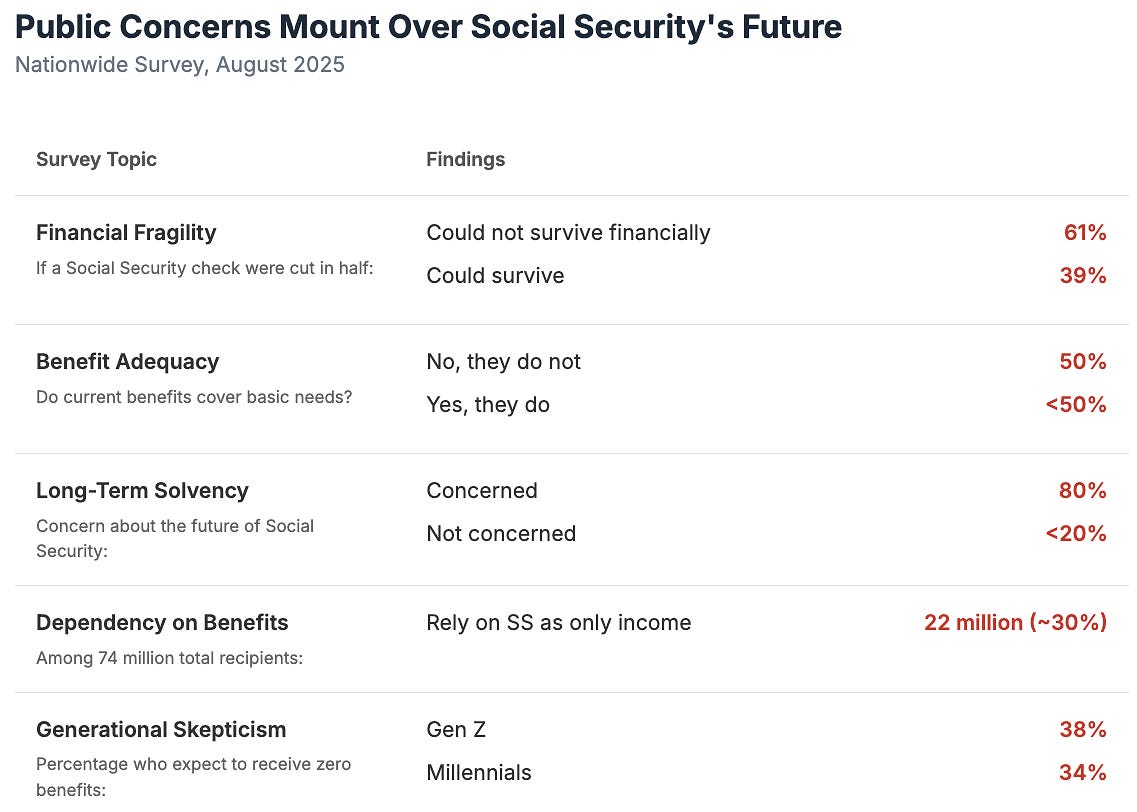

Second, a different survey finds that 61% of Americans would be financially ruined if they missed just half a Social Security check.

These are not two separate stories.

They are cause and effect.

The abstract risks the experts are debating will become real-world disasters for the people who have absolutely no margin for error.

I'm writing this because it seems like the public conversation is stuck on the political drama instead of the real human consequences.

To understand how we got here, you have to realize this level of fragility isn't normal.

It wasn't always like this.

For most of the post-WWII era, the U.S. economy, however messy, operated on a few assumptions

Policy was predictable enough to plan around.

The social contract — workers fund retirees — was broadly understood.

The Fed could act independently to anchor credibility.

Data from the Bureau of Labor Statistics was taken as fact.

None of these rules were perfect, but they gave people confidence to plan decades ahead. That confidence was the invisible infrastructure of retirement.

Now, those rules are being dismantled. Tariffs, deficits, immigration curbs, Fed intimidation, politicized data — they are all symptoms of the same disease: a system shifting from rules to rulers.

Social Security was built on a long-term, mathematical promise.

But it's failing in a system that now runs on short-term political power.

When a long-term commitment gets in the way of a short-term win, the commitment loses every time.

To see how deep this decay goes, you have to look at the core machinery of the economy. Then you can draw a straight line from each broken rule to the fragility of the American retiree.

The Four Pillars of America’s Rule-Based System — And How They're Cracking

You can draw a straight line from each crack in the foundation to the fragility of the American retiree.

Pillar One: Predictable Policy

You can’t run a business, let alone plan a retirement, on a foundation of quicksand.

Tariffs are sold as patriotic leverage, but they are simply taxes.

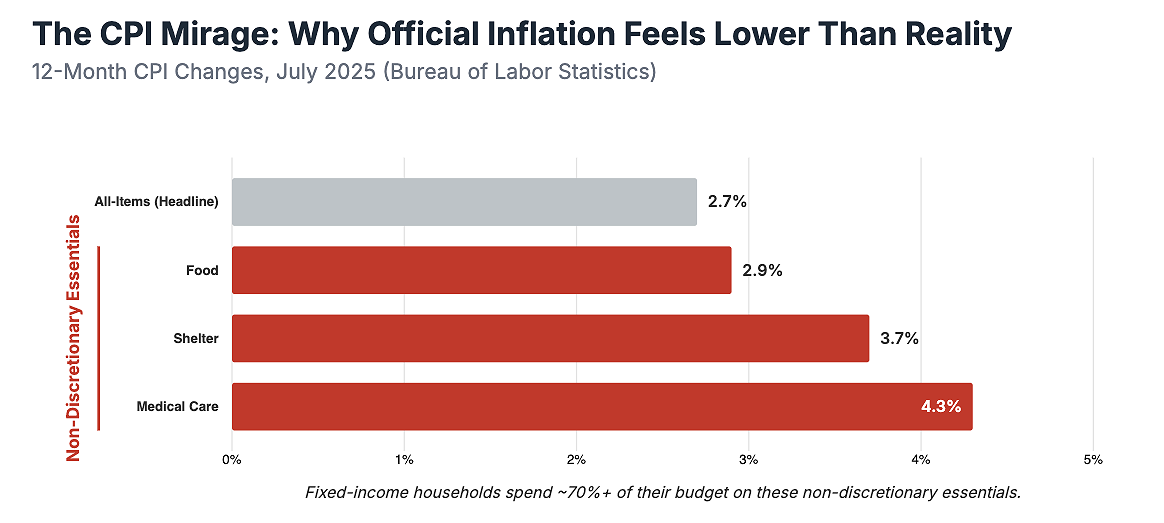

You don't need to read an economist's chart to get it — you just notice the fridge costs $120 more, or the weekly grocery run is $40 higher.

People living on a fixed check don’t get a piece of the supposed "win."

They just get the bill.

And we ran this experiment before: the history books call it the Smoot-Hawley Act, a brilliant "America First" idea that helped turn a recession into the Great Depression.

It was a catastrophic, unforced error; it appears we've decided to repeat it.

The same goes for deficits.

Trump’s "One Big, Beautiful Bill" was classic Washington math: cut taxes, crank up spending, and promise a miracle.

78% of economists say the costs outweigh the benefits, which is the polite way of saying the miracle isn't coming.

Deficits are just taxes with a time delay.

We saw it in the 1970s when deficits and an oil shock gave us stagflation.

Anyone on a fixed income got wiped out in slow motion, with their savings losing value every single month.

Pillar Two: The Social Contract

Social Security rests on a simple bargain: today’s workers fund today’s retirees.

But that bargain assumes a steady stream of new workers.

Two-thirds of economists say more immigration would strengthen the system. Fewer workers means fewer payroll contributions.

Fewer contributions mean less money in the trust fund.

Japan has already shown where this road leads with its refusal to replenish the workforce, resulting in decades of stagnation and permanent strain on pensions.

Pillar Three: Independent Money

The U.S. dollar isn't backed by gold.

It's backed by a single idea: that the people managing our money supply are sober, apolitical accountants. That idea is the only thing standing between a stable currency and a worthless piece of paper.

That credibility is now for sale.

Trump's public attacks on Powell and Lisa Cook are an attempt to turn the Fed into an arm of the White House.

Look up how Argentina let politics run its central bank — they turned their money into confetti, and a whole generation of middle-class savers was gutted. Once the money itself loses integrity, everyone holding it pays the price.

Pillar Four: Honest Numbers

The final rule is that the data can be trusted.

Without a shared scoreboard, planning is impossible.

Economists rated their concern about politicized statistics at 7.5 out of 10.

And why not? Look at the graph above. The BLS director was just fired for reporting slower job growth.

This is the stuff of banana republics. If the scoreboard can be changed to suit the ruler, then every long-term promise — from inflation adjustments to Social Security’s own solvency reports — becomes pure guesswork.

The 2034 depletion date is a test of the system's integrity.

If the government is willing to fire the scorekeeper, how can you possibly trust its promise to pay you back in ten years?

So what does this systemic decay actually feel like if you’re 68 and retired today?

Your Social Security check arrives: $1,900. It doesn’t cover basics. More than half of recipients say this.

The trust fund depletion date is 2034. That means a 20–25 percent automatic cut unless Congress acts. That’s $400 less per month on the average check.

Inflation, juiced by tariffs and deficits, pushes groceries $40 higher each month and appliances $100-plus higher per purchase.

Medicare premiums rise faster than cost-of-living adjustments.

And hanging over it all: a one-in-two chance the Fed is being leaned on, and a better-than-even chance the official inflation data you’re using to plan is massaged.

No wonder 61 percent say they couldn’t survive a missed half-check.

The system is already stretched to breaking.

So what do you do?

You can’t fix Congress

You can’t stop tariffs

You can’t audit the BLS

But you can build your own private, rule-based system

When you realize the game is rigged, you stop playing.

And that means rethinking the single most common piece of financial advice given for the last 40 years: buy and hold.

That strategy worked because it was a bet on the system itself — that the U.S. economy, guided by predictable rules, would grow over the long term and lift all boats, you just had to be patient.

That bet is now off.

In a system run by rulers, not rules, "holding" is just another word for "hoping."

Hoping the ruler doesn't decide to inflate away your savings to win an election.

Hoping your corner of the market doesn't get hit by a surprise tariff.

Hoping the official numbers you're using to calculate your net worth bear some resemblance to reality.

In this environment, 'buy and hold' is just a bet that the people in charge won't screw you over.

Look at the evidence. That's a sucker's bet.

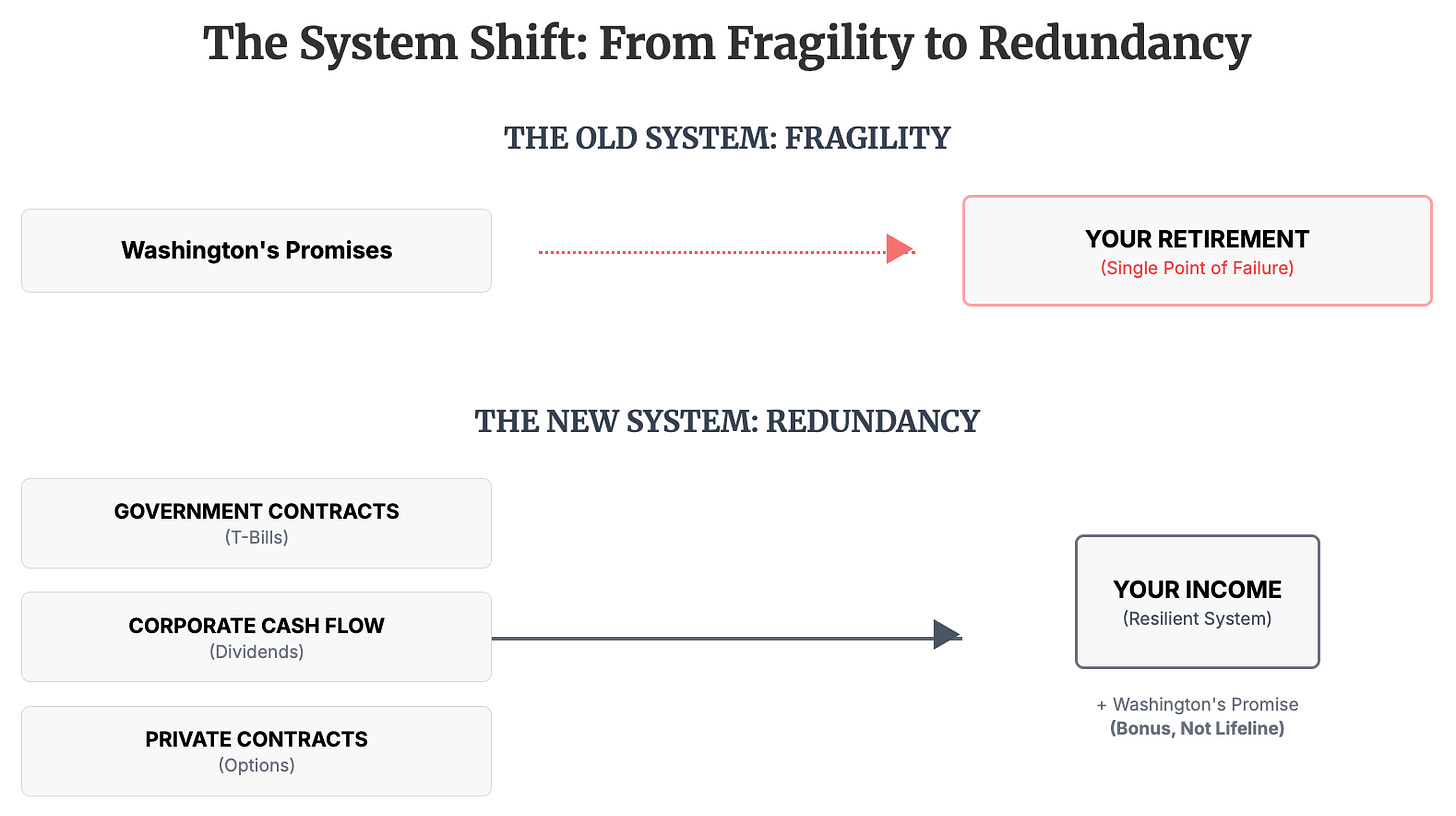

The only logical response is to build a machine that makes the political game irrelevant.

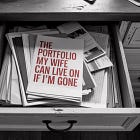

You need to construct a private system of cash flow so redundant that the failure of any one component - especially a government promise - doesn't matter.

You start with the most basic, non-political contracts you can find: Treasury bills.

Treasury bills and money-market funds are built on a simple, legally binding promise: they pay on time and in full.

Building a bond ladder with staggered maturities creates a predictable, non-political stream of cash flow. It buys you certainty in a world that has lost it.

On top of that foundation, you partner with corporate fortresses that run on their own rules, insulated from Washington's incompetence.

Companies like Johnson & Johnson, Coca-Cola, Procter & Gamble, and Waste Management. Their business models are built on billions of daily, repeatable human habits.

Their dividends are a private contract with their shareholders, one they've honored through wars, recessions, and every flavor of political chaos imaginable.

Finally, you exploit the system's primary flaw: its new obsession with short-term volatility.

The old "buy and hold" model was a bet on long-term stability.

The new environment requires a tool that profits from short-term instability.

That tool is selling options.

When you sell a covered call or a cash-secured put, you are essentially arbitraging time. You are selling a short-term contract (30-45 days) to a market that is terrible at pricing long-term value. You collect cash today based on the market's immediate fear or greed, while still holding a long-term, high-quality asset.

You're using the market's own anxiety as your revenue stream.

Put those three together — and the entire equation changes.

Because the fundamental contract of the 20th century - that you could outsource your financial security to the government is now void.

The only logical response is to engineer its replacement.

A system where your survival isn't dependent on the political competence, where your checks come from contracts you control, from companies that outlast politicians, and from a business you run yourself.

Retirement was supposed to be about peace and about living on your own terms after decades of work.

That peace won’t be delivered by Washington.

It will be built by you, with rules you can enforce.

That is how you make yourself immune to a missed check.

For Premium Subscribers, tomorrow I’ll be back with this week’s best cash-secured put opportunities - practical trades that apply these principles directly.

And if you missed yesterday’s post, where I laid out a full Legacy Portfolio built on this same foundation, you can catch up here:

Thank you for tuning in and supporting this project!

Mike Thornton, Ph.D.

A great post once again Mike. I admire your efforts at trying to wake up retirees and future retirees to the new paradigms. Trust in the system is falling, for good reason, and thus we will be required to lean more on ourselves. Thank you for laying out these ideas.