“Will my money last as long as I do?”

You spent decades working, saving, investing — building real capital through effort and discipline.

By every conventional measure, you “won” the accumulation game.

And yet, here you are — uneasy. Because the world has changed.

The rules that built your wealth no longer protect it.

The 60/40 portfolio, the 4 % rule, the “just sell a few shares each year” plan —

On paper, they look tidy, but in practice, they’re fragile.

A badly timed downturn can erase years of careful work. Inflation eats what used to feel safe. Markets move faster than ever.

This isn’t at all your fault.

The old playbook was written for a world that no longer exists.

It helped you build capital, but it won’t reliably convert that capital into the cash flow you now need to sustain your lifestyle when you stop working.

That’s why I built The Multiplier.

It’s a system built for retirees who want a steady, reliable paycheck from their portfolio — one that grows with inflation, survives market crashes, and never forces you to sell down principal you spent decades building.

The Multiplier exists to address the four problems that make retirement fragile.

→ Outliving Your Savings — the #1 fear retirees report.

We solve that by building income streams that don’t expire. Every dollar of dividends, distributions, and premiums is engineered to grow with you, not dry up after 10 years.

→ Inflation and Rising Costs

Groceries, healthcare, insurance — they all climb. Your paycheck should keep its purchasing power for decades, not erode year by year. That’s why our system targets dividend growth and option income that rise over time.

→ Market crashes

Most investors dread volatility. We harvest it. Using clearly defined rules and strict position sizing, we turn fear-driven market swings into steady income week after week — while protecting principal first.

→ Information Overload & Dependence on Hot Tips

The Multiplier is a clear repeatable framework that produces cash flow you can understand, measure, and trust. You don’t top X stock lists. You need a process you understand and can implement confidently. No jargon. No trading circus.

If This Sounds Like You…

You worked hard, saved steadily, and built a portfolio that should give you peace of mind. But it doesn’t.

You want a way to turn what you already have into a steady, dependable paycheck — without day trading and being glued to the screen.

You don’t want to gamble, but you don’t want to sit on cash either.

You’ve seen what a bad year can do to people’s plans, and you don’t want your future hanging on the next correction or interest-rate decision.

If that sounds familiar, you’re in the right place.

I built The Multiplier with one goal: to translate the techniques institutions use to fund pensions and endowments into a process you can run yourself —

to generate income from what you already own, in a world that’s changed faster than the advice meant to guide you through it.

This is a 5-minute walkthrough of the core mechanics — how the system is built and why it works.

In the next five minutes, you’ll see the entire system: three simple pillars and one repeatable loop that turns dividends and options premiums into reliable, growing income.

It’s the shortcut I wish I had when I was just figuring out how to pay myself safely in retirement.

1. OK, so what is The Multiplier, in one minute?

The Multiplier is a step-by-step plan that transforms regular buy-and-hold stocks into a steady, growing income stream.

It does three big things all at once:

Own great companies that pay and grow dividends.

Sell options on those same shares to collect extra income every month.

Reinvest what you don’t spend, so each cycle builds on the last.

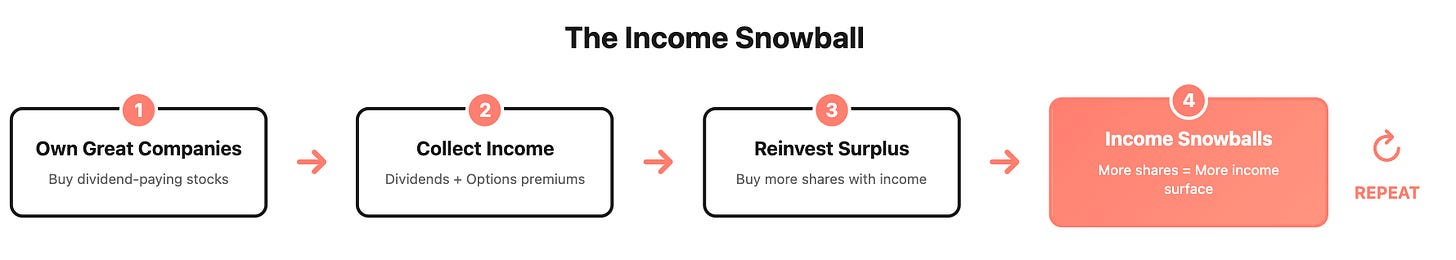

The loop repeats.

Dividends and option premiums feed back into new shares you buy;

These new shares create even more surface for dividends and option premiums.

And your income snowballs automatically, building on itself — without selling principal or guessing what the next market’s hot pick will be.

2. The four “bucket” portfolio system (your master checklist)

Every stock you hold should live in one of these buckets.

Each bucket has a job.

When you combine all four, you cover every need in retirement:

income now, income growth, safety, and extra yield from volatility.

3. How the Multiplier Loop Builds on Itself

Collect option premium + dividends → Cash drops into your account today.

Buy more shares with that cash → Your next dividend checks get bigger.

Sell options on the new shares and the ones you already own → You pocket even more premium.

Repeat → Each round stacks on the last—small at first, huge later.

Example: Your first month’s premiums buy just 4 extra shares. Those 4 become 6, then 10, then 20 as the loop repeats.

No guesswork. No timing the market. A loop you can run for life.

4. What the numbers look like in Practice

Let’s look at what this system can produce in real numbers:

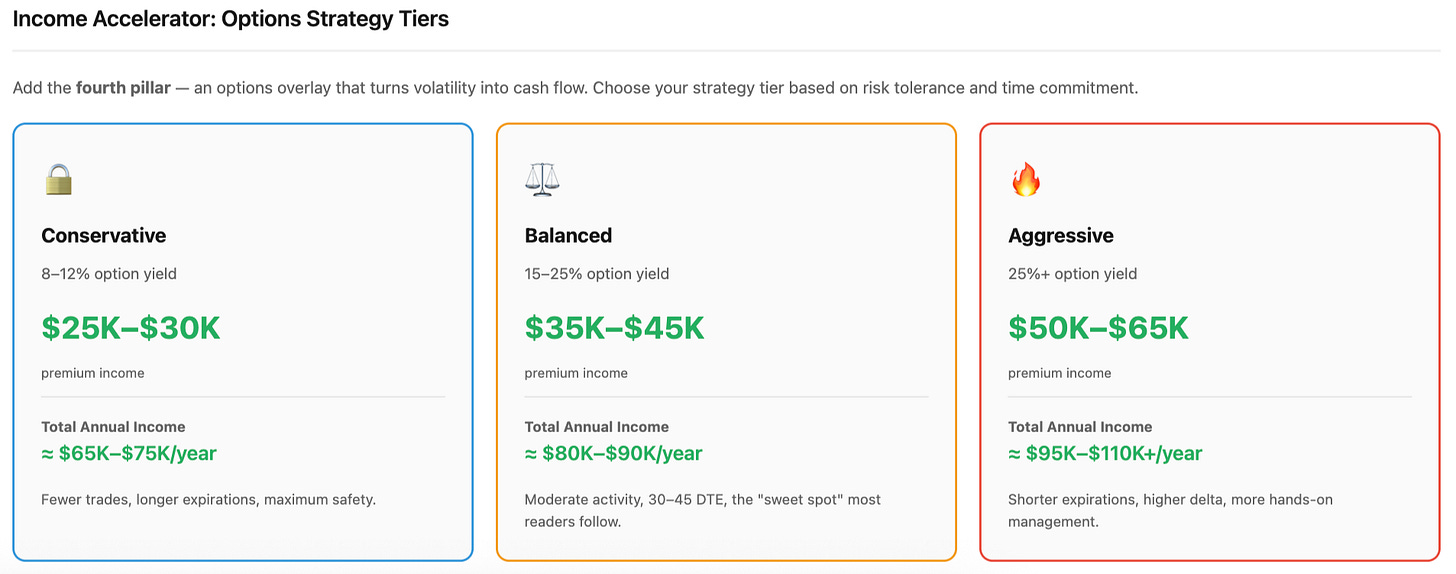

Now we add the fourth pillar — the options overlay that turns volatility into cash flow. Readers can choose how actively to run it through the three VADER tiers:

What It Looks Like With $250,000 (Growth-Tilted Setup)

With a smaller portfolio, the goal is to make every dollar work harder — while staying within clear guardrails.

This version leans more on the Income Accelerator to speed up growth.

That’s 6 %–11 % total cash flow on a $250 K account — enough to reinvest aggressively and grow faster without taking reckless risks.

Each cycle builds on the last: premiums fund more shares, new shares earn more dividends, and the wheel keeps turning.

Yet the Multiplier still puts safety first.

The cash used for option trades is always fully collateralized — backed by T-Bills or by shares you already own. That means no borrowing, no margin calls, and no open-ended losses.

Even in a market drop, your income base — dividends, high-yield distributions, and T-Bill interest — keeps paying. The options layer simply adjusts to new prices, generating fresh premiums as volatility rises.

That’s how the system stays resilient: the foundation holds, and volatility becomes fuel instead of danger.

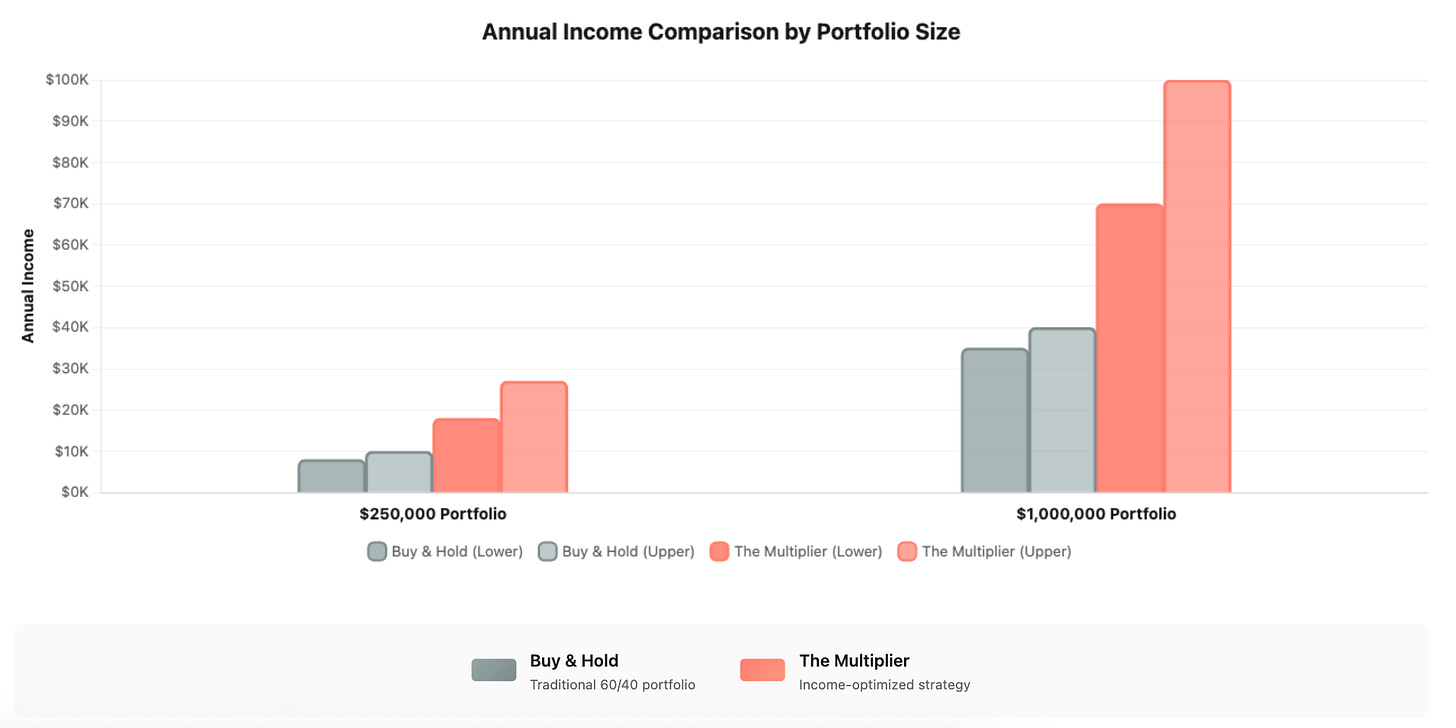

Let’s put it into perspective:

A $1,000,000 buy-and-hold portfolio (typical 60/40 mix) earns about $35,000–$40,000 a year in dividends and bond interest.

Run that same million through The Multiplier + VADER and it produces $70,000–$100,000 a year — more than double the income without selling a single share.

At $250,000, a buy-and-hold investor might earn $8,000–$10,000 a year in yield.

The Multiplier, using the same amount of capital, generates $18,000–$27,000 through dividends, T-Bills, and option premiums.

Same money.

Same market.

Different system

5. How the Options Layer Works

Options are the Income Accelerator of the Multiplier.

First, What an Option Actually Is:

An option is simply a contract between two investors.

It’s an agreement about a stock’s future price.

→ A call option is the right to buy a stock at a set price.

→ A put option is the right to sell a stock at a set price.

Most people buy options hoping to profit from a big move.

We do the opposite — we sell options and collect the premium up front.

That premium is cash paid to us for taking the other side of the bet.

In most cases, the buyer never uses the option — and we keep the money.

It’s a conservative, income-focused approach used by major institutions like pension funds, endowments, and insurance companies to generate predictable cash flow from the assets they already hold.

We do the same thing — on a smaller, fully collateralized scale. We’re simply adapting that same playbook for individual investors, using smaller, fully collateralized positions.

Two Simple Moves We Are Working With

(1.) Covered Call → You rent out what you already own.

You own 100 shares of a company like Johnson & Johnson.

You agree to sell them later at a higher price (“the strike”) in exchange for a premium today.

If the stock never reaches that price → you keep your shares and the cash.

If it does → you sell at a profit you already chose — and keep the premium.

(2.) Cash-Secured Put → You get paid to wait for a better price on the Stock you want

You keep enough cash ready to buy 100 shares at a lower price you’d be happy with. You collect a premium up front for making that promise.

If the stock never falls → you just keep the cash.

If it does, you buy the shares cheaper → and still keep the premium.

Why It Keeps Working Week after Week:

Every trade is fully collateralized — backed by cash or shares you already have.

You collect income first, risk second — premiums hit your account the day you sell the contract.

Your worst case is owning a stock you already like, at a discount you already chose.

There’s no guessing, no leverage, and no day trading.

It’s all rule-based income generation.

6. How We Pick the Option Trades

Every trade that appears in The Multiplier is selected by VADER — the Volatility Arbitrage Dividend Enhancement Return system algorithm.

VADER wasn’t built for this newsletter.

It was developed during my time with a quantitative analytics group that managed options overlays for pension and endowment clients, built to identify the highest-probability trades under institutional risk limits.

It was stress-tested through multiple volatility cycles — 2011, 2015, 2018, and 2020 — maintaining a 78–82 % win rate across more than a decade of live trades.

When I retired, I rebuilt it for my own capital first to prove it could scale down efficiently without losing precision.

Then I translated it for private portfolios, preserving the core model while streamlining execution, so it could operate smoothly outside the institutional infrastructure.

Now VADER runs through more than 800,000 individual option contracts across over 3,200 stocks. It evaluates them through sixteen filters — liquidity, volatility structure, balance-sheet strength, dividend history, and upcoming catalysts.

Out of that entire universe, only 20–30 contracts make the cut.

These are the best of the best — the setups where fundamentals, pricing, and probability align in our favor before the trade is even placed.

The goal is simple: stack the odds, not gamble.

Once trades are scored, the system sorts everything into three tiers:

🔒 Conservative (8–12 %) — Longer expirations, wide cushions, maximum safety.

⚖️ Balanced (15–25 %) — Steady income, moderate activity, optimal mix of yield and control.

🔥 Aggressive (25 % +) — Shorter expirations, tighter strikes, higher hands-on yield.

Every Thursday, you’ll see the top cash-secured puts.

Every Sunday, the covered-call setups.

Each trade comes with ticker, strike, expiration, premium, and a brief rationale — so you can follow along or learn to run the process yourself.

This is what turns option selling into a repeatable, data-driven process.

7. How the System Stays Safe

The Multiplier works because it runs inside clear boundaries.

These are the rules that protect your capital, your income, and your peace of mind.

1. Every trade is fully collateralized.

No borrowing. No margin. No naked options.

Each covered call is backed by shares you already own.

Each cash-secured put is backed by T-Bills or cash ready to buy.

You always know the worst-case scenario — and you’re comfortable with it.

2. You keep your portfolio balanced.

These are the core ranges that make the system stable:

Dividend Growth: 40–50 %

High Yield: 20–30 %

T-Bills: 15–25 %

Options overlay: 5–10 % (up to 20 % for smaller, growth-tilted accounts)

When one pillar drifts, we trim a little and rebalance.

3. Don’t chase yield.

If something pays 12 %+ with no clear reason, it’s a warning, not an opportunity.

We aim for sustainable cash flow — we need it to survive recessions and rate swings.

4. Define your worst case before you trade.

Before selling a put, decide: “Would I be happy owning this stock at that strike?”

Before selling a call, decide: “Would I be fine selling it at that price?”

If the answer isn’t yes, skip the trade.

5. Spend deliberately, reinvest automatically.

Cover your monthly expenses with income, then put the rest back to work.

Every reinvested dollar speeds up the income flywheel.

6. Review quarterly, not daily.

You’re not timing the market, you are not daytrading — you’re running a clearly defined rules-based process. Once a quarter, check allocations, income flow, and open contracts. Adjust slowly, with intention.

8. How Much Time Does it Take Each Week

It’s a simple routine that fits into 30–45 minutes a week:

Here’s the rhythm most readers follow:

Thursday — 15–20 minutes

Review the Cash-Secured Put list, choose one or two setups that fit your tier, and place or paper-trade them.Sunday — 15–25 minutes

Review the Covered-Call list, close or roll existing positions, and enter new ones if needed.

That’s it. No daily monitoring, no reacting to headlines.

Once trades are placed, the rules take over.

Each quarter, spend another 10–15 minutes to check your allocations and log your income — dividends, T-Bill interest, and premiums. You’ll see the system working in real numbers.

9. How to Start with The Multiplier

Start by learning the framework — not by trading it.

The goal in your first few weeks is to understand the system, observe it in action, and build muscle memory through repetition.

Here’s the progression that works best:

1. Read the Essentials

https://themultiplier.substack.com/t/retirement-income-toolkit

Begin with the Guides on Dividend Growers, High Yield, and T-Bill Ladders.

They’ll show you how each pillar supports the system and how income keeps flowing even when prices don’t.

2. Watch the Process

Follow the weekly Trade Sheets:

Thursday: Cash-Secured Puts

Sunday: Covered-Calls

Don’t trade yet. Just watch the setups, track the premiums, and note what happens as time passes. This observation builds pattern recognition — the first layer of muscle memory you need to manage your capital with confidence.

3. Study the Live Trading Lab.

Every trade I place is tracked in real time — entries, exits, rolls, outcomes, and notes.

Spend a few sessions following the updates.

This is where repetition becomes instinct.

You’ll start to recognize how contracts behave, when volatility pays, and why discipline matters more than market direction.

4. Paper-trade before you trade with real money

Simulate a few VADER trades using your broker’s paper-trading mode or a simple spreadsheet.

Record the ticker, strike, premium, and expiration.

Follow them through to the end.

Two or three full cycles are enough to build confidence and mechanical understanding — the foundation of muscle memory.

5. Request options approval

Once you’ve seen a few cycles and understand how the system behaves, ask your broker for Level 2 options approval (covered calls and cash-secured puts).

It’s free and straightforward.

This simply unlocks the tools you’ll use later — nothing changes until you decide to go live.

6. Start small

When you’re ready, open your first position: one covered call or one cash-secured put.

Trade deliberately, not frequently.

Consistency beats intensity every time.

You’ll know you’re getting it when the steps feel automatic.

That’s muscle memory — the quiet confidence that comes from running a process, not reacting to markets.

That’s when The Multiplier stops being a theory and starts becoming your system.

Love the systematic approach to income generation! The combination of dividend growth + options premiums is powerful. How do you balance the income vs growth components in different market environments?

Mike, looking forward to digging in. Have you written about why you don’t go for shorter expiries that maximize decay?