Pocket an Extra $150,000 in Retirement—Switch from JEPI to This 15-Minute DIY Call-Writing Play

So, I was looking at a prospectus for JPMorgan's JEPI and JEPQ funds, and a thought struck me: I decided to reverse-engineer their strategies. I spent the next few weeks running the numbers through every scenario I could dream up.

I modeled bull markets, bear markets, and everything in between.

And the conclusion I reached is very simple: For most investors with accounts over $100,000, a do-it-yourself covered call strategy using VIG beats these popular ETFs.

I call this the VIG-Edge Covered-Call Blueprint.

It wins on every metric that truly matters.

You get better after-tax income.

Your costs are lower.

You get to participate in market upside.

It's more tax-efficient and strategically flexible.

A properly built DIY approach can deliver 15-25% more after-tax income.

It also allows you to keep 40-60% more of your gains during bull markets.

Here’s the proof, and the exact blueprint to build it.

The Thesis: Why DIY Wins the Income Game

JPMorgan packaged the world’s most basic options strategy into over $50 billion worth of ETFs.

They took covered calls, something any reasonably experienced investor can do, and created a product.

They charge you to execute a strategy you can implement for free in any major brokerage account.

But that's not the worst part.

The problem is, this product systematically underperforms what you can build yourself, I'll show you the math.

Their structure has a major tax flaw: they convert qualified dividends, which are taxed at a favorable rate, into ordinary income.

This single detail destroys their tax efficiency.

They also significantly limit your participation in stock market upside while generating yields you could match or even beat yourself, just by covering a part of your position.

My central argument is this: these ETFs solve the wrong problem.

They sell convenience but sacrifice wealth creation.

If you're an investor capable of basic, systematic execution, these funds are a costly compromise.

Over a full retirement, that compromise can compound into six-figure losses.

I know that sounds dramatic, but the proof is in the numbers. I’ll show you.

The implementation is also far simpler than Wall Street wants you to believe.

The Evidence: Why "Good" Numbers Hide Bad Strategy

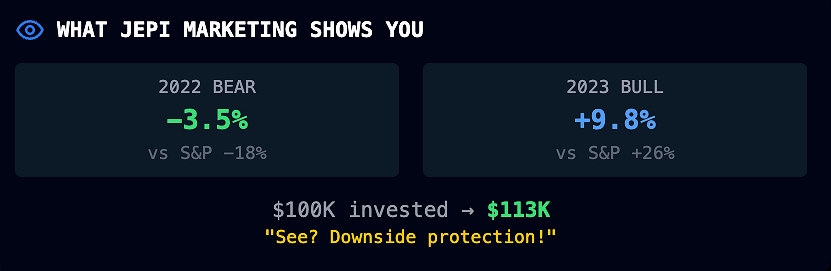

Here is what JPMorgan's marketing materials will show you:

In the 2022 bear market, JEPI lost only 3.5% while the S&P 500 crashed 18%.

JEPQ fell 12.9% while the Nasdaq imploded by 33%.

Then, in the 2023 bull market, JEPI gained 9.8% while the S&P surged 26%.

JEPQ was up 36% against the Nasdaq's massive 55% explosion.

The sales pitch sounds compelling. "See? Downside protection with positive returns!"

These funds are designed to protect you from losses by guaranteeing you miss the big gains.

I don't think that’s protection, but rather wealth limitation.

Imagine you invested $100,000 at the start of 2022.

JEPI's Path: You would have lost 3.5% in 2022, then gained 9.8% in 2023.

Your final balance would be about $105,957.VIG's Path: You would have lost 9.8% in 2022, then gained 14.5% in 2023. Your final balance would be about $103,279.

At first glance, JEPI appears to come out ahead by about $2,700.

But this completely ignores the tax torpedo waiting for you.

To understand this, you first need to know about the two main types of investment income:

Qualified Dividends: This income comes from stocks and receives special tax treatment. Most retirees will pay just a 15% tax rate. Some pay 0%, and high earners pay 20%.

Ordinary Income: This includes wages, interest, and critically, option premiums and most ETF distributions. This income is taxed at your regular income rates, which could be 22%, 24%, 32%, or even higher.

Now, here is the critical difference in strategy.

The JEPI/JEPQ Approach: When these ETFs sell covered calls, their distributions lose their qualified dividend status. The IRS treats almost all of their payouts as ordinary income. Your 8-10% yield gets hammered at your highest tax rate.

The VIG Alone Approach: VIG is a standard ETF holding dividend-paying stocks. Roughly 90% of its distributions are qualified dividends, getting the preferential 15% rate.

The DIY VIG + Calls Approach: You hold VIG directly, so you preserve the qualified dividend treatment on its 1.8% yield. Only the extra income you collect from selling call options gets taxed as ordinary income.

Let's run a real example:

Disclaimer: Everything I've shared is simply for educational and informational purposes and should not be considered financial advice. Everyone's financial situation is unique, and what works for one person might be completely wrong for another. Before making any financial moves, it's always wise to consult a qualified financial advisor who is familiar with your specific circumstances.

Imagine a $100,000 position that generates an 8% total yield.

Let's assume a 22% ordinary income tax bracket and a 15% qualified dividend tax bracket.

JEPI Scenario:

You receive $8,000 in distributions.

Let's assume 90% is ordinary income: $7,200 is taxed at 22% ($1,584 tax).

The other 10% is qualified: $800 is taxed at 15% ($120 tax).

Total Tax: $1,704

After-Tax Income: $6,296

DIY VIG + Calls Scenario:

First, the VIG dividends. The fund yields 1.8%, so that's $1,800.

90% is qualified: $1,620 is taxed at 15% ($243 tax).

10% is ordinary: $180 is taxed at 22% ($40 tax).

Next, the option premiums. To get to our 8% total yield, we needed another $6,200. This is all ordinary income, taxed at 22% ($1,364 tax).

Total Tax: $1,647

After-Tax Income: $6,353

Okay, so the annual difference is only $57 on $100,000.

That might not sound like much.

But this simple example misses the bigger picture.

The real power of the DIY approach comes from its flexibility, because you can:

Stop selling calls during a raging bull market to capture all the upside.

Time your option sales to optimize your tax bill from one year to the next.

Choose your own strike prices based on real-time market conditions.

Keep a portion of your holdings uncovered for pure growth.

JEPI's structure consistently forgoes a significant portion of market upside.

The DIY approach lets you decide when to trade upside for income, and when to let your winners run.

This structural tax efficiency and flexibility compound dramatically over a 20 or 30-year retirement.

And, let's talk about fees…

JEPI and JEPQ charge 0.35% annually for their management.

But what are they managing? It's the most basic options strategy on the planet.

If you have a $500,000 retirement position, that fee is $1,750 every single year.

You can execute the exact same strategy yourself with commission-free trades at most brokers.

In contrast, the VIG ETF has an expense ratio of just 0.05%.

Your total annual cost for a $500k DIY position would be $250.

The ETF approach costs you $1,750 for the same position.

Your net savings are $1,500 a year.

Over 20 years, that is $30,000 of real money leaving your account every year for a service of questionable value.

But the most damaging aspect of the packaged ETF approach — you give up significant upside potential during long-term bull markets

JEPI and JEPQ's strategy systematically sacrifices a large part of the market's upside by design.

Every market rally that goes past their chosen strike prices represents wealth you forfeited. Throughout the 2023 surge, JEPI holders mostly watched from the sidelines. The market delivered incredible returns, and they missed out.

A DIY approach is different.

Imagine you only sell calls against 60% or 80% of your position.

You still generate substantial income from the covered portion.

But you also capture meaningful gains on the uncovered portion.

You are not forced to choose between income and growth.

You can optimize for both.

The DIY Framework: Building a Better Income Stream

Why VIG is the Perfect Tool?

I looked at a lot of ETFs for this.

VIG is a collection of "dividend aristocrats."

These are companies that have raised their dividend payouts for at least 10 consecutive years. Think Microsoft, Apple, Coca-Cola, and Johnson & Johnson. These are blue-chip companies with highly liquid options markets and predictable volatility.

The options chains are deep. The companies are stable. The growing dividend provides a natural hedge against inflation.

VIG gives you everything you need for systematic covered call writing, without the risk of being concentrated in a single stock.

Its current yield is around 1.8%.

Its historical volatility is in the 15-18% range.

The options premiums can consistently generate an additional 4-7% in annual income.

The exact amount depends on market conditions and how you structure the strategy.

The Core Strategy Architecture

Right... how to actually build it. There is no single "right" way. It depends on your age and risk tolerance.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.