In this quick countdown, I’m laying out my personal top 10 for March 2025, ranked from #10 to #1.

You’ll see which names are “solid but not flashy” and which are must-have anchors if your goal is to race toward a million-dollar portfolio.

They’ve held up when rates spike, economies wobble, and headlines scream doom.

Each one has the balance sheet, reliable revenue engine, and management savvy to keep cranking out dividends even if everything else goes haywire.

How These 10 Fit Together In Your Portfolio

An ideal approach might be to dollar-cost average across these ten.

You’ll capture:

Global Diversification: From Canadian banks to U.S. utilities to an international tower landlord.

Secular Trends: Clean energy, unstoppable water demand, plus constant data usage.

Resilient Cash Flow: Even in downturns, QSR is selling burgers and RBC is collecting interest.

You won’t get hammered by a single-sector meltdown.

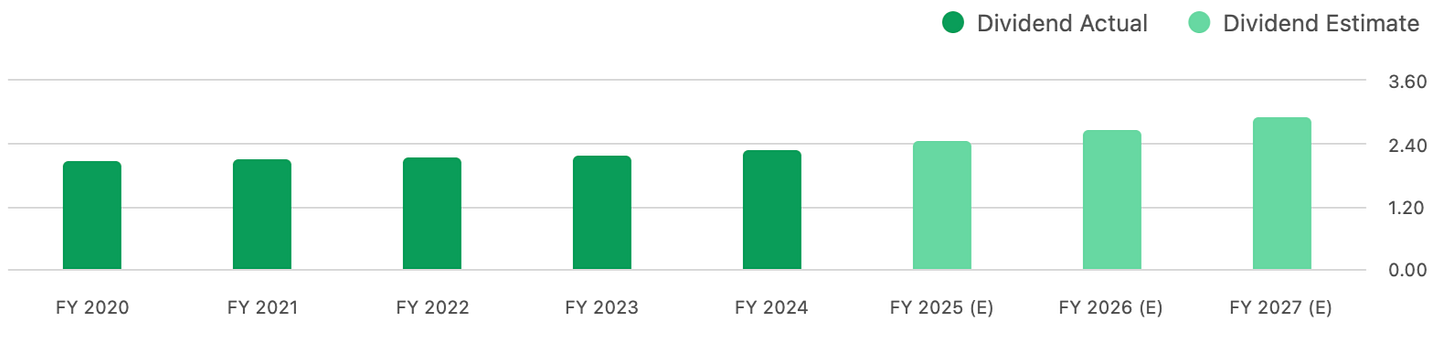

And each of these has a respectable dividend that creeps up (or jumps) over time.

If you’re nearing retirement, the yield from these stocks could eventually cover a chunk of your daily expenses without needing to sell shares during drawdowns.

On the flip side, if you’re still piling up capital, you can reinvest the payouts, accelerating your wealth climb.

When to Pump the Brakes

Payout Ratios Spike: If you see any of these companies pushing beyond a 60–70% payout ratio without a compelling reason (like an acquisition year), you might want to re-evaluate.

Debt Balloons: A healthy debt-to-equity ratio is fine, but watch out if they start borrowing too heavily to fund buybacks or dividends.

Yield Falls Off a Cliff: Sometimes, a stock’s price rockets so high that the yield sinks below an acceptable threshold. You might decide it’s overpriced and lighten your position (though I’m often partial to letting winners run).

Lastly, I always reserve the right to pivot if macro conditions turn ugly.

If, for example, interest rates skyrocket into the stratosphere and capital costs quadruple.

The Dividend Power 10

#10 — State Street Corporation (STT)

Custodian to the World’s Money

Why #10? Smooth and steady, but overshadowed by other financials with bigger yields and stronger growth.

Yield Range: ~3–4%

Recent Dividend Growth: ~6–8% annually

Why It Works:

They serve the giants of the investment world—managing, holding, and overseeing trillions in assets.

This custody model can be more stable than mainstream banking, especially if they keep a lid on costs.

Over time, that stable fee income flows right into shareholder distributions.

🔴Risk Scenario: In a brutal bear market, assets under management shrink. That means fewer fees rolling in. Also watch if an aggressive competitor starts undercutting them on fees.

🟢Buy Zone: Typically, a forward P/E around or under 12 is a green light. Look for stable margins ~30%, a sign they’re covering overhead just fine.

#9 — Canadian Imperial Bank of Commerce (CM)

Conservative Canadian Bank

Why #9? Great yield, moderate growth, but overshadowed by a rival bank on this list (hint: #4) with stronger global reach.

Yield Range: Around 5.5–6%

Recent Dividend Growth: About 3–4% per year

Why It Works:

A venerable Canadian bank, older than your great-grandparents (probably).

Conservative lending culture, so it weathers recessions better than some American counterparts.

Canada’s financial regs aren’t exactly known for letting banks run wild, so dividend cuts historically happen less often.

🔴 Risk Scenario: If the next downturn smacks consumer credit, growth in the dividend could stall. Keep an eye on the payout ratio; if it soars past 60%, you want to ask why.

🟢 Buy Zone: Typically, I love it when the yield creeps up over 5%. If the P/E heads near single digits, that’s even more appealing.

#8 — Comcast Corporation (CMCSA)

Broadband Beast

Why #8? The yield is decent, growth is solid, but the uptrend can stall if entertainment competition heats up.

Yield Range: ~3–3.5%

Recent Dividend Growth: ~9% a year

Why It Works:

They’re not “just cable.” Internet, streaming, theme parks—solid free-cash-flow spigots.

Typically manages debt responsibly, rather than splurging on dubious acquisitions.

Their broadband segment is a near-monopoly in some regions, so short-term demand drops are rare.

🔴 Risk Scenario: If the digital entertainment landscape flips too fast (or if streaming competition chips away profits), that might slow their payout hikes.

🟢 Buy Zone: I get intrigued when the P/E dips near 14 or when that yield pushes 4%. That’s historically a good entry.

#7 — Restaurant Brands International (QSR)

Fast Food, Franchise Model

Why #7? Recession-resistant, yet not as high-octane as the top picks. Good stable earner.

Yield Range: ~3.5–4%

Recent Dividend Growth: ~4–5% annually

Why It Works:

They own major fast-food brands that remain popular in economic booms and busts.

Because they franchise heavily, overhead is lower, letting them funnel more cash into dividends.

People love cheap, quick meals, especially when wallets tighten.

🔴 Risk Scenario: Dietary trends do shift over time, and if commodity costs go ballistic, that can clip margins. Keep tabs on whether they pass on expenses to franchisees effectively.

🟢 Buy Zone: When the yield cracks 4%, it’s typically worth a fresh look. Sometimes a PR scandal or short-term setback knocks the price down—often an opportunity rather than a red flag.

#6 — Essential Utilities (WTRG)

Water, Everyone Needs It

Why #6? Rock-solid utility. Consistent, sure—but overshadowed by some faster growers coming up.

Yield Range: ~3.5–4%

Recent Dividend Growth: ~7% annually

Why It Works:

This is the water supply. Folks can skip a latte, but they won’t skip water.

Regulated utility structure means stable revenues, which often leads to steady payouts.

Historically invests heavily in infrastructure, so it can handle expansions and keep that dividend climbing.

🔴 Risk Scenario: Regulators can get feisty about rate hikes. Also, watch if the company overextends on capital spending and piles on too much debt.

🟢 Buy Zone: Yield crossing ~3.4% generally means the market’s undervaluing it. These glimpses often show up in general utility sell-offs.

The Top 5

Now we’re getting into the real MVPs—the stocks that bring the perfect combo of yield and growth to seriously boost your wealth.

If I had to pick a few heavyweights to anchor a path to that million bucks, these would be it:

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.