Brace yourself for a raw look at Tesla’s meltdown.

Let’s expose the hype that lures everyday folks into overpriced stocks.

The Power (and Pitfalls) of Brand

Tesla didn’t just invent an electric car; it invented a movement.

In the early days, you saw eager lines of well-educated urban dwellers—often progressive and tech-savvy—proudly paying a premium to “drive the future.”

But brand momentum is fragile.

Ties to polarizing public figures can turn yesterday’s fans into today’s loudest critics.

In Tesla’s case, the shift in perception seems to have alienated large swaths of its original demographic.

The car that was once the statement of a cleaner tomorrow suddenly became a political lightning rod.

Regardless of fairness, the outcome is straightforward—fewer people are excited to buy.

Why This Matters to Investors:

Customer Loyalty as a Moat—Until It Isn’t

So-called “unbreakable” customer loyalty can vanish if a brand misreads the room. If you’re holding shares that rely heavily on dedicated fan bases, keep one eye on public sentiment.

Short-Term Volatility from Emotional Swings

Big brand missteps can spark a quick sell-off, even if a company’s balance sheet looks fine. Emotional trading is powerful in the short term.

The Valuation Crossroads

For much of its history, Tesla didn’t trade like a mere automaker; it traded like a tech revolution.

Its sky-high valuation depended on the notion that it wasn’t just building cars—but redefining entire industries, from solar energy to autonomous driving.

But that mania cut both ways:

Price/Earnings (P/E) That Defied Gravity – At one point, Tesla’s P/E dwarfed that of legacy automakers by a factor of 10 or more.

Expectations were priced for perfection.

Cash Flow Tightrope – Tesla spent years juggling rapid expansion, major R&D, and debt servicing. While free cash flow (FCF) eventually turned positive, any hiccup in demand can tip it back into the red.

In essence, the stock soared on the belief that it would always be an unstoppable innovator.

Now that brand backlash (and stiff competition) have surfaced, it’s open season for doubt.

Let’s Look at The Key Tesla Financials

Revenue Growth Rate

Tesla once boasted year-on-year revenue surges above 70%. These days, that pace has decelerated, yet it’s still respectable for an automaker. Keep in mind, though, growth alone doesn’t guarantee profitability—especially if margins begin to thin.

Automotive Gross Margins

Historically, Tesla’s gross margins have outpaced many legacy brands. However, price cuts or reduced delivery volumes can quickly dent that advantage. Given the company’s heavy spending on R&D and expansion, a margin slip can sting twice as hard.

Forward P/E

Even after sliding from the $400s down to the $230 range, Tesla still trades at multiples far above mainstream automakers. The trailing P/E of around 113, indicating that even the drop hasn’t fully deflated the hype.

A big premium can be fine—if Tesla keeps proving it’s more than “just another car company.” But if brand sentiment continues to sour, justifying that premium gets tricky.

When a stock’s valuation is built on endless hyper-growth, even a slight downshift can trigger an outsized price collapse.

Brand Controversies Abroad: Europe’s Cold Shoulder

In Europe, where environmental awareness has long shaped consumer preferences, Tesla used to be the shining star.

Now, Chinese EV makers and established European brands are offering competitive alternatives—some at lower prices.

Stack that against Tesla’s diminishing “cool factor,” and you get real, measurable sales erosion.

Implications for Investors:

Competition Grows in a Hurry

The more Tesla showed the EV space was viable, the more automakers jumped in. Suddenly, it’s not the only game in town.Regulations and Consumer Sentiment

Europe’s strict emissions laws used to play in Tesla’s favor. Now, consumers might opt for local or cheaper options if brand loyalty wanes.

So Is Tesla “Permanently Toast”?

Skeptics argue Tesla is doomed: brand erosion, polarizing leadership, intensifying competition.

Bulls insist Tesla still boasts unmatched technology, scale, and a passionate fan base that can’t be easily replicated.

So, which is it?

Legitimate Moat or Glorified Unicorn? Tesla revolutionized the EV world, no question. But the margin of error narrows when you’ve got a big P/E to defend.

Possible Bounce-Back

Large manufacturers and public figures can sometimes weather epic storms (think Apple in the late 1990s). A strong pivot, improved management, or fresh product line could revive Tesla’s appeal.

If your goal is a million-dollar portfolio, be smart about position sizing.

Balance the high-stakes nature of Tesla with safer, dividend-rich stocks or index funds that keep you afloat if the story truly collapses.

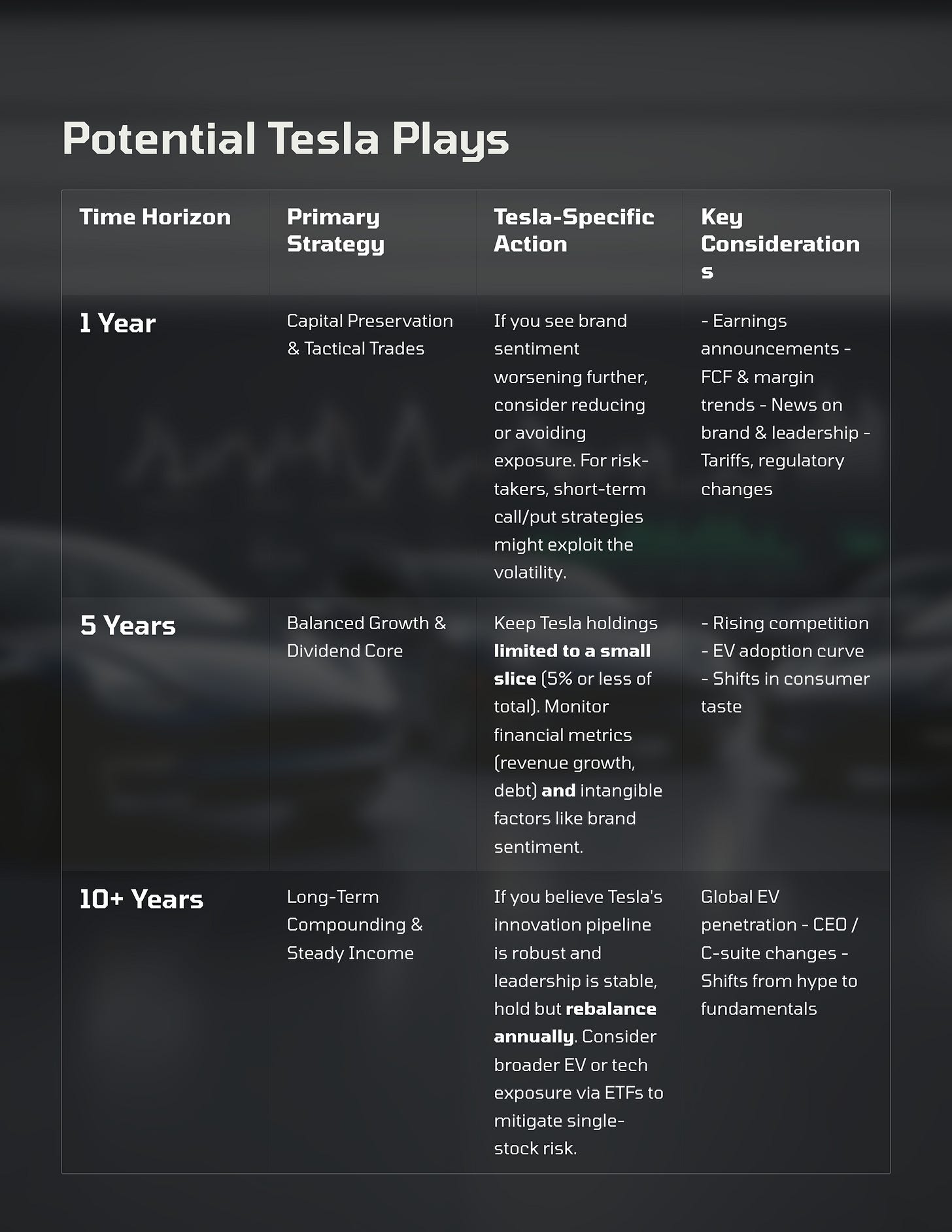

Your Action Plan: Different Horizons, Different Moves

Investors often panic because they lump every timeline together.

But your approach should pivot depending on whether you’re thinking short, medium, or long term.

Here’s a quick-hitter checklist to help you decide when—or if—you want to touch a wobbly stock like Tesla.

No strategy is set in stone—every pivot should be guided by new data, not by knee-jerk reactions.

Tesla’s troubles might be a red flag, or they might just be a temporary stumble.

Either way, the lessons here are priceless:

No single company should define your net worth.

Even “sure things” can become “maybe not” overnight.

Discipline, consistent growth, and re-invested dividends are the ultimate passport to financial independence.

Thank for tuning in!

––

Mike Thornton, Ph.D.

Proud Father of Two,

and Die-Hard Believer in Doing Good While Growing Wealth