How Self-Confidence Supercharged My Long-Term Portfolio

My Journey of Self-Trust and Better Finances

I want to be completely transparent with you: Everything in life—especially the big stuff like building wealth—hinges on your ability to trust yourself. And I’m not talking about some fluffy, motivational-poster trust.

I’m talking about the real deal—knowing, deep down, that you’ve got what it takes to handle whatever comes your way.

I learned this the hard way. I vividly recall one brutal night: 2 AM, eyes burning, the computer screen’s glow flickering across my tiny apartment as I hit refresh for what felt like the thousandth time.

My heart pounded with every minor uptick or downtick, and the charts started to blur together. I remember thinking, “Is this really worth losing my sanity over?”

I’d read all the expert advice, memorized the historical returns on index funds, and still freaked out every time the market dipped. Even though it took real effort to check quotes back then—dial-up connections, clunky trading platforms—I couldn’t stop myself from obsessing over every new line on the screen.

Because underneath the spreadsheets and strategies, I didn’t trust myself to stay the course and handle whatever curveballs came my way.

Here’s the blunt reality: no matter how disciplined your financial plan or how stacked your portfolio is, it means nothing if you don’t believe you can stick with it.

I’ve watched countless investors collapse under the weight of doubt. Some procrastinate on critical tasks, like rebalancing portfolios or updating budgets. Others push themselves to the brink of burnout, convinced that if they ever ease off, everything will collapse.

Many surrender to distractions—scrolling social media or obsessing over every micro-movement in the market—because tackling the real, high-impact work feels too daunting. Then there are those who ignore their health by skipping workouts or staying up late every night, fearing they’ll fall behind.

In all these scenarios, the problem isn’t know-how.

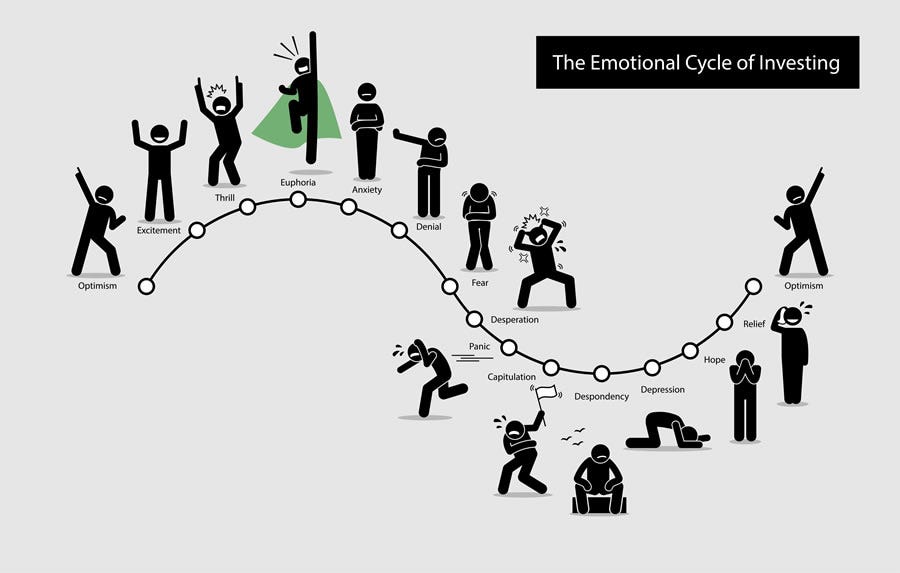

It’s not trusting that you can face discomfort, judgment, or unknown outcomes—and come out stronger. When you trust yourself, you don’t panic-sell at the first sign of a market downturn or scramble to day-trade on a whim.

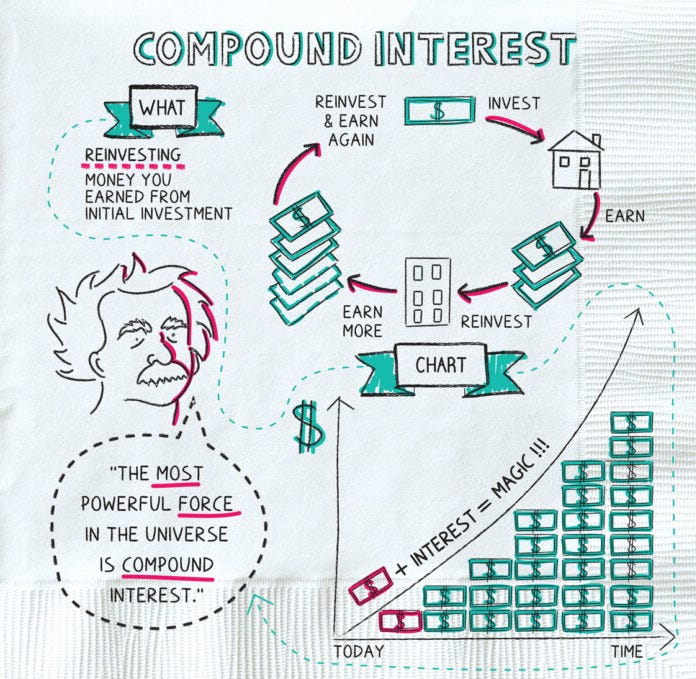

Instead, you hold steady, let compounding do its job, and keep your energy where it belongs—on the bigger picture.

That morning after my sleepless night, I stared into the mirror, feeling like a zombie running on nerves and caffeine.

At that moment, a single thought looped in my head: “Enough. I either believe in my ability to build real wealth, or I continue to self-sabotage this.” I decided right then that I couldn’t live in the endless cycle of worry and second-guessing.

I committed to a set of concrete steps and felt a genuine shift for the first time—more energy, clarity, and, over time, more money rolling in.

It was my “hero’s call to adventure,” so to speak. I was stepping out of the chaos and into a sense of calm control.

What Changes When You Trust Yourself?

When you lock into genuine self-trust, your entire mindset undergoes a shift. You stop panicking over temporary market slides because you trust that rebalancing—or even doing nothing—is sometimes the best move.

You start each day by focusing on the one outcome that really matters to you, instead of drowning in a thousand to-dos. You grow more at ease having tough conversations with your partner, financial advisor, or boss, relying on your innate ability to handle real-time tension without endless rehearsals.

The way you look after yourself also evolves. You exercise more, eat healthier, and allow space for mental breaks because you invest in yourself with the same conviction you bring to your buy-and-hold strategy.

And ultimately, you streamline your decisions, whether that’s choosing a few tried-and-true index funds or identifying a real estate deal that aligns with your long-term vision.

That’s not reckless. In fact, it’s the opposite: you’re strategic precisely because you’re done being hijacked by fear and self-doubt.

How I Built Self-Trust (and How You Can, Too)

Over the years, I’ve honed a direct yet powerful system to solidify self-trust.

It starts by identifying your weakest link: the one place you doubt your capability the most. Maybe it’s making a big investment decision, neglecting your health, or putting off that side hustle.

Once you’ve pinpointed it, commit to something tiny—five minutes on a daunting task, a single day without social media—so you can bank a quick win and start eroding the toxic “I can’t handle this” narrative.

From there, eliminate your biggest energy drains. If you’re addicted to refreshing your brokerage app every ten seconds, go on a brief digital detox—48 hours, a week, whatever stretches you. Each time you resist the urge to check, you’re proving you can endure the discomfort of not knowing every market fluctuation in real time.

To build even deeper trust, tackle a conversation you’ve been dreading. Call that person or schedule the meeting without over-preparing. Just trust that you’ll find your footing, and then notice how empowered you feel once you pull it off.

As these mini-challenges stack up, pause to absorb your wins. Notice how each success boosts your confidence, reinforcing a new cycle of self-belief. Trust, like compound interest, isn’t built overnight—it grows with consistent, repeated practice.

Linking Self-Trust to Financial Success

I’m a buy-and-hold fundamentalist for a reason. Consistent contributions and reinvested gains can snowball into serious wealth, provided you don’t sabotage yourself midway.

When the market hits a rough patch, the investor lacking self-trust bails. The self-assured investor, however, might pick up more shares at a discount and reap the benefits on the rebound.

The key is staying the course and trusting yourself not to jump ship when headlines turn scary. That’s the difference between crossing the finish line to Financial Independence—where you’re living out your retirement dreams in style—and getting stuck in a cycle of near-misses and perpetual worry.

Consistency requires emotional fortitude; you have to believe you can handle a recession, a personal crisis, or a sudden career shift without blowing up your plan. With that calm, clear head, you’ll make far better decisions in your professional life, entrepreneurial pursuits, and everyday money moves.

I won’t lie: it’s not always easy.

But I can promise that building a solid foundation of self-trust will genuinely transform your life.

I went from an anxiety-ridden night owl to someone who sees steady growth—both in my bank account and my daily peace of mind.

And as my trust in myself grew, my portfolio returns started reflecting that newfound conviction.

Thanks for reading. Stay disciplined, invest steadily, and let’s meet up on the winning side of financial independence.

- Mike