Generating 27.6% Annual Returns with Put Selling + Fresh Picks with 50-117% Yields

Insurance companies collect premiums, hoping they never pay claims.

I collect option premiums, hoping I DO get the claims.

One of us is doing this backwards. Spoiler: it's not me.

I'm expecting to pull $8,000 over the next 60 days from $174K—and you can watch every move.

In today’s issue:

→My complete 12-position playbook;

→Fresh picks ranging from safe 8% yields to aggressive 117% annualized returns;

→The exact sizing rules that prevent catastrophic losses

→How to turn losing positions into bigger winners.

Inside the Live Laboratory

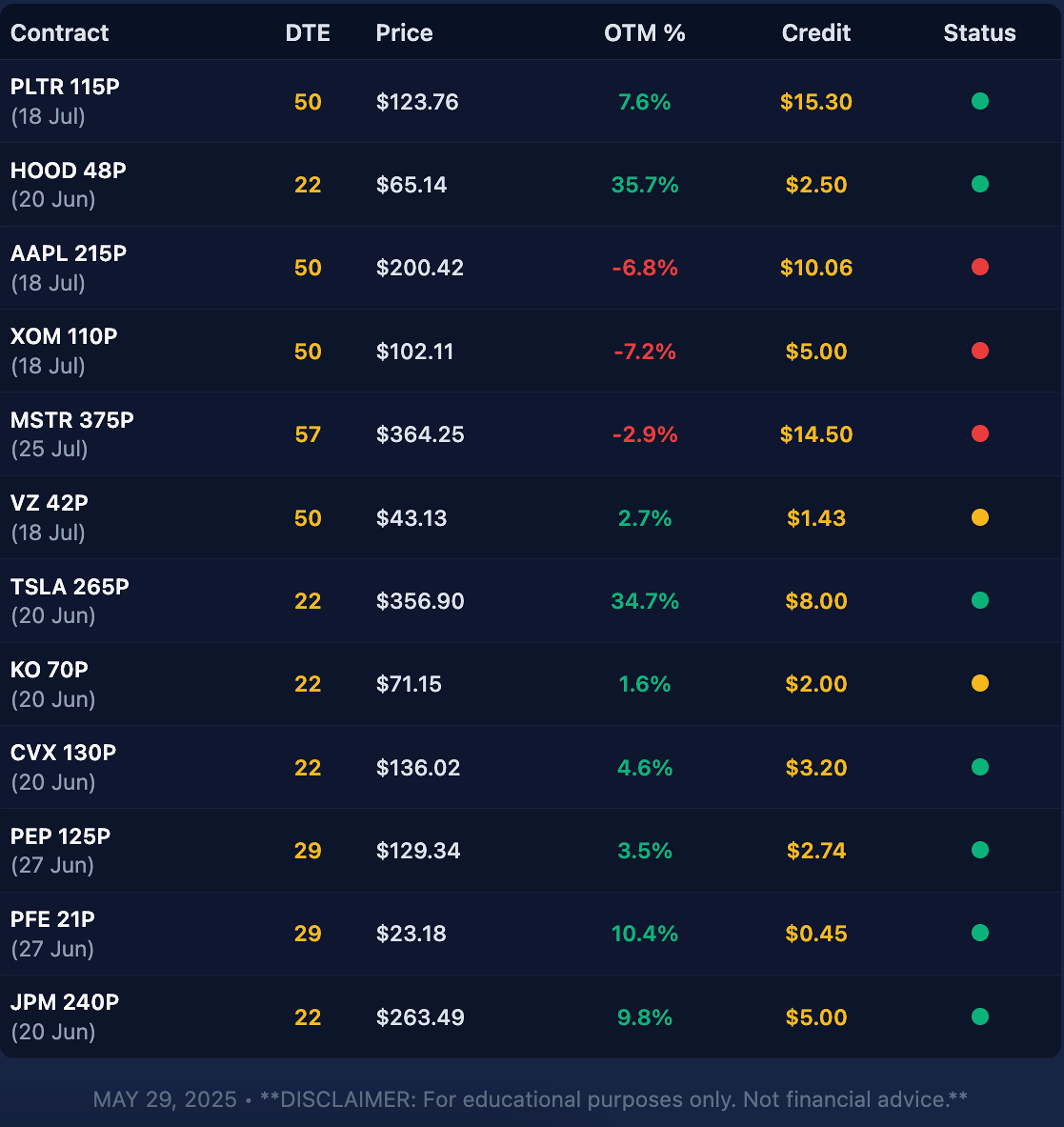

My current CSP book holds $174,000 in collateral across 12 contracts.

I build my portfolio for premium harvest first and share acquisition second, and the positioning reflects that philosophy. Collateral is diversified across 10 tickers representing tech, consumer staples, energy, healthcare and financials.

Every trade I'm about to dissect follows the same risk management framework that cna be applied with $10,000 or $1,000,000.

🟢 The Green Zone (7 Contracts)

These beauties are printing $25 daily in time decay. Combined. While you sleep.

PLTR alone delivers 97.1% annualized returns if it expires worthless. But even if Palantir stumbles, I'm buying at $99.70 effective cost—a 20% discount to where big money was buying six months ago.

TSLA has almost zero chance of hitting my $265 strike. The $8.00 credit I collected beats 3 weeks of dividend payments from most blue chips. In just 22 days. Getting monthly income that normally takes a quarter to earn.

Key insight: Notice how these positions cluster around 0.18 delta on average. This isn't coincidence. 0.15-0.25 delta represents the statistical sweet spot where premium decay outpaces assignment risk by the widest margin.

Too low, not enough juice. Too high, you're gambling instead of investing.

🟡 The Yellow Caution Zone (2 Contracts)

These straddle the comfort zone.

Not panicking, but watching.

Verizon at $42 would be a gift—6.2% dividend yield, recession-proof cash flows, and a stock that's been range-bound since the Obama administration.

The assignment arbitrage: Beginners fear assignment. Professionals prepare for it. If KO gets put to me, I immediately sell covered calls against the position.

Double-dipping the premium stream.This is "layered income generation"—when one strategy (CSPs) seamlessly transitions into another (covered calls) without missing a beat.

🔴 The Red Zone Check (3 Contracts)

Beginners panic and close for losses. Professionals see more profit opportunities.

Apple at $200 isn't a problem—it's been trading around this level for two years. My $10.06 collected premium means I'd be buying AAPL at $204.94 effective basis. Compare that to the $230+ prices from six months ago.

Exxon below $110 actually creates opportunities. The $5.00 premium gives me a $105 effective basis on an oil giant trading at 10x earnings with a 5.8% dividend yield. XOM hasn't been this cheap since the shale boom.

MicroStrategy needs special handling because it moves with Bitcoin. There are ways to hedge the crypto risk while keeping the premium income from the software business side.

Each position has multiple profitable exit strategies—the key is knowing which lever to pull when.

A detailed management playbook is reserved for Premium subscribers.

VADER's Fresh Picks: New Premium Opportunities (May 29, 2025)

Every Thursday, my VADER algorithm scans 3,200 optionable stocks through 16 quality filters.

This week's Tier 1 selections offer institutional-grade opportunities with sleep-well-at-night safety margins.

Disclaimer: The tables below show how I screen for income. They are not trade recommendations, signals, or financial advice. Use them as an educational foundation only—back‑test, sanity‑check, and consult a licensed professional before risking a nickel.

🔓 TIER 1 – Conservative Income

Tier 1 represents the "slow cooker" approach to income generation.

Conservative deltas (-0.20 range), blue-chip quality, and meaningful OTM cushions. This is patience arbitrage at its finest—getting paid to wait for opportunities most investors only dream about.

Apple dominates because of what I call the "iPhone Annuity"—billion+ users locked into an ecosystem that prints cash regardless of economic weather.

The August 180 strike offers 11.18% annualized yield with a 10% cushion. Even if assigned, you're buying the world's most valuable company at a $175.70 effective basis (after premium).

But here's where most investors get it backwards.

They see an assignment as a failure. I see it as the whole point.

Getting assigned can be the best outcome.

Assignment means:

Buying at YOUR chosen price (the strike)

With a discount (the premium you collected)

On a pre-approved stock (your screening process)

At maximum pessimism (when puts are ITM)

My PFE 21P might get assigned? Perfect. $20.55 effective basis on a pharmaceutical giant yielding 6%+. I'll immediately layer covered calls for double-dip income.

This is "systematic income generation"—every outcome has a profitable next step.

Premium subscribers get the full breakdown:

🔥 Tier 2 & 3 picks targeting 50-117% returns

🔴 Exactly how I'm managing those three underwater positions

📊 Risk management framework from institutional trading

⚡ Step-by-step June expiration strategy

P.S. The Lifetime plan may be ending soon, possibly within days or weeks (unfortunately, it is not up to me). Current Lifetime members keep access forever.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.