"Mike, I want to use VADER and the Multiplier system, but I’m based in Europe. Can I?"

Short answer: Not only can you adapt VADER, but European markets also offer advantages that U.S. investors can't access.

EU markets receive far less attention than their U.S. counterparts. This market inefficiency creates perfect opportunities for the Multiplier strategy.

I'll explain exactly how to apply these institutional-grade insights to your European portfolio.

Verified against Eurex, Euronext, ICE, STOXX, and official issuer filings as of May 14, 2025.

The Multiplier Strategy: A Quick Refresher

For those who might be new to this approach:

Own quality, dividend-growing stocks

Sell covered calls or cash-secured puts for immediate income

Reinvest that premium to buy more shares

Repeat until your income curve starts accelerating

The beauty is in the compounding effect.

As your position grows through reinvested premiums, each new round generates more income than the last.

It's like a snowball that picks up more snow with each revolution.

European Markets: Different Rules, Different Opportunities

After analyzing contracts across multiple European exchanges, I've found several key differences that create unique opportunities:

I've noticed that TotalEnergies (TTE) and Exxon (XOM) often trade at similar valuations, but TTE's options frequently price in higher volatility, creating better premium opportunities.

This isn't just a temporary situation—it's a persistent pattern.

These inefficiencies aren't secrets, but they're overlooked by most individual investors, creating a significant opportunity for those willing to learn the European option landscape.

The Four-Bucket System: Europe Edition

In my investing philosophy, every dollar should fit into exactly one of these portfolio buckets:

🔒 Bucket 1: Steady Dividends & Strong Moats

These pay you while you wait

TotalEnergies (TTE): Energy giant paying €0.85/share quarterly

Sanofi (SAN): French pharma that stays strong even in recessions

Allianz (ALV): German insurance powerhouse with rock-solid dividend

When to sell options: Always. These are your workhorses—sell puts when they dip, calls when they rise.

Think of Bucket 1 as your financial foundation—the basement and ground floor of your wealth house. It's not sexy, but without it, the whole structure collapses. These companies have been pumping out dividends since your kids were in diapers, and they'll likely still be paying when your grandkids are in college.

🚀 Bucket 2: Growth Machines

These multiply your capital

ASML: A Dutch company that makes machines that make computer chips

LVMH: Owner of Louis Vuitton, Hennessy, and 70+ luxury brands

Airbus: Boeing's main rival with a massive order backlog

When to sell options: Only sell far out-of-the-money calls (30+ delta) to avoid capping upside.

Bucket 2 is your wealth accelerator. These aren't speculative moonshots—they're established companies still in their prime growth phases. ASML, for instance, holds a virtual monopoly on the machines needed to make advanced computer chips. Try finding another company where every major tech giant worldwide has no choice but to buy from them.

🛡️ Bucket 3: Sleep-Well-At-Night Stocks

These protect you in downturns

Ahold Delhaize: Grocery giant—people always need food

Deutsche Post: Germany's version of UPS/FedEx

Nestlé: Swiss food conglomerate that barely budges in crashes

When to sell options: Sell puts during market panic, calls during calm.

I call these the "apocalypse stocks." Short of zombies roaming the streets, these businesses keep chugging along regardless of economic conditions.

When the market tanked 23% in March 2020, Ahold Delhaize dropped just 7%—and was back to positive within three weeks.

Why? Because even in a pandemic, people need groceries.

💰 Bucket 4: Premium Cash Cows

These generate the fattest option checks

Stellantis (STLAM): Car maker with consistently juicy premiums

Intesa Sanpaolo (ISP): Italian bank with options that pay 2-3x normal rates

ENI: Italian energy company with persistently mispriced options

When to sell options: Only when you're comfortable with assignment, and never more than 15% of your portfolio.

Bucket 4 is where the real option income magic happens, but it comes with a warning label.

These stocks consistently offer the fattest premiums in Europe—often 2-3x what you'd get from comparable U.S. companies.

But there's no free lunch.

The premiums are higher because these companies have more volatile stock prices.

Mix these in the right proportions: 40% Bucket 1, 25% Bucket 2, 20% Bucket 3, and 15% Bucket 4. Adjust based on your risk tolerance, but never go above 15% in Bucket 4.

The beauty of this four-bucket system is balance:

When growth stocks are soaring, Bucket 2 drives your returns.

When markets crash, Buckets 1 and 3 provide stability.

And Bucket 4 keeps the cash flowing regardless of market direction.

It's like having four different engines on your financial aircraft—if one sputters, you've got three backups.

A Practical Example with TotalEnergies

Let's walk through a specific example using TotalEnergies (TTE), currently trading at €62/share:

Step 1: Purchase 100 shares of TTE @ €62 each = €6,200 investment

Step 2: Sell a covered call

Sell the €65 call expiring in 45 days

Collect €1.25 per share (€125 total premium)

Step 3: Possible outcomes

If TTE stays below €65:

You keep your shares

You keep the €125 premium

You collect the €0.85/share final dividend (€85)

Total income: €210 (3.4% in 45 days, which would be about 27% annualized)

If TTE rises above €65:

Your shares get called away at €65

You make €3/share in price gain (€300)

Plus you keep the €125 premium

Plus you get the €85 final dividend

Total profit: €510 (8.2% in 45 days)

Step 4: Reinvest and repeat

The power of this strategy comes from reinvesting your premiums to grow your position over time.

A reader from Frankfurt started with 200 TTE shares in January and has built that to 243 shares by May, simply by reinvesting the premiums he's collected.

This represents a 21.5% increase in his position size in just 5 months, without adding any new capital.

That additional 21.5% will generate proportionally more dividend income and option premiums going forward.

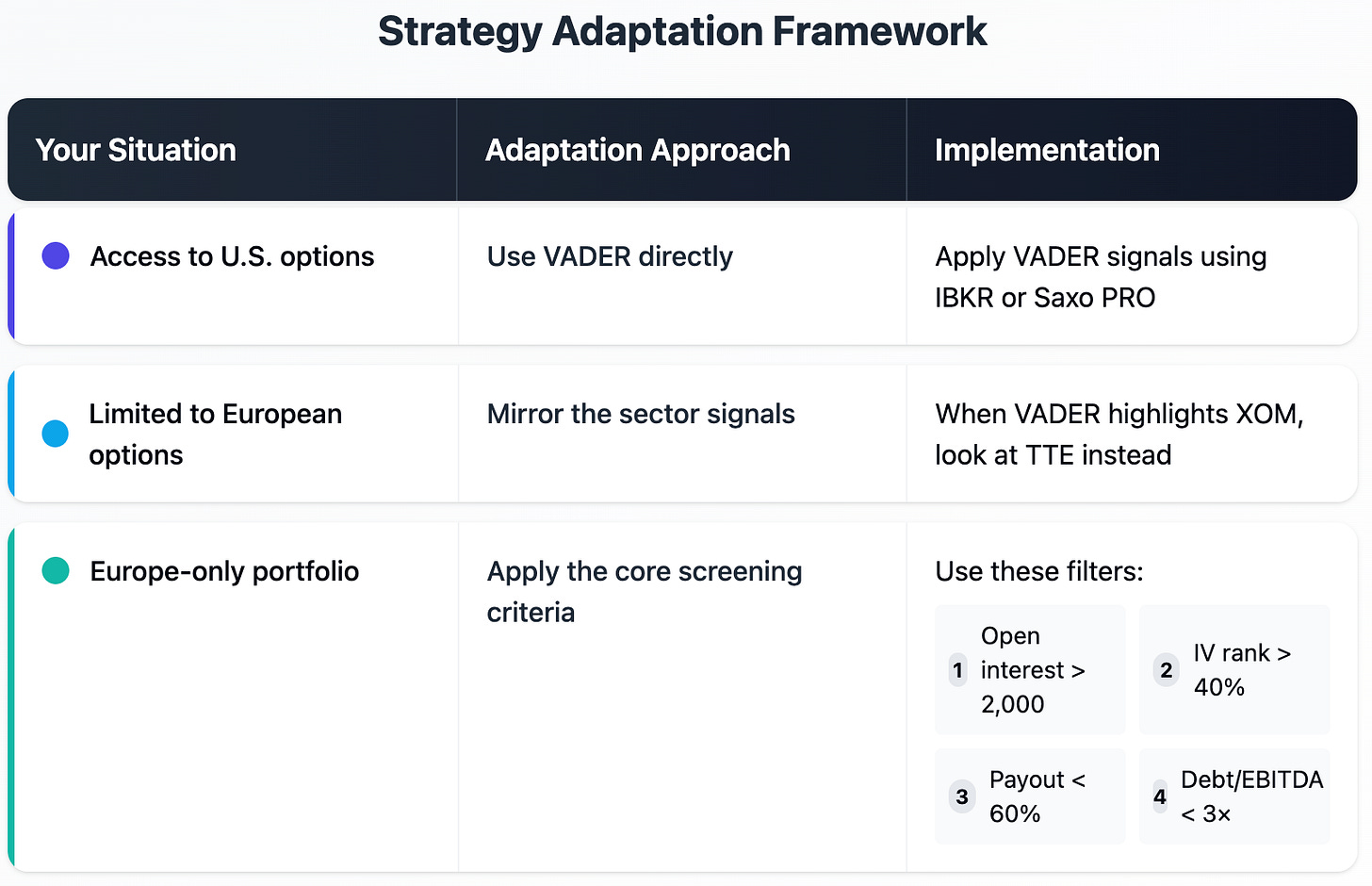

Adapting VADER for European Markets

My VADER system was designed for U.S. markets, but here's how European investors can adapt it:

The underlying principles work regardless of geography.

The key insight is that sector-wide volatility tends to affect related companies across markets.

When U.S. energy stocks experience volatility spikes, European energy stocks often follow suit, creating similar option selling opportunities.

Timing Your Entry: Using Volatility as Your Guide

The VSTOXX is Europe's equivalent to our VIX—it measures market volatility.

I've found it to be an excellent guide for when to implement different option strategies:

Below 18: Market is calm—focus on building your share positions

18-25: Good conditions for selling puts (currently at 22.5)

25-30: Ideal environment for covered calls

Above 30: Premium levels are elevated—a great time to be more active

Many investors make the mistake of selling calls when volatility is low and puts when volatility is high—exactly the opposite of what's optimal.

By using the VSTOXX as a guide, you can align your strategy with market conditions.

European Broker Considerations

European brokers have additional regulatory requirements that can impact your options trading:

Professional vs. Retail Classification:

EU regulations restrict certain options unless you qualify as a "professional investor." IBKR allows you to self-certify if you've conducted a sufficient number of trades (typically 10+ significant trades per quarter for the past year).

Broker Recommendations:

Based on my experience with European clients, these brokers offer the best combination of options, access, and reasonable fees:

IBKR: Most comprehensive options access with competitive fees

Saxo Bank: Good platform, but higher fees

Consors (Germany only): Solid choice for German residents

I've found that many European discount brokers have limited options, capabilities, or charge excessive fees that can significantly reduce your returns over time.

Frequently Asked Questions

"Can I use tax-advantaged accounts for this strategy?"

UK SIPPs allow listed options; ISAs do not

French PEA accounts don't permit options

German tax-advantaged accounts allow options, but dividends are taxed at source

"What's the key difference between European and American style options?"

European-style options can only be exercised at expiration, not before. This is particularly valuable for dividend strategies, as you can sell calls across ex-dividend dates without risk of early assignment.

For example, TotalEnergies pays its €0.85 final dividend with an ex-date of June 19, 2025. With European-style options, you can sell calls that expire after this date and still collect both the premium and the dividend without assignment risk.

"What's a reasonable starting capital?"

€25,000 is a practical minimum. This allows you to purchase at least one 100-share lot and maintain cash for puts. With €50,000, you can implement a more diversified approach using multiple positions.

P.S. If you are under 25K - check out my post from yesterday:

"How much time does this require?"

This strategy takes about 100 minutes per week:

Thursday: 45 minutes to review and sell puts

Sunday: 45 minutes to review and sell calls

Wednesday: 10 minutes for a quick portfolio check

The key is consistency, not constant monitoring. Setting a regular schedule helps maintain discipline.

The Psychological Advantage

Beyond the technical details, this strategy provides a different psychological relationship with the market.

While most investors hope for rising prices, option sellers often prefer sideways or slightly declining markets—perfect conditions for collecting premium.

This contrarian perspective can be powerful when most of the market is focused on capital appreciation.

By generating income regardless of market direction, you create a more resilient portfolio that can thrive in various market conditions.

I'll be back tomorrow with specific cash-secured put setups for the Premium subscribers.

Thank you for tuning in today and supporting my work!

Mike Thornton, Ph.D.

Interesting post, I am based in europe and of course looked at this. But I feel like I will be still doing USA Stocks and Options .

- less work as I can be inspired by your picks

- the volumes and spreads on USA Options are much better than volumes, even for highly traded equity like TTE.

- even if commissions are a bit higher here I feel that I recover part of that just on the better spreads.

I only need to get a broker that will let me have an account in USD to not have forex fees each time.

Any ideas on a platform with good volume and option interest data on european traded options ?

Good trading to all

Hi Mike, couple of questions here:

1) When you talk about Bucket 4 and the recommended 15% allocation, are we talking about just CSPs or also CC for this bucket?

2) Can you explain why it's recommended to sell puts when volatility is low and sell calls when it's high?