Does Your Portfolio Pay You a Weekly Salary? Mine Does.

[Week 27 CC Update]

Stop asking where the market is going — It's the wrong question.

The right question is: "How do I get paid from the market's constant motion, regardless of direction?"

Everything changes when you adopt this mindset. It’s exactly how professional funds operate, they are not trying to predict the future, they generate income from the present.

And this mindset shift delivers clear results: last week, we banked $2,890 in premium across 24 positions - enough to cover the average monthly mortgage payment, created in just five days.

Do the math: that's 31.7% annualized.

Let’s unpack how you can do this, too.

If you're new here, welcome!

You're looking at my weekly update on a living, breathing portfolio that generated $2,890 in cash premium last week alone and has produced positive income in 47 of the last 52 weeks.

In each issue, I’ll take you inside this portfolio to dissect every existing trade under real market conditions.

Then, we'll look forward, identifying the best new income opportunities the market is offering for the week ahead.

My goal is to hand you the institutional playbook, from finding new opportunities to managing every trade from open to close.

Strategy Recap: The VADER & Our Live Trading Lab

During my stint managing institutional option flow, I discovered something that changed everything for me from that point on.

Retail investors lose money in options not because they're unlucky or stupid, but because they're playing the wrong side of a mathematical certainty.

Every option has two sides: buyer and seller.

The buyer hopes for a big win.

The seller collects consistent cash income.

The buyer fights against time.

The seller gets paid for waiting.

Yet, 90% of people still choose to be buyers, they are essentially volunteering to fund our weekly paychecks.

The Birth of VADER

The VADER was built out of pure frustration.

On my institutional trading desk, we'd correctly predict a stock's direction and still lose money. Then we crunched the numbers on 847,000 real-world option trades and we saw a huge statistical imbalance: selling options was profitable 73.2% of the time, buying them — just 26.8%.

From there, we reverse-engineered the mechanics of thousands of winning trades to create VADER — algorithm designed to put that powerful 73% probability on our side with every position.

The Three-Stage Filtration Process:

VADER isn't a screener, it was built as a ruthless elimination engine.

We start with the universe of 3,217 optionable stocks and force them through a three-stage filtering process designed to find only institutional-grade opportunities.

Filter for Viability: We start by eliminating 78% of stocks based on essential liquidity and volatility metrics.

Filter for Quality: The remaining stocks are then measured against 16 strict institutional standards, leaving only about 150 blue-chip quality companies.

Filter for Opportunity: Finally, we rank these elite companies by their income potential, sorting them into Conservative (8-12% yields), Balanced (15-25% yields), and Aggressive (25%+ yields) tiers.

The result is a curated list of the 20-30 best opportunities in the entire market, delivered directly to our Premium Subscribers' inboxes.

Every Thursday, VADER generates fresh cash-secured put opportunities.

Every Sunday, new covered call candidates emerge.

Our Live Portfolio: The Traffic Light System

But finding opportunities is just the start.

The most critical skill is calm, confident trade management. That's why I track every position publicly. You need to see how a professional handles things when a trade doesn't go perfectly.

That's why I track every position publicly, especially the messy ones.

For example, after my June 30th roll, seven contracts that were previously flashing were successfully managed back to 🟡 Watch or 🟢 Green.

Witnessing these turnarounds does two things:

It builds your instinct for managing risk under pressure.

It shows you which stocks are resilient income generators, creating a powerful opportunity radar for your own future trades. You follow the decision making process during volatile periods, observe how challenged positions are managed, and learn the critical timing decisions that separate profitable systematic trading from gambling.

Every one of the 24 active positions, which together generated $2,890 last week, is managed by one simple, universal protocol: The Traffic Light System.

It’s how we remove emotion and maintain a 31% target yield.

The status of the entire portfolio is clear at a glance:

33% are 🟢 GREEN - These trades are running perfectly, quietly generating income. No action needed.

42% are 🟡 YELLOW - These trades are approaching a pre-planned decision point. We watch them calmly, ready to act.

25% are 🔴 RED - This is where the most valuable learning occurs. "Adjustment" doesn't mean danger; it means it's time to follow a calm, pre-scripted plan to improve our position.

My portfolio is in excellent health.

We’ve pocketed nearly $6k in premium, and after a planned, profitable sale of our AMD shares on Monday, our exposure will be even lower.

Risk gauge is low, and our focus this week is simply extending a few trades for more cash.

I walk through every decision in the Yellow and Red Zones in the Premium Section. That's where you learn how to respond with a calm system instead of emotion.

Introduction to This Week's VADER Opportunities

The current market setup is extraordinary.

Technology names pumped full of AI hysteria.

Healthcare trading at discount valuations.

VADER has identified setups that combine fundamental strength with technical opportunity for max profit extraction.

CRITICAL DISCLAIMER: The tables below show how I screen for income. They are not trade recommendations, signals, or financial advice. Use them as an educational foundation only—back‑test, sanity‑check, and consult a licensed professional before risking a nickel.

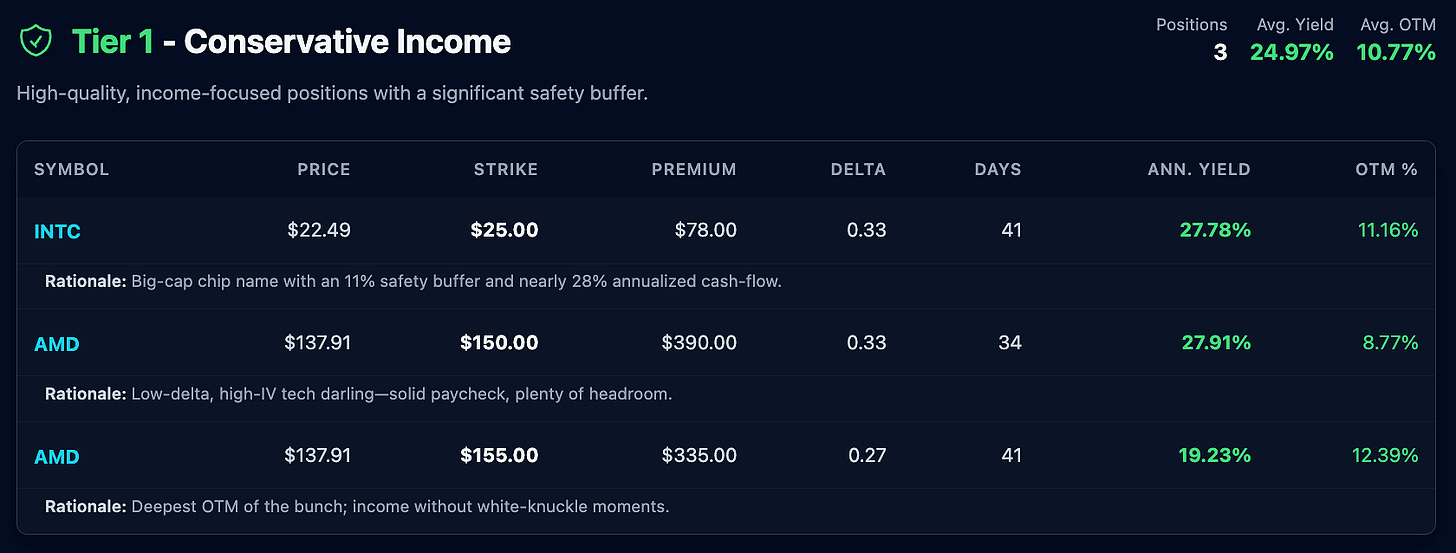

🔒 Tier 1: Conservative Income Picks

For those who value sleep over adrenaline, these positions target 20-30% annualized returns with substantial protective buffers.

Deep Dive: INTC $25.00 Call Analysis

Intel is the perfect example of how market sentiment creates option-selling opportunities. Everyone knows the company faces competitive pressure. Everyone knows it's lost ground to AMD and NVIDIA. What they don't know is that this creates a mathematical arbitrage.

Current setup: $22.49 stock price, $25.00 strike, 11.16% safety buffer.

For this position to fail, Intel would need to rally over $2.50 per share just to reach our strike. Meanwhile, we collect $0.78 in premium for the privilege of potentially owning shares at $24.22 effective cost.

At current levels, Intel represents deep value masked by sentiment concerns.

Assignment scenario: If Intel shares somehow rocket past $25, we get assigned at an effective cost of $24.22. Fair value for a company trading at 12.3 times forward earnings with government subsidies and dividend income.

Now we turn up the dial with the Balanced Tier, which currently targets 35-67% annualized yields by selecting slightly closer strikes & the Aggressive Tier, which generates yields over 75% by treating assignment as a core part of the profit strategy.

🔒 PREMIUM ACCESS REQUIRED

The complete Tier 2 and Tier 3 analysis, including specific strike recommendations, exact entry timing, and professional position management protocols, are available exclusively to Premium Trading Laboratory Members.

Premium subscribers receive Sunday's complete VADER picks (targeting 50-75% yields), Thursday's cash-secured put opportunities, and detailed position management tactics.

⚖️ TIER 2: Balanced Approach

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.