So, What Exactly Is the Dividend Discount Model?

The Dividend Discount Model (DDM) insists that a stock’s “real” worth is nothing more than the sum of all future dividends it might pay—discounted back to today’s dollars. Fancy. The logic goes like this:

Companies make profits.

Some of those profits may end up as dividends.

If you guess all future payouts right—and discount them for the time value of money—presto, you’ve got the stock’s “fair value.”

Never mind that predicting decades of dividend behavior is basically an exercise in fortune-telling.

Key Takeaways (Because Everyone Loves Bullet Points)

DDM sees a stock’s price as the sum of future dividends’ present value—like a crystal ball for perpetual payouts.

If DDM says the value is higher than what the market charges, the stock might be “cheap.” And we all love bargains, right?

If DDM value comes out lower, it’s “expensive.” Sell it—preferably to the next unlucky soul who doesn’t check the math.

Please note that the real world has a habit of spoiling perfectly neat theories.

How DDM Tries to Charm You

Imagine you’re trying to put a price tag on your friend’s actual willingness to keep paying you back: You plop each future dividend into a formula that accounts for time and risk. The result? A neat price that says, “This stock is definitely worth $X.” Because obviously, the future is perfectly predictable.

Time Value of Money: The Big, Repetitive Lesson

Would you rather have $100 now, or $100 a year from now?

Everyone says now, so you can invest it and, hopefully, make more.

The DDM hangs its hat on this concept, discounting future dividends so you feel all warm and fuzzy about your “risk-adjusted” math.

Cracking the Code on Expected Dividends

Fixed Growth Rate?

We pretend dividends will grow at, say, 5% until the Earth implodes. Because nothing screams realism like “forever.”Spotted a Trend?

If a company’s been hiking dividends by 4 cents each year, you might bet your life savings they’ll keep that pattern going. (Nothing bad ever happens to stable dividend payers… right?)

The “Discounting Factor” a.k.a. The Cosmic Guess

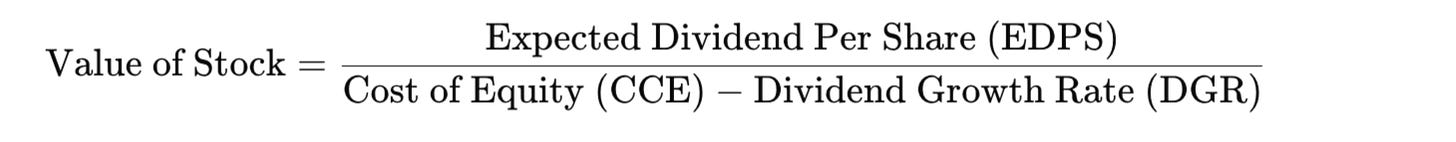

You have a “required rate of return” (r) because, as an investor, you apparently want some payoff for risking your cash. Then there’s a “dividend growth rate” (g). Subtract one from the other—(r – g)—and there you have your discount factor. Yes, this formula can yield nonsense if a company’s growth rate is higher than your required rate. But let’s ignore that inconvenient reality.

The DDM Formula: Just Plug It In

Basically, guess next year’s dividend and the growth rate, guess your required return, and hope those guesses are correct.

This formula shines brightest for companies that actually pay (and grow) dividends regularly. But hey, if a company doesn’t pay dividends, you can still use DDM by pretending it does. Who needs reality?

The Greatest Hits Variations

Zero-Growth DDM

Perfect for folks who believe a company’s dividend will never budge—ever. Seems plausible if you’re analyzing some ancient slow-growing firm, I guess.Gordon Growth Model (GGM)

The iconic version, courtesy of Myron J. Gordon, that presumes dividends grow at a constant rate until the universe collapses. Just one tiny rate, forever. Right.Supernormal Dividend Growth Model

Admits that maybe dividends can spike in the early years (that’s your “supernormal” phase) then slow to a snail’s pace, which is apparently the new normal in the indefinite future.

A Couple of Examples (Spoiler: They’re Flawless in Textbooks)

Example 1: Company X

This year’s dividend: $1.80

Growth rate: 5%

Cost of equity: 7%

Step 1: Next year’s dividend = $1.80 * (1 + 0.05) = $1.89

Step 2: Using the GGM, Price = $1.89 / (0.07 – 0.05) = $94.50

Presto, you’ve discovered the perfect price. Don’t you feel enlightened?

Example 2: Walmart

They’ve paid dividends that tick up by 4 cents each year.

Growth is ~2% per year.

Your required rate of return is 5%.

So you do $2.28 / (0.05 – 0.02) = $76. Because obviously Walmart’s only worth $76, no matter what the market says.

Shortcomings: Where Reality Rears Its Ugly Head

Perpetual Constant Growth?

Because yeah, all companies maintain the same growth rate forever, no matter how markets shift.Ridiculously Sensitive Inputs

Tweak the growth rate or your required return by a hair, and your “fair value” gyrates like a carnival ride.Doesn’t Work If (r < g)

Oops. The formula collapses if a company’s dividend growth is somehow bigger than your required return. That leads to negative stock prices. Surreal, right?

Putting the DDM to Work—If You Dare

DDM is the proud occupant of the “cool theoretical model” category. It can compare stocks across different markets, even if they’re in unrelated industries. If the DDM tells you a stock’s intrinsic value is higher than its market price, well, maybe it’s cheap. If it’s lower, maybe it’s expensive.

But let’s not get starry-eyed: assumptions rule the roost here. If you’re off on dividends or growth, you might as well pick stocks by throwing darts at a board—and that’s probably cheaper than all these detailed calculations.

FAQs (In the Tone of “Are We Seriously Still Asking?”)

1. What Are the Main Types of DDM?

Gordon Growth, two-stage, three-stage, H-Model… basically variations that add more assumptions, hoping to mimic the real world better.

2. How Does DDM Help?

It gives you a theoretical fair price based on future dividend expectations. Then you see if it’s above or below the current price to decide if you want in or out.

3. 25% Dividend Rule?

If a dividend is so big that it’s 25%+ of the stock’s value, the ex-dividend date moves. Because the market can’t handle normal procedure when dividends get that outlandish.

The Bottom Line: Use with Cynical Caution

The DDM tries to pin down a “fair” value for a stock based on guessable future dividends. It shines if you’re evaluating a boringly reliable company with consistent dividend hikes. If the firm is new, unpredictable, or stingy on dividends, the DDM quickly becomes a guessing game. And let’s face it, markets have never been shy about handing out humiliating lessons when assumptions go wrong.

So treat the Dividend Discount Model like one arrow in your investing quiver. Cross-check results with reality—balance sheets, actual growth prospects, industry trends, maybe even a tiny pinch of common sense. Because at the end of the day, there’s nothing more humbling than a model that collapses the moment a single input shifts from your tidy little plan.