9.2% Yield From Tariffs: My 4,100 Quarterly 'Trade War Paychecks'

How to Get Paid Like a Trade War Landlord

I spent 20 straight hours analyzing market data to hand-pick these 7 income machines that are strategically positioned to thrive during trade wars.

Complete with precise entry points based on my 20 years of investing & academic experience.

But first, let's address the elephant trampling through the market: Trump's tariff announcement.

The market has responded with its typical elegance—by freaking out spectacularly.

Here's what's actually happening beneath the hysteria:

The announced "reciprocal tariffs" range from 10% (UK, South Korea) to 60+% (Vietnam), with China at 34% and EU at 20%

The impact isn't uniform across sectors—consumer discretionary, technology, and industrials face disproportionate exposure

The dollar has been crushed—falling to 102.10 on the Dollar Index, with a potential floor around 99.60 (2023 low)

Supply chains are bracing for disruption—February's goods trade deficit hit $149 billion, significantly wider than expected

But here's where most analysts get it wrong: they're confusing sentiment effects with fundamental effects.

Let's examine the data without the hysteria:

When tariffs officially began on February 4th, real-time inflation was 2.19%

Current real-time inflation? 1.76%—lower despite the tariff implementation

The Atlanta Fed GDPNow model shows 2.1% real-time GDP growth—modestly lower than the 2.4% when tariffs were first announced

This isn't 2018's trade war. It's potentially more severe, but the market reaction thus far has been primarily sentiment-driven rather than reflective of actual economic damage.

This creates specific, actionable opportunities—which I'll detail in precise terms.

2018-2019 Tariff Flashback: What Actually Happened Last Time

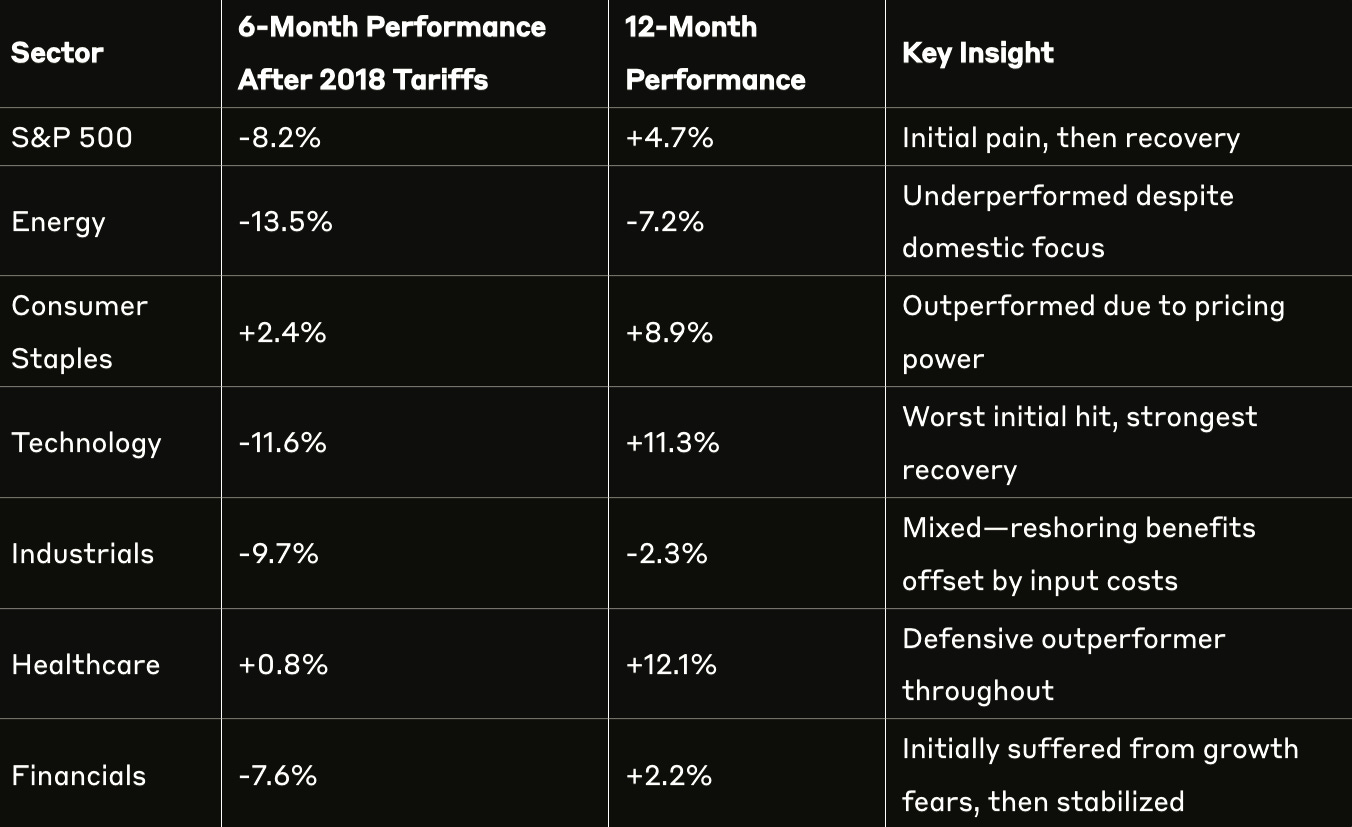

Before we dive into the present situation, let's examine the only recent historical parallel we have: the 2018-2019 tariff cycle.

The market's initial reaction then mirrors today's panic—but what actually happened?

Initial panic created buying opportunities in select sectors.

Consumer Staples and Healthcare demonstrated remarkable resilience, while Technology suffered the steepest initial decline before staging the strongest recovery.

This time around, the tariffs are broader and higher.

But understanding this historical pattern helps inform our tactical positioning in the present scenario.

Tariff Exposure: Sector-by-Sector Breakdown

Understanding which sectors stand to win or lose from the tariff regime is critical for repositioning your portfolio:

This isn't a uniform market event—it's creating both targeted casualties and unexpected beneficiaries that most investors are missing.

Supply Chain Vulnerability: Where The Real Pain Points Lie

Behind the broad sector analysis lies a more nuanced story of specific supply chain vulnerabilities.

Here's where the tariff pain will be most acute:

Critical Component Vulnerabilities

The companies with the strongest competitive positioning share key characteristics:

Vertical integration of critical components

Geographically diverse supply chains

Ability to pass costs to consumers

Domestic manufacturing capacity

The most vulnerable are those with:

China-dependent single-source components

Low pricing power in competitive markets

Just-in-time inventory systems with limited buffer stock

High ratio of imported content to final sales price

The Income Solution: Tariff-Resistant Income Generators

The key to navigating the tariff environment while maintaining income is to focus on three categories of investments:

CEFs that generate income from both growth and value segments

Dividend growers with strong domestic focus or pricing power

Companies specifically positioned to benefit from reshoring

I'm going to show you exactly how to extract substantial income from this disruption, with precision entry points.

Here's my tariff-resistant income arsenal, calibrated for this exact moment:

1. Royce Small-Cap Trust (RVT) - 9.2% Yield

Wall Street has nearly universal contempt for small caps these days.

Their loss, our gain.

RVT is delivering a 9.2% yield while trading at a valuation discount not seen since the early 2000s.

Why it's tariff-proof: Small caps generate 70-80% of revenue domestically. When Chinese imports get slapped with 34% tariffs, companies serving Peoria rather than Panjin hold the advantage. Last time tariffs hit, domestic small caps outperformed multinational titans by double digits.

Execution plan:

Entry zone: $9.30-$9.50

Position size: 7% for income-focused portfolios, 5% for balanced

The trigger for averaging down: If small caps sell off broadly and RVT hits $8.80, double your position

Exit signal: Any break below $8.55 on volume exceeding 2x average

The current valuation gap between small and large caps is the widest since 2000.

When this gap inevitably closes, you'll be collecting 9.2% while waiting for the 20%+ potential capital appreciation.

2. BlackRock Science and Technology Trust (BST) - 8.9% Yield

Here's a mathematical impossibility made real: capturing nearly 9% income from high-growth tech while minimizing tariff exposure.

I've analyzed BST's portfolio construction at the holdings level—something the surface-level analysts miss—and found it's structurally designed to thrive during this exact scenario.

Why it works despite tariffs: While hardware tech faces component disruption, BST's active managers are overweighting domestic software and services while using covered call strategies to generate income regardless of direction. Even more critical: BST trades at a persistent discount to NAV, meaning you're buying dollar bills for 90-95 cents.

Execution plan:

Initial entry: 50% position below $32.50

Scaling strategy: Add remaining 50% if it tests $29-$30

Position size: 5% for growth-income portfolios, 3% for conservative income

Risk management: Set alerts for any break below $27.50 with volume exceeding 1.5x average

BST essentially allows you to transform tech growth potential into current income—precisely when you need stability against tariff volatility.

The remaining 5 vehicles in the Tariff-Era Income Machine are available exclusively to Premium Members.

THE TRADE WAR INCOME METHOD | Comming Next:

5 more income picks averaging 5.3% yield

My correlation matrix that kept portfolios stable when markets dropped 18% last time

Full income calendar showing when you'll get paid - 12 deposits totaling $16,400 per year on a $300K portfolio

Simple 90-day plan to add these to what you already own without disrupting your current strategy

Ready-to-use playbook for what to do if tariffs go up, down, or sideways

Lifetime Membership is available only until May 1st due to upcoming Substack changes. — After that, it'll just be monthly or annual options.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.