53% profit in 7 days.

That's what our May cash-secured puts on CVX and NEE have delivered.

Not annually. Not quarterly. In a single week.

My VADER system just identified 9 fresh opportunities with similar potential.

But first, let's review what's working now and what's next:

The May VADER Puts Scorecard

How to read this table:

Days Left: Time until option expires

Buffer: How far the stock can drop before you lose money (e.g., +5% means stock can fall 5% from current price and you still break even)

% Profit Now: What percentage of the maximum potential profit you've already captured

Cash Profit: Actual dollars you can bank by closing the position now

Annualized: Return projected to a full year for comparison (important for comparing options with different timeframes)

Look at those numbers.

Our short-dated aggressive puts on CVX and NEE are already showing over 50% profit in just one week, with annualized yields north of 50%.

Even balanced June positions are delivering exceptional returns, with 60% of the premium already captured.

This is why I emphasize position management over prediction.

But what specific actions should you take with each position?

Strategy Refresher: Cash‑Secured Puts in Plain English

This strategy boils down to one concept: getting paid to place limit orders on stocks you'd buy anyway.

How it works:

You sell a put contract, agreeing to buy 100 shares at the strike price

Your broker reserves the cash needed to buy those shares

You collect premium immediately

Only two possible outcomes:

Stock stays above strike → you keep 100% of premium

Stock drops below strike → you buy shares at an effective discount

Why it works: Time decay is relentless. Options lose value every day—like ice melting in the sun.

Most stocks spend 80-85% of days either moving sideways or moderately up/down. Only 2-5% of days see dramatic drops.

When you sell puts, those odds work in your favor.

How I Pick Winners:

I don't pick the above trades by gut feeling.

I use my Volatility Arbitrage Dividend Enhancement Return algo - aka VADER.

Twice weekly, I screen 3,200+ stocks through 16 specific filters, sorting opportunities into three tiers:

Conservative: 5-6% yearly yield, minimal drama

Balanced: 7-10% yield, my personal sweet spot

Aggressive: 10-18% yield, for tactical traders

These exact picks hit Premium subscribers' inboxes every Thursday and Sunday—the same ones powering my family's retirement.

Disclaimer: The tables below show how I screen for income. They are not trade recommendations, signals, or financial advice. Use them as educational foundation only—back‑test, sanity‑check, and consult a licensed professional before risking a nickel.

New Premium Opportunities (May 15, 2025)

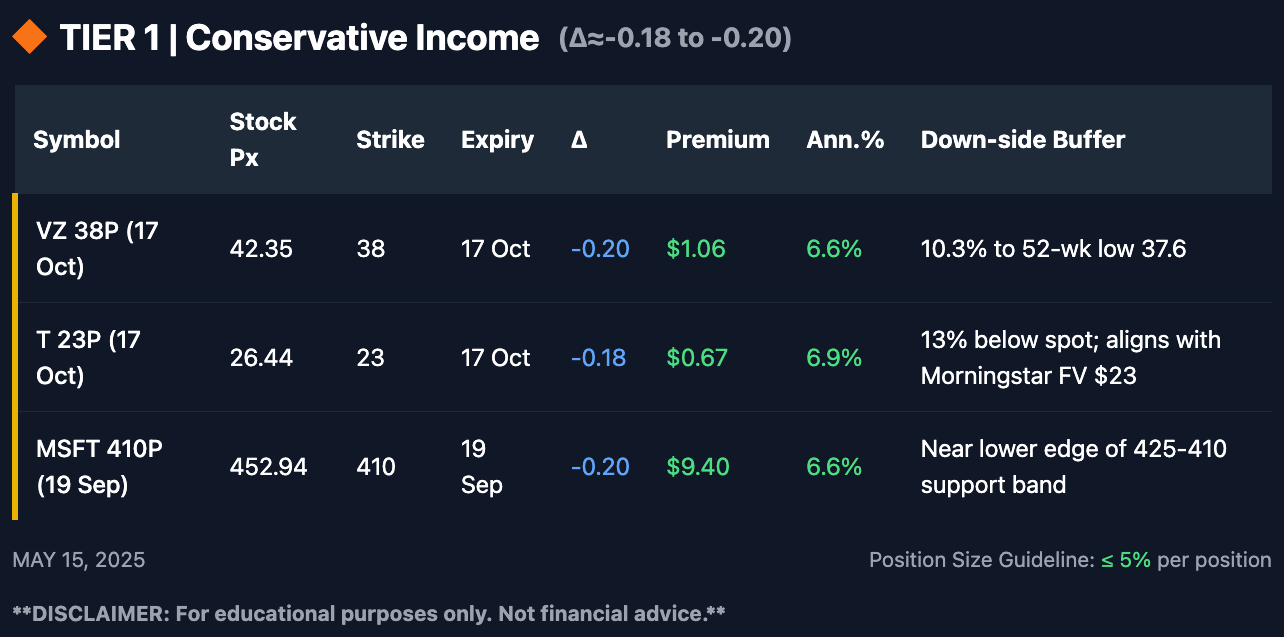

TIER 1 – Conservative Income

(Δ ≈ |0.10-0.25|; focus: capital buffer & blue-chip durability)

These are "sleep-well-at-night" trades. With delta around -0.20, there's only about a 20% chance you'll end up owning shares. The premium is lower, but so is the risk.

Why they clear the bar:

Fortress balance sheets: all three carry investment-grade debt and long dividend histories.

Low implied vol: IV rank sits in the 12th-28th percentile—premium is mostly theta.

Technicals: strikes rest beneath multi-month support (VZ $37.6, T $23, MSFT $410/$395), leaving room for normal variance without assignment.

Position cap: ≤ 5% of portfolio each (capital stays tied up for 4-5 months).

Alternate order: VZ 38P (17 Oct) → VZ 39P (19 Sep) (Δ≈-0.22, 6.1% ann.).

TIER 2 – Balanced Approach

(Δ ≈ |0.25-0.45|; focus: mid-teens yield with moderate buffer)

These are the "Goldilocks" trades—not too hot, not too cold. With delta between -0.25 and -0.45, there's roughly a 25-45% chance you'll own shares at expiration.

The higher premium compensates for the increased risk.

This is where I deploy most of my personal capital.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.