9 Moves You Should Make To Protect Your Portfolio In 2025’s Roller-Coaster Market

Your blueprint for outsmarting policy shifts, AI hype, and inflation spikes—while safeguarding your financial future.

What you might have missed:

2025 will test your discipline.

Policy shifts, rate cuts, tech volatility, and AI hype could throw your portfolio off course — but only if you let them.

I’ve been through markets like this before, and I know how easy it is to feel overwhelmed. - But you don’t need to panic; you need a clear plan.

Here’s

WHAT’s happening

HOW it impacts your finances

EXACT STEPS to safeguard your portfolio and retire early.

Plus: I’ve included a quick cheat sheet at the end for easy reference, so you can stay on track and revisit these strategies whenever you need them.

1. The Policy Shifts vs Your Wallet

Tighter immigration + higher tariffs can push prices up, significantly if labor costs rise.

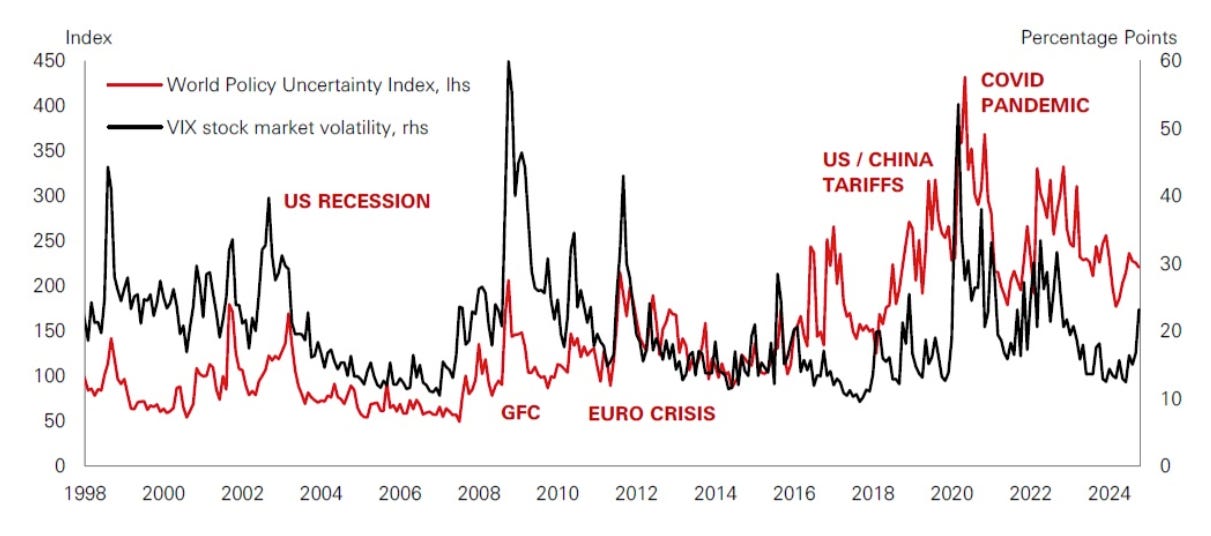

Historically, policy adjustments like these can fuel volatility—often impacting your portfolio in ways you didn’t see coming.

What I’m Watching:

Increased tariffs that raise import costs, impacting domestic purchases.

Not necessarily an immediate collapse, but potentially fewer discounts and higher inflation.

If your budget is tight or you have a fixed income, keep an eye on expenses.

Do This:

Keep a 6-month cushion in a high-yield account to avoid panic-selling stocks if your costs of living spike.

2. The Fed, Rates, and Why Valuations Matter

The Federal Reserve may cut short-term rates, providing cheap capital for businesses, though it won't guarantee stock gains if widely anticipated. Additionally, some sectors, like big tech, are seeing overvaluations.

My Reflection:

I recall the late ’90s tech mania. Eventually, reality sets in. Am I saying 2025 will mirror the dot-com crash? Not exactly. But when investors pursue future expectations too eagerly, stock prices may disconnect from actual earnings.

Wallet Impact

If you’re mostly in growth stocks and they’re priced to perfection, even a tiny earnings miss could yank your portfolio down.

For instance, the forward price-to-earnings (P/E) ratio of some large-cap tech stocks is hovering 30% above their five-year averages.

If growth stalls, this is a red flag.

Do this:

Monitor your overall allocation to the top tech names. I’m not dumping them; I’m simply right-sizing my positions.

If your portfolio is heavily skewed toward growth, consider shifting a portion into mid-cap or small-cap stocks, which still stand to benefit from lower rates but aren’t priced as high.

3. Beyond the Usual Mega-Cap Suspects

Over the past few years, a handful of massive companies have dominated the market. However, some pros (myself included) see that leadership will broaden in 2025. The earnings gap between the mega-caps and the rest of the pack is narrowing, opening the door for more stocks to shine.

Where I’m Looking:

Mid-Cap Stocks: These firms often have floating-rate debt, which becomes manageable if the Fed cuts rates. This frees up capital for expansion, potentially increasing share prices.

M&A Targets: If looser regulations promote dealmaking, the number of mid-caps and small-caps suitable for acquisition could rise. I maintain a shortlist of potential buyouts based on technology, patents, or market share.

Portfolio Impact:

This shift helps diversify away from a few giants. I allocate part of my equity portfolio to mid-cap index funds or researched individual stocks, balancing the concentration in big tech.

Do This:

Identify a watchlist of mid- or small-cap stocks with strong balance sheets, unique products, and buyout potential. If a takeover rumor arises, share prices could surge.

4. The Ongoing AI Revolution

We’ve shifted from building the core infrastructure (chips, data centers) to integrating AI into everyday operations—think improved logistics, advanced healthcare, and data-heavy industries.

My Personal View:

Companies using AI to boost revenues will likely surpass those that don’t. More companies beyond the “Magnificent Seven” are using AI to cut costs and generate revenue.

Wallet Impact:

AI can enhance your portfolio. However, be cautious—the valuations of AI firms can soar quickly. Avoid buying merely due to the hype.

Do This:

Balance pure AI infrastructure plays (like chipmakers or data-center REITs) with companies harnessing AI to sharpen their competitive edge. This way, you’re not too exposed to hype alone; you also benefit from real-world, revenue-generating AI applications.

5. Curbing Expectations on Stock Returns

We’ve had a couple of robust years in stocks. I’d love another 20% gain as much as anyone, but I’m realistically planning for single-digit returns on major indexes in 2025.

The S&P 500’s forward P/E is already around 20—not extreme, but definitely higher than the historical average of ~16–17.

Portfolio Impact:

Be selective during slower growth. Avoid randomly targeting the tech sector. If necessary, invest time in research or consult an expert.

Do This:

Add income-generating assets (REITs, bonds) to maintain steady returns if the market slows.

6. Rebalancing for Risk Management

Time after time, I’ve seen investors ride a bullish streak without rebalancing. Suddenly, you realize 80% of your portfolio is in stocks that soared.

That’s a recipe for heartbreak if a correction happens.

Wallet Impact:

A heavy equity tilt can hurt your retirement savings during a recession or unexpected inflation. Protecting your downside is as crucial as pursuing the upside.

Do This:

Rebalance on a fixed schedule (every 6 or 12 months). Consistency historically smooths returns and reduces risk.

7. Possible Inflation Spikes

If tariffs raise import costs and immigration restrictions tighten the labor market, wage pressures may increase, potentially fueling inflation, despite possible short-term Fed rate cuts.

Portfolio Impact:

High inflation reduces the actual value of bond interest, particularly with lower-yield securities. Rising living costs can also affect your retirement budget.

Hypothetical Example: Inflation vs. Bond Yields

Risk Scenario: If inflation rises from 3% to 6% in a year, the real return on a 5% bond would be negative, eroding purchasing power for those on fixed incomes.

Action Step:

Keep some inflation-fighting assets on standby. That might be TIPS (Treasury Inflation-Protected Securities), certain commodities, or real estate with a history of rising rental income.

8. Leaning on Value Plays

Value stocks have lagged behind growth, but that won’t last. If markets shift focus from pure growth to stable earnings and cheaper valuations, value stocks could rebound.

My Approach:

I’m shifting part of my portfolio into undervalued financial and industrial stocks, especially if deregulation increases. With less red tape, mid- to small-cap financials could accelerate mergers and acquisitions.

Wallet Impact

Value stocks often pay dividends, which can supplement your monthly cash flow.

Do This

If the broader market hovers around 20 P/E, use a value screen to find quality names trading at lower multiples—say, a P/E ratio below 15. You could see solid capital gains plus a steady dividend yield if your research checks out.

9. Bond Opportunities

If the Fed cuts rates further, bond prices typically rise. But if rates increase again, at least current yields might cushion some losses. We’re at a rare point where bond yields are somewhat attractive compared to past years.

My Favorite Spots

Agency Mortgage-Backed Securities and asset-backed securities with relatively high credit quality.

Short-duration corporate bonds for decent yields with less interest-rate risk.

Wallet Impact

Bond interest can stabilize your monthly finances, especially for early retirement. If growth stocks take a beating, you still have that bond coupon coming in.

Do This

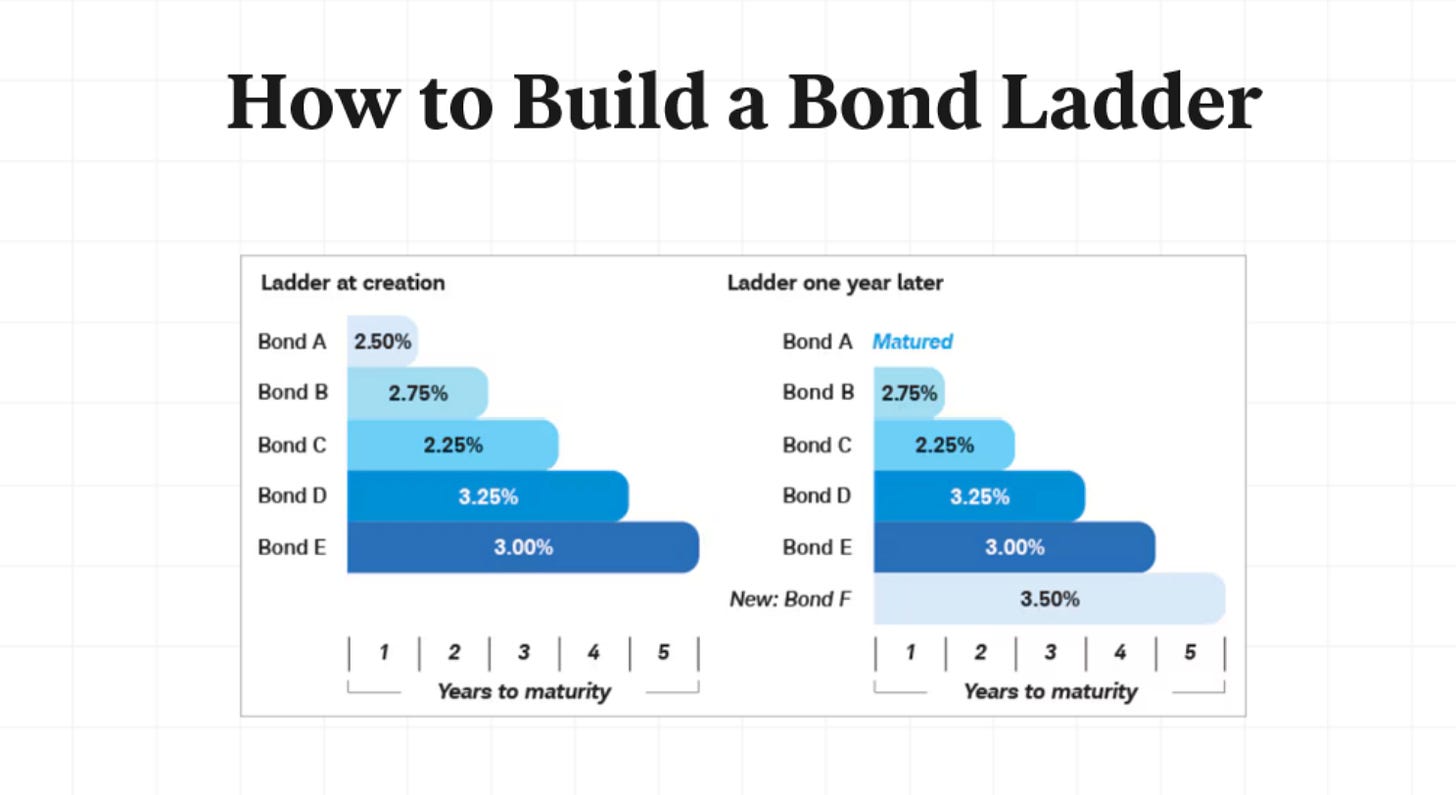

I like to hold a portion of my portfolio in laddered bonds—spreading maturities out so I’m not stuck with all long-term or all short-term. That way, I can adapt if rates move unexpectedly.

☑️One-Page “Cheat Sheet” for Quick Reference

Cash Buffer

Keep 6 months of expenses in a high-yield account for unexpected inflation or job loss.

Allocation Blueprint (Example)

30% in U.S. Large-Cap (including some big tech)

20% in Mid-Cap or Small-Cap Growth

10% in AI Infrastructure (chipmakers, data-center REITs)

10% in REITs / Real Estate for rental income

10% in Value Stocks (financials, industrials, dividend payers)

15% in Short-/Medium-Duration Bonds

5% in TIPS or Inflation-Protected Securities

(Percentages are a sample template; adjust based on your personal risk tolerance, goals, and timeline.)

Rebalance Regularly

Revisit your portfolio every 6 or 12 months. If a sector grows 5–10 points beyond the target, trim and redistribute to bonds or value plays.

Focus on Dividend & Interest

Income sources (dividends, bond coupons, real estate) can smooth out volatility and fuel compounding.

Monitor AI & Tech Hype

Stay invested in growth areas but avoid going all-in at inflated valuations. History shows mania cycles eventually correct.

Hedge Against Surprises

TIPS, real estate, and commodities can mitigate inflation risk if costs surge unexpectedly.

2025 Could Be a Roller Coaster, But Stay the Course

Policy shifts, rate cuts, tech volatility, and the AI frenzy might test your patience. However, pursuing headlines won’t lead you to financial independence.

Instead, stick to what works: discipline, a clear risk tolerance, and a portfolio built to weather surprises. This year is your chance to turn “someday” into “I can see this happening.”

Stay the course

- Mike

Thank you for the great guideline on safeguarding our finances and investments in today’s rapidly changing environment. I especially appreciate the cheat sheet—it’s truly a valuable resource! With so much happening in the economy, geopolitics, and the shifts in federal policies, it's clear that these factors will impact the market in ways that can be very difficult to predict. Your insights are greatly appreciated!

Good advice. The hard part is having the discipline to follow it. 😁