Portfolios following conventional retail advice averaged — 4.2% annually.

Portfolios using institutional frameworks — 8.7% annually.

Same market conditions. Same twenty-year period. Wildly different outcomes

Same starting point. Same timeline. A $2.8 million gap.

Yet the retail world is still following rules designed for 1976 — when Treasury bonds yielded 15% and retirements lasted 13 years, while institutional money had quietly adapted.

Today, I'm pulling back the curtain on strategies that institutional money has hoarded for decades.

Not because I'm feeling generous, but because watching people follow demonstrably inferior advice while the wealthy compound their way to financial immortality has become... let's call it morally indefensible.

The Great Deception: How "Conservative" Became Dangerous

Most retirement advice is built on a foundation of mathematical quicksand.

Most likely the rules your advisor learned are based on market data from 1926 to 1976 – back when 30-year bonds yielded double digits and the average retirement lasted about as long as a good mortgage.

Slight problem: It's not 1976 anymore.

Today's retirees face three decades of expenses in an environment where "safe" investments yield 4% while inflation runs 3.2%.

The math that worked for your parents will not work for you.

Yet most advisors keep reciting the same five commandments, apparently unaware that the economic ground has shifted beneath their feet?

The cost of this collective blindness is about $847,000 per retiree, give or take.

Outdated Rule #1: "Put Your Age in Bonds"

“As you get older, shift heavily into bonds. A 70-year-old should hold 70% bonds for "safety."

Here's the problem: This rule assumes bonds are always safer than stocks.

They're not.

Remember 2022?

Everyone panicked about stock volatility, bonds lost more money than the S&P 500. The supposedly bulletproof 60/40 portfolio had one of its worst years in recorded history – both assets crashed together.

What institutional money does instead:

They think of bonds as tactical weapons, not religious obligations.

When rates are attractive – like now, with 10-year Treasuries above 4% – they load up. When rates were near zero from 2010 to 2021, they dramatically reduced exposure.

Revolutionary concept: adjust your strategy based on what's actually happening in markets, not your birthday.

Instead of "age in bonds," think "opportunity cost in bonds."

If bonds yield more than inflation plus a reasonable risk premium, great.

If not, why voluntarily lock in guaranteed losses for decades?

What makes sense today — 25-35% in bonds when they're yielding 4%+, regardless of whether you're 55 or 75. The rest should go into assets that can actually grow your purchasing power over thirty years.

Because here's the thing nobody talks about: you're not investing for ten years anymore. You're investing for three decades. Act accordingly.

Outdated Rule #2: "The 4% Withdrawal Rule"

Withdraw 4% of your portfolio in year one, adjust for inflation annually, and your money will last 30 years. Simple.

Here's why that's wrong: This rule was built on market conditions that no longer exist.

When William Bengen created the 4% rule in the 1990s, you could get 7% from Treasury bonds and buy the S&P 500 at 60% of today's valuation.

You could actually build a portfolio that supported 4% withdrawals.

Today's uncomfortable reality:

S&P 500 dividend yield: 1.7%

10-year Treasury yield: 4.2%

Blended portfolio yield: maybe 2.5%

So where does that extra 1.5% come from?

You're eating your seed corn – selling assets to make up the difference.

If markets tank early in retirement (hello, 2000-2002 and 2008), withdrawing 4% from a shrinking portfolio accelerates the death spiral.

Studies show this can slash portfolio life by 8-12 years.

What institutional money figured out: Flexibility beats rigidity.

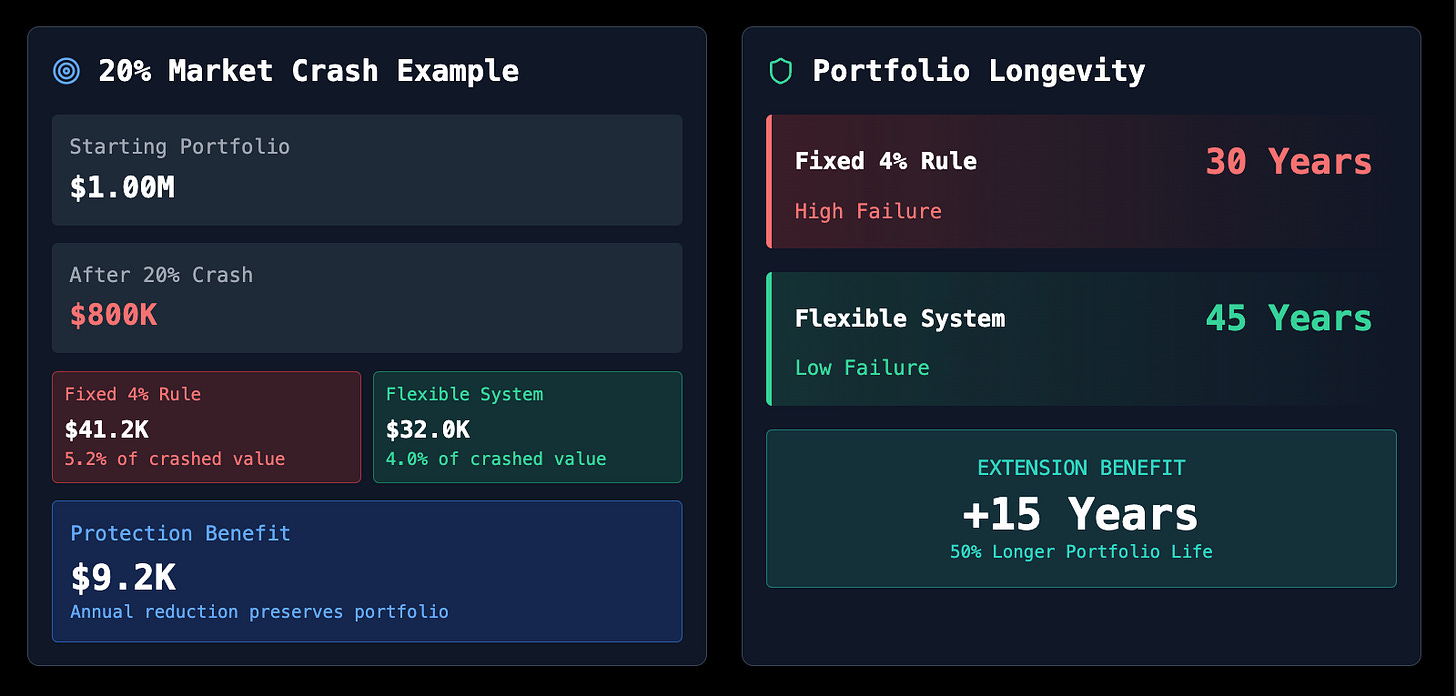

Instead of a fixed 4%, they adjust withdrawals based on portfolio health:

Portfolio up big: Take 4.5-5%

Portfolio down big: Take 3-3.5%

Normal year: Take 4%

This way, portfolio life extends from 30 years to 45+ years with only modest lifestyle adjustments.

Real example: You start retirement with $1 million, planning $40,000 annually. After a 20% market crash, instead of withdrawing $41,200 (4% plus inflation), you take $32,000 (3.2% of the reduced balance).

That temporary belt-tightening prevents permanent damage.

It's like being the house instead of the gambler – you adjust the odds in your favor rather than betting everything on a fixed outcome.

The mindset shift I find very useful — stop thinking of retirement spending as fixed and start thinking of it as adaptive.

Your lifestyle should flow with your portfolio's health, not fight against it.

Outdated Rule #3: "Never Touch Your Principal"

Live off dividends and interest only. Never sell shares.

This made sense once.

Back when blue chips yielded 6% and bonds yielded 8%, you could generate real income without touching principal.

Why it's insane today:

Average S&P 500 dividend yield: 1.7%

To generate $50,000 annually from dividends alone: You need $2.94 million

Most people don't have $3 million sitting around.

So they either live on poverty-level income or chase dangerous high-yield investments that inevitably slash dividends during recessions.

What institutional money learned decades ago: Total return is all that matters.

Whether your gains come from dividends, price appreciation, or strategic asset sales is completely irrelevant economically.

What matters is net spendable dollars and the long-term sustainability of your approach.

+ the tax advantage:

Qualified dividends: Taxed at 15-20%

Long-term capital gains: Taxed at 0-20%

Many retirees pay 0% on capital gains with smart bracket management

A portfolio yielding 2% that appreciates 6% annually provides the same economic value as a portfolio yielding 8% with no growth.

Actually, it's better because you control the timing and taxation of your gains.

The institutional playbook:

Own quality assets with strong total return potential

Harvest gains strategically to manage tax brackets

Use losses to offset gains where possible

Don't artificially limit yourself to "income only"

Outdated Rule #4: "Diversification Means Safety"

Spread money across asset classes. When one zigs, another will zag.

Let’s look at the 2008 reality again: Supposedly "uncorrelated" assets – international stocks, REITs, commodities, high-yield bonds – all crashed together. Everything except maybe Treasury bonds went down in unison.

Traditional diversification often amounts to organized mediocrity.

The problem with correlation-based thinking — correlations spike to 1.0 during crises – exactly when you need diversification most.

What institutional money does differently — they diversify income sources, not just asset classes.

Geographic spread: U.S., international developed, emerging markets

Sector variety: Technology, healthcare, utilities, energy

Strategy mix: Buy-and-hold, options income, real estate, bonds

Income source variety: Wages, Social Security, pensions, dividends, option premiums, rental income

Don't just own different assets that might move independently.

Own different cash flow streams that respond to different economic conditions.

Smart diversification example:

40% Total stock market (broad economic growth exposure)

20% International stocks (geographic/currency diversification)

15% REITs (real estate income, inflation hedge)

15% Treasury bonds (deflation protection, liquidity)

10% Commodity exposure (inflation hedge)

Each piece responds differently to inflation, deflation, growth, recession.

That's actual diversification, not just owning a bunch of stuff.

Outdated Rule #5: "Set It and Forget It"

Pick your allocation and stick with it forever. Market timing doesn't work.

There's a massive difference between market timing (trying to predict the future) and tactical adaptation (responding intelligently to observable changes).

Institutions never use static allocations. Ever.

What changes and why:

Interest rate shifts → When 10-year bonds yielded 0.5% in 2020, institutions went underweight bonds. When rates hit 5% in 2023, they loaded up. That's basic math.

Valuation swings → When stocks trade at 10x earnings (2009), you buy more. When they hit 30x earnings (2000), you trim. Obvious.

Economic cycles → During expansions, emphasize growth and credit-sensitive assets. During recessions, emphasize defense and quality. Risk management 101.

Adaptation always beats speculation. Respond intelligently to major changes in market conditions rather than trying to predict what happens next.

Rule of the Thumb Framework for smart adaptation:

Major shifts only when conditions are extremely compelling

Regular rebalancing when market moves create large deviations

Tactical tilts of 5-10% based on relative valuations

Never abandon diversification for single bets

Practical Implementation Action Plan

Step 1: Asset Allocation Reality Check

Forget age-based formulas. Base your allocation on:

Current interest rate environment (bonds more attractive when yields compensate for risk)

Equity valuations (stocks more attractive when P/E ratios are reasonable)

Personal factors (risk capacity, other income, health considerations)

Today's environment suggests:

40-50% Stocks (mix of U.S., international, value/growth)

25-30% Bonds (shorter durations, TIPS for inflation protection)

15-20% Alternatives (REITs, covered call strategies, commodities)

5-10% Cash (opportunity fund for dislocations)

Step 2: Dynamic Withdrawal Implementation

Abandon rigid 4%. Instead:

Start with 3.5-4% based on current portfolio balance

Adjust annually based on portfolio performance (+/-0.5%)

Never increase withdrawals after down years

Consider modest increases after exceptional years

Step 3: Tax-Efficient Sequencing

Withdrawal order matters:

Taxable accounts first (harvest losses, realize gains at favorable rates)

Tax-deferred accounts before RMDs start (manage brackets strategically)

Roth accounts last (maximize tax-free compounding)

Step 4: Income Stream Development

Build multiple cash flow sources:

Social Security optimization (delayed credits = 8% annual increases until age 70)

Portfolio income (dividends, option premiums, REIT distributions)

Flexible withdrawals (adjusted based on market conditions)

Optional part-time work (reduces portfolio pressure, provides purpose)

Why This Matters Now More Than Ever

The retirement landscape has fundamentally shifted. Longer lifespans, lower yields, and persistent inflation have rendered traditional strategies not just suboptimal, but dangerous.

Most investors haven't adapted. They're following advice designed for a world that no longer exists.

Will adapting require more attention than buying a target-date fund and forgetting about it? Absolutely.

Could it potentially add $500,000+ to your lifetime retirement security?

Also absolutely.

The market doesn't reward good intentions or wishful thinking.

It only rewards intelligent, systematic action.

Thanks for tuning in and supporting my work!

Mike Thornton, Ph.D.

Pure gold! Wish I had this wisdom a couple of decades ago.

This is the content the internet needs! Thanks Mike!