4 Unbreakable Dividend Stocks for Mid-to-Late-Career Investors

⏳ Time Horizon to Living Off Dividends: 5–15 years

Imagine it’s a decade from now, and you’re still collecting steady paychecks—even if the market dives by 30%.

That’s the power of a well-built “dividend machine”.

In this article, I’ll reveal how to craft a portfolio that funds your everyday life—without chasing get-rich-quick schemes or losing sleep over market swings.

Who’s a Good Fit for This Portfolio?

⏳ Time Horizon to Living Off Dividends — 5–15 years to transition from growth to income reliance.

🛡️ Risk Tolerance — Moderate (comfortable with market swings but values reliable cash flow).

🎯 Primary Goal — Stable, inflation-beating dividend income over the long term.

💼 Career Stage — Mid-to-late career investors aiming to retire or live off investments relatively soon.

Inside, You’ll Discover:

Four “Unbreakable” Dividend Picks that keep paying—even in market meltdowns—and how to stack them for consistent 4–5% yields.

Precise Portfolio Weightings that balance stability, growth, and real-world cash flow for the next 5–15 years.

Advanced Income-Boosting Tactics, including covered calls and a T-Bill “safety net,” so your dividends keep rolling in—no matter what the market does.

Real-Life Model Portfolios and stress tests, so you can see exactly how these strategies hold up through recessions, rate spikes, and everyday life expenses.

By the time you’re done reading, you should be able to piece together a dividend “machine” that might fund your future mortgage, groceries, and yes—some epic vacations.

Let’s get to it.

Before We Dive Into Tickers, Let’s Nail Down the Core Mindset

When I was accelerating my wealth, two revelations hit me:

It’s all about stability in a tsunami: I want rent checks (i.e., dividends) even if markets are down 30%.

Growth still matters: A big chunk of your portfolio needs to increase its payout faster than inflation. If it’s not rising, you’re essentially falling behind.

These two points are the foundation.

If a dividend can’t survive rough times—and grow afterward—why bother?

Battle-Tested for the Next Recession

I’ve seen folks who brag about picking “the next Apple” or nailing 10-baggers.

That’s cool if you’re 25 and can stomach the risk.

But if you’re approaching 40, 50, or beyond—and want a bulletproof plan—these picks outshine the hype because:

Real Estate Essentials: People always need groceries. And retirees need affordable housing. That’s your moat.

Defense: Global tension never fully disappears. Nations always modernize.

Midstream: We’re not ditching oil, gas, or their infrastructure overnight.

Let’s Break the 4 “Unbreakable” Dividend Stocks Into 4 Categories

A monthly rental machine.

A lifestyle-housing juggernaut.

A recession-resistant defense titan.

A top-tier midstream pipeline.

These selections aim for sweet spots in yield, growth, and durability.

I personally hold each category in my retirement portfolio. And yes, they’ve delivered through economic storms (and my mortgage never skipped a beat).

1. The Monthly Dividend Giant

Why monthly? Dividends hitting your account 12 times a year feels a lot like your own rent check.

It’s psychologically comforting, and it can also smooth out your cash flow if you’re actually living off these payouts.

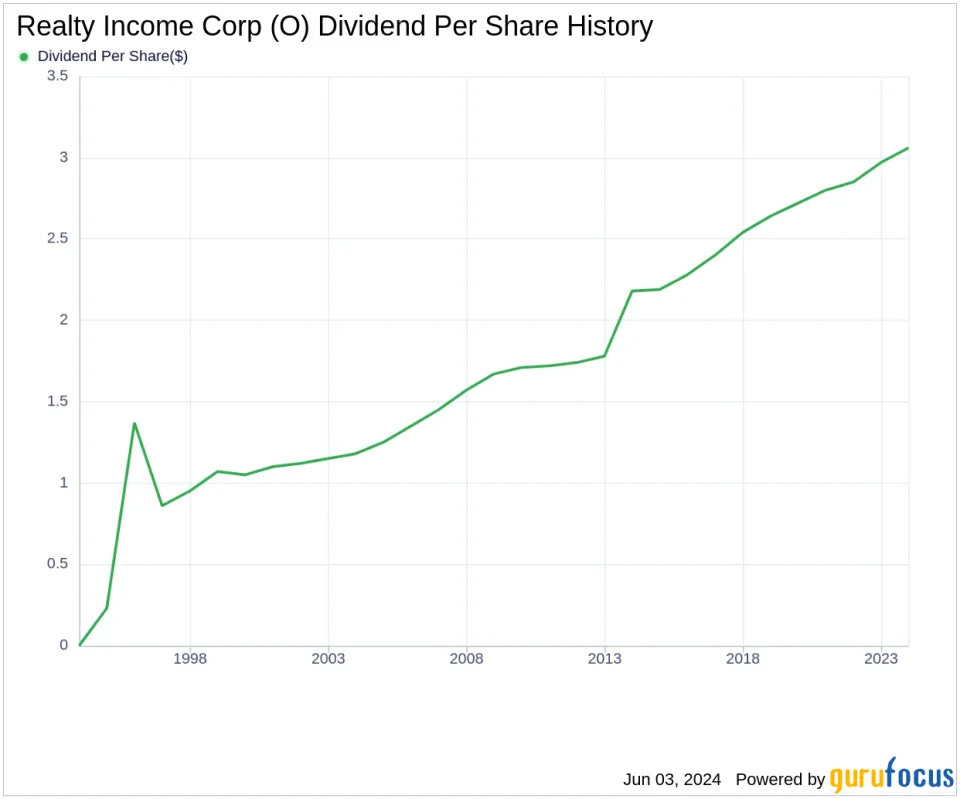

Exact Ticker: Realty Income (O)

Yield: Typically 5–6%, often near the higher end these days.

Core Advantage: They lease primarily to grocery stores, pharmacies, and dollar stores—stuff that never goes out of style (or out of business easily).

Balance Sheet: A-grade rating and a consistent track record of modestly climbing payouts.

What to Watch: If it ventures beyond safe, essential retail tenants (or if leverage spikes), that’s a red flag. For now, it’s steady.

Deep-Dive Metrics:

Over the past twenty years, Realty Income has grown its dividend by approximately ~4–5% annually.

It commonly trades at a multiple of 17–19x AFFO; if you can grab it below ~15–16x, that’s typically a bargain for the long run.

During the 2008–2009 crisis, O’s share price fell, but the dividend never missed a payment—and kept inching up.

Implementation Tip: Start by allocating about 20–25% of your “dividend bucket” to this. Drip the dividends back in (or into other stable picks) until retirement. Then flip the switch and use that monthly cash for your living expenses.

Now I’m going to reveal the remaining three stocks that—together with our first pick—can form a true ‘dividend machine’ for your retirement.

These companies have proven themselves through market crashes, recessions, and rate spikes—and they continue paying reliable dividends no matter what’s happening in the economy.

In this premium section, you’ll discover:

Three Additional High-Conviction Dividend Picks (including my favorite real estate niche play, a recession-proof defense giant, and a midstream powerhouse).

Exact Portfolio Weightings and how to blend all four picks for a 4–5% yield—plus steady dividend growth that can cover your mortgage, groceries, and even vacations.

Advanced Income-Boosting Strategies: From covered calls and rebalancing tips to a T-Bill “safety net” method you can deploy for emergencies.

Real-Life Model Portfolios for both aggressive accumulators and pre-retirees, so you can see how this plan might look with your actual numbers.

I’ve personally invested more than 10 hours compiling the research, metrics, and stress tests—which is why I reserve this level of detail for premium members.

To make this an easy decision, I offer a 7-day free trial to explore all my premium content and see if it meets your needs—no strings attached. If you decide it’s not for you, simply cancel before the trial ends.

Even if you upgrade today, you’re protected by a 30-day money-back guarantee, so there’s zero risk on your end.

Unlock the full report now to start building a bulletproof dividend strategy that might fund your everyday life—while you sleep soundly at night.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.