Why chase stocks when you can get paid to let them come to you?

A portfolio of twelve positions generated $14,043 in upfront cash—an 86% annualized return—for simply setting buy orders at prices below the current market.

It’s a powerful shift in mindset: monetizing market volatility instead of being a victim of it.

Now, the work continues by rolling a key position in AAPL and capturing early profits.

Today, I'm sharing my CSP portfolio management decisions, showing how I'm handling two positions that have moved against me + the fresh VADER-screened opportunities I'm considering.

The core cash-secured put strategy remains elegantly simple:

Selling puts on companies I'd genuinely want to own, at strike prices representing attractive entry points to me, while collecting immediate premium income.

If assigned → I acquire shares at my predetermined "good deal" price.

If not assigned → I keep the premium and hunt for the next opportunity.

It's essentially how I run a self-funded limit order system.

My four-step process adapted for CSPs works like this:

(1) My VADER screen identifies technically and fundamentally sound companies

(2) I select strike prices offering compelling risk-adjusted income with reasonable (3) I collect premium immediately while monitoring for rolling opportunities

(4) I either accept profitable assignment or roll positions forward to capture additional income.

So, let's see how that process is translating into real-world results.

Performance Review: Current Position Statuses

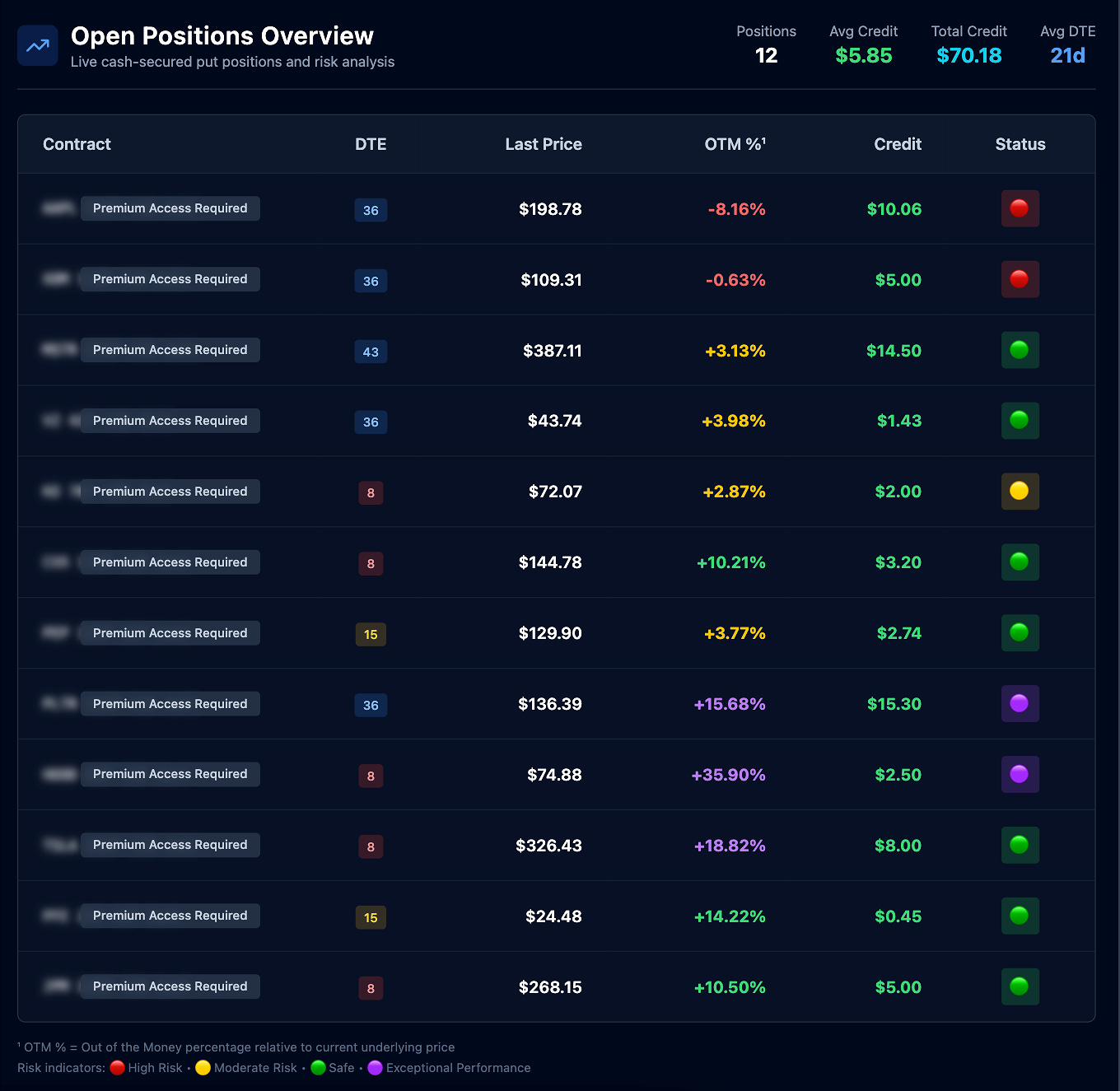

The 12-position portfolio sits in solid shape despite recent market choppiness:

9 positions remain comfortably green

1 sits in my yellow watch category

2 have moved into what I call critical red territory requiring active management

Performance Numbers:

Total premium collected: $14,043

Secured collateral: $175,600

Current term return: 8.0%

Annualized return: 86%

Even with two positions now in the money, the portfolio maintains a healthy +9.2% average cushion—this reflects my approach to proper position sizing and strike selection discipline.

Below is a snapshot as of this morning:

Open Positions Overview

In the Implementation Plan section below, I'll detail my exact moves for the week. I'll break down not just what I'm doing with key positions, but the why behind each action.

There, you can see how I'm managing the portfolio and learn from the reasoning behind this week's actions.

But first, the new opportunities the market is offering.

Fresh VADER CSP Opportunities (June 12, 2025)

This week's hunt yielded particularly compelling setups across my three-tier risk classification system. But first:

Quick Definitions For New Readers Before We Move Forward:

Delta: Approximate probability of assignment (-0.30 = ~30% chance)

DTE: Days to expiration

OTM: Out-of-the-money (strike price below current stock price)

CSP: Cash-secured put (you agree to buy 100 shares at strike price)

Assignment: You buy the stock at strike price (not necessarily bad!)

With those terms defined, here is how I use them to classify opportunities and manage my own portfolio's risk.

How I classify my positions:

Tier 1 positions: I target conservative deltas (-0.15 to -0.30) with strikes sitting 5% or more out-of-the-money—I think of this as "rent collection with a wide lawn."

Tier 2 approach tightens the parameters to deltas between -0.30 to -0.45 with 2-5% OTM cushions for higher income velocity.

Tier 3 is where I venture into delta ranges of -0.45 to -0.60 with minimal cushions, reserved for when I'm comfortable dancing closer to the flame.

My position sizing approach:

Tier 1 can handle 5-10% allocations in my portfolio

Tier 2 warrants 3-7% positions

Tier 3 demands strict 1-2% limits to preserve my portfolio stability.

These personal rules are part of a larger, more fundamental mindset about risk that anyone can adopt.

A Framework for Thinking About CSP Risk

Success with Cash-Secured Puts isn't just about the premium; it's about disciplined risk management.

Before entering any trade, you need a clear framework for what you're willing to risk.

Here’s my simple, three-tiered system to help you guide your decisions:

1. The Foundational Principle: Start With Your End Goal

Before looking at tiers, internalize this rule: Only sell puts on stocks you genuinely want to own at the strike price. Getting assigned isn't a failure; it's the successful execution of your plan to buy a quality company at your predetermined price.

Tier 1: Your Foundation (Conservative)

These are the highest-conviction plays on fundamentally sound companies.

The goal is steady income with a low probability of assignment.

→ Focus on one Tier 1 position at a time.

→ Example: A put on a blue-chip stock or a less volatile company you've researched thoroughly.

Tier 2: Calculated Aggression (Higher Yield)

Here, you accept a higher chance of assignment (~40%) in exchange for a more significant premium. These are often on more volatile but still desirable stocks.

→ I’d consider adding ONE Tier 2 position for an income boost.

→ Prerequisite: You must be absolutely comfortable owning the stock if it drops.

Tier 3: Specialist Plays (For the Experienced)

These are high-risk, high-reward setups that require deep experience and active management. They might involve earnings plays, or turnaround situations.

Only attempt these after you have a strong track record and robust risk management. For most, it's best to stay away.

A Rule for Beginners: To ensure discipline, never allocate more than 5% of your portfolio to any single CSP position when starting out. This prevents one bad trade from derailing your progress.

With that framework established, let's review this week's screened opportunities.

EDUCATIONAL TRANSPARENCY: The tables below show how I screen for income-generating put-selling opportunities. This is my personal approach for educational purposes only—not recommendations or financial advice. I'm showing you my process so you can learn from my methodology. Selling cash-secured puts involves the obligation to buy the underlying stock at the strike price if assigned, which can happen if the stock price falls below the strike at expiration. I ensure I have the cash secured and am willing to own the stock at that price before I enter any position.

Fresh VADER CSP Picks (June 12, 2025)

🔒 Tier 1: Conservative Income

Ideal for retirement accounts where you want steady income without constant monitoring.

These five setups deliver impressive 42% average annualized yields while maintaining 10-14% downside cushions—exactly my sweet spot for sleep-easy income generation.

Average deltas near -0.28 suggest roughly one-in-four assignment probability, which I consider historically benign odds when I'm genuinely happy owning these companies. Cash requirements range from $300 to $33,000 per contract, accommodating my preference for avoiding concentration risk across different position sizes.

⚖️ Tier 2: Balanced Approach, Calculated Aggression

These require more active management but reward with significantly higher yields. Best for taxable accounts where you can harvest losses if needed.

This is where I deploy most of my personal capital.

Keep reading with a 7-day free trial

Subscribe to The Multiplier to keep reading this post and get 7 days of free access to the full post archives.